CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-1

CHAPTER 5:

PERSONAL CONSUMPTION EXPENDITURES

(Updated: November 2019)

Definitions and Concepts

Recording in the NIPAs

Overview of Source Data and Estimating Methods

Benchmark-year estimates

Nonbenchmark-year estimates

Current quarterly and monthly estimates

Quantity and price estimates

Table 5.A—Summary of Methodology for PCE for Goods

Table 5.B—Summary of Methodology for PCE for Services

Technical Note: Special Estimates

New motor vehicles

Net purchases of used motor vehicles

Gasoline and other motor fuel

Rental of tenant- and owner-occupied nonfarm housing

Financial service charges and fees

Securities commissions

Financial services furnished without payment

Life insurance

Property and casualty insurance

Nonprofit institutions serving households

Personal consumption expenditures (PCE) is the primary measure of consumer

spending on goods and services in the U.S. economy.

1

It accounts for about two-thirds of

domestic final spending, and thus it is the primary engine that drives future economic

growth. PCE shows how much of the income earned by households is being spent on

current consumption as opposed to how much is being saved for future consumption.

PCE also provides a comprehensive measure of types of goods and services that

are purchased by households. Thus, for example, it shows the portion of spending that is

accounted for by discretionary items, such as motor vehicles, or the adjustments that

consumers make to changes in prices, such as a sharp run-up in gasoline prices.

2

In addition, the PCE estimates are available monthly, so they can provide an early

indication of the course of economic activity in the current quarter. For example, the PCE

1

For a comprehensive presentation of BEA’s information on PCE, go to www.bea.gov, select

“Data,” then

“By Topic,” and then “Consumer Spending” from the list of options.

2

For a long-term look at consumer spending, see Clinton P. McCully, “Trends in Consumer Spending and

Personal Saving, 1959–2009,” Survey of Current Business 91 (June 2011): 14–21.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-2

estimates for January are released at the end of February, and the estimates for February

are released at the end of March; the advance estimates of gross domestic product (GDP)

for the first quarter are released at the end of April.

The PCE estimates are an integral part of the U.S. national income and product

accounts (NIPAs), a set of accounts that provides a logical and consistent framework for

presenting statistics on U.S. economic activity (see “Chapter 2: Fundamental Concepts”).

Definitions and Concepts

PCE measures the goods and services purchased by “persons”—that is, by

households and by nonprofit institutions serving households (NPISHs)—who are resident

in the United States. Persons resident in the United States are those who are physically

located in the United States and who have resided, or expect to reside, in this country for

1 year or more. PCE also includes purchases by U.S. government civilian and military

personnel stationed abroad, regardless of the duration of their assignments, and by U.S.

residents who are traveling or working abroad for 1 year or less.

Table 5.1 shows the kinds of transactions that are included in and excluded from

PCE. Most of PCE consists of purchases of new goods and of services by households

from private business. In addition, PCE includes purchases of new goods and of services

by households from government and government enterprises, the costs incurred by

NPISHs in providing services on behalf of households, net purchases of used goods by

households, and purchases abroad of goods and services by U.S. residents traveling,

working, or attending school in foreign countries. PCE also includes expenditures

financed by third-party payers on behalf of households, such as employer-paid health

insurance and medical care financed through government programs, and it includes

expenses associated with life insurance and with private and government employee

pension plans. Finally, PCE includes imputed purchases that keep PCE invariant to

changes in the way that certain activities are carried out—for example, whether housing

is rented or owned or whether employees are paid in cash or in kind. PCE transactions are

valued in market prices, including sales and excise taxes.

In the NIPAs, final consumption expenditures by NPISHs is the portion of PCE

that represents the services that are provided to households by NPISHs without explicit

charge (such as the value of the education services provided by a nonprofit college or

university that is over and above the tuition and other costs paid by or for the student’s

household). It is equal to their gross output, which is measured as their current operating

expenses (not including purchases of buildings and equipment, which are treated as

private fixed investment), less their sales to households and to other sectors of the

economy (such as sales of education services to employers) and less the value of any

investment goods (such as software) that are produced directly by the NPISH. Services

that are provided by NPISHs and are paid by or on behalf of households (such as the

tuition and other costs) are already accounted for in PCE as purchases by households.

(For more information, see the section on NPISHs in the technical note at the end of this

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-3

chapter.)

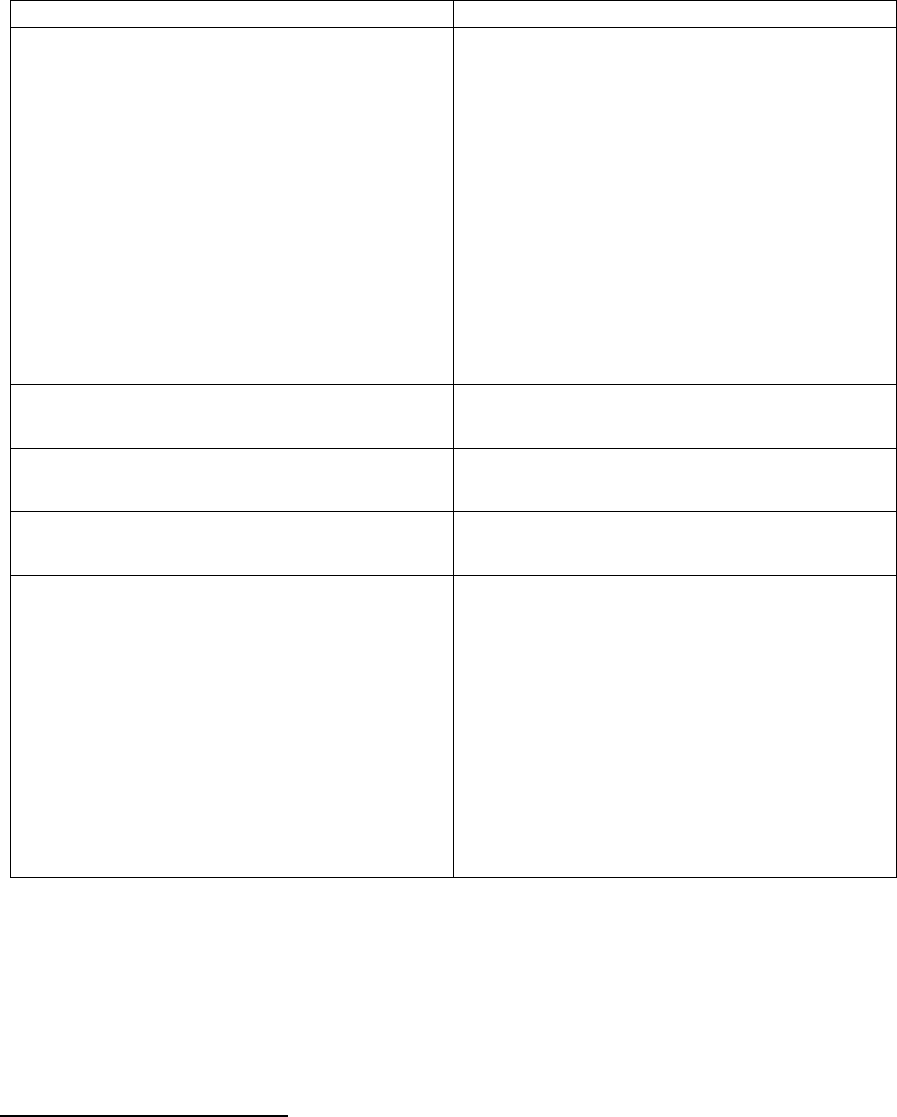

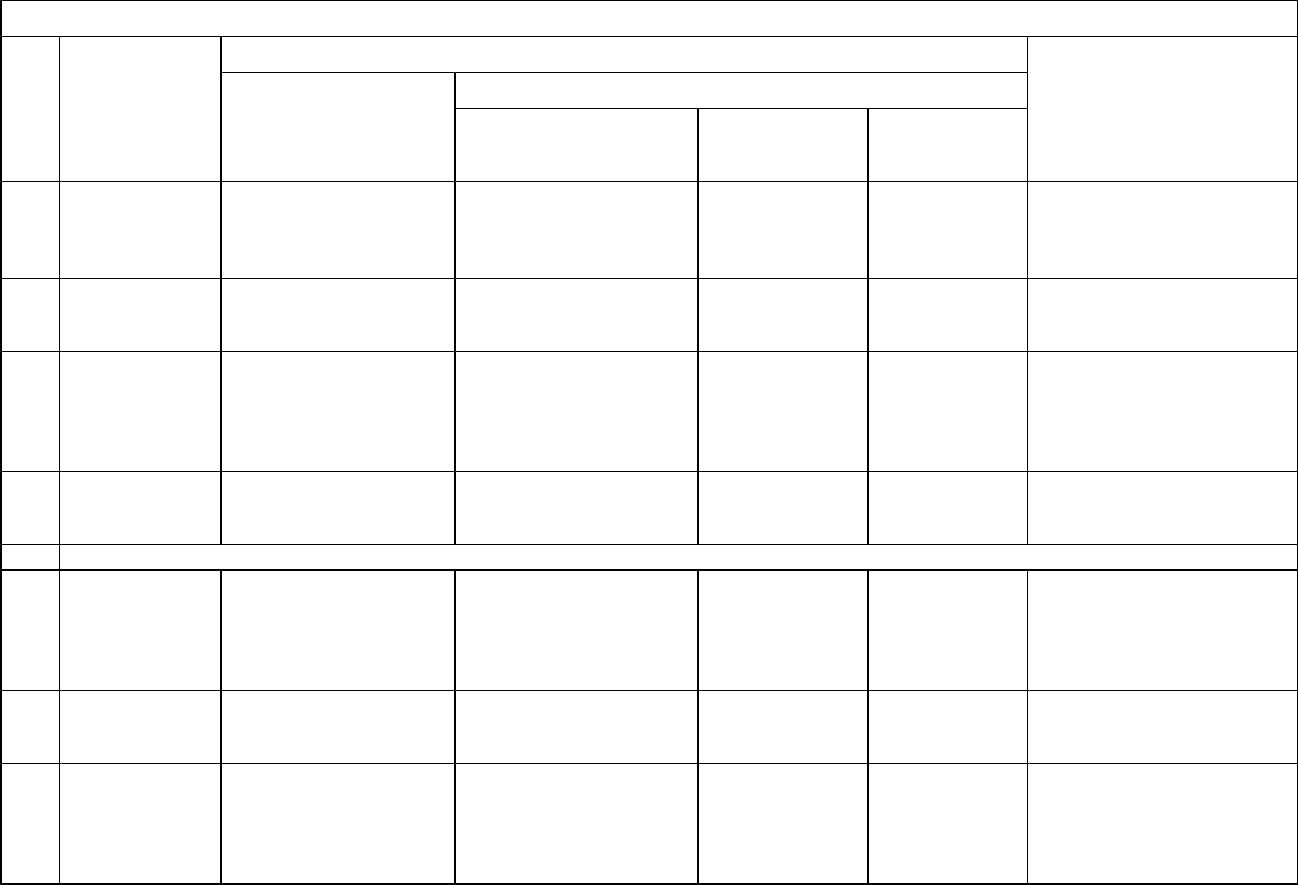

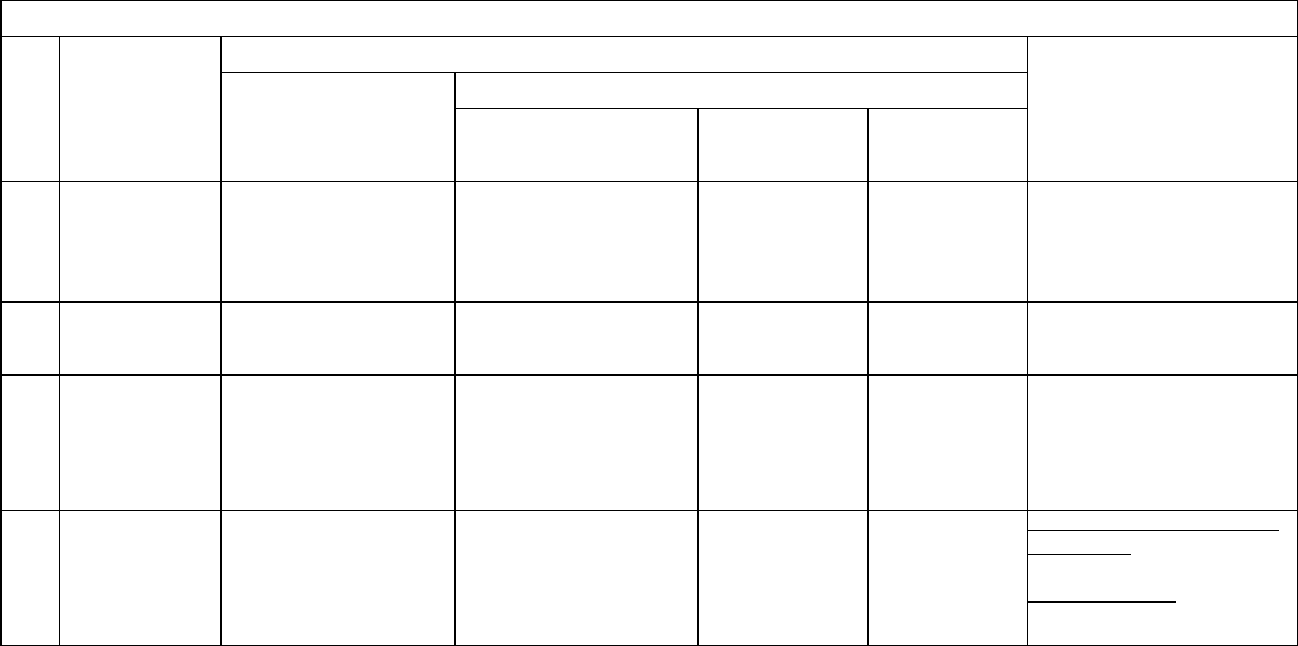

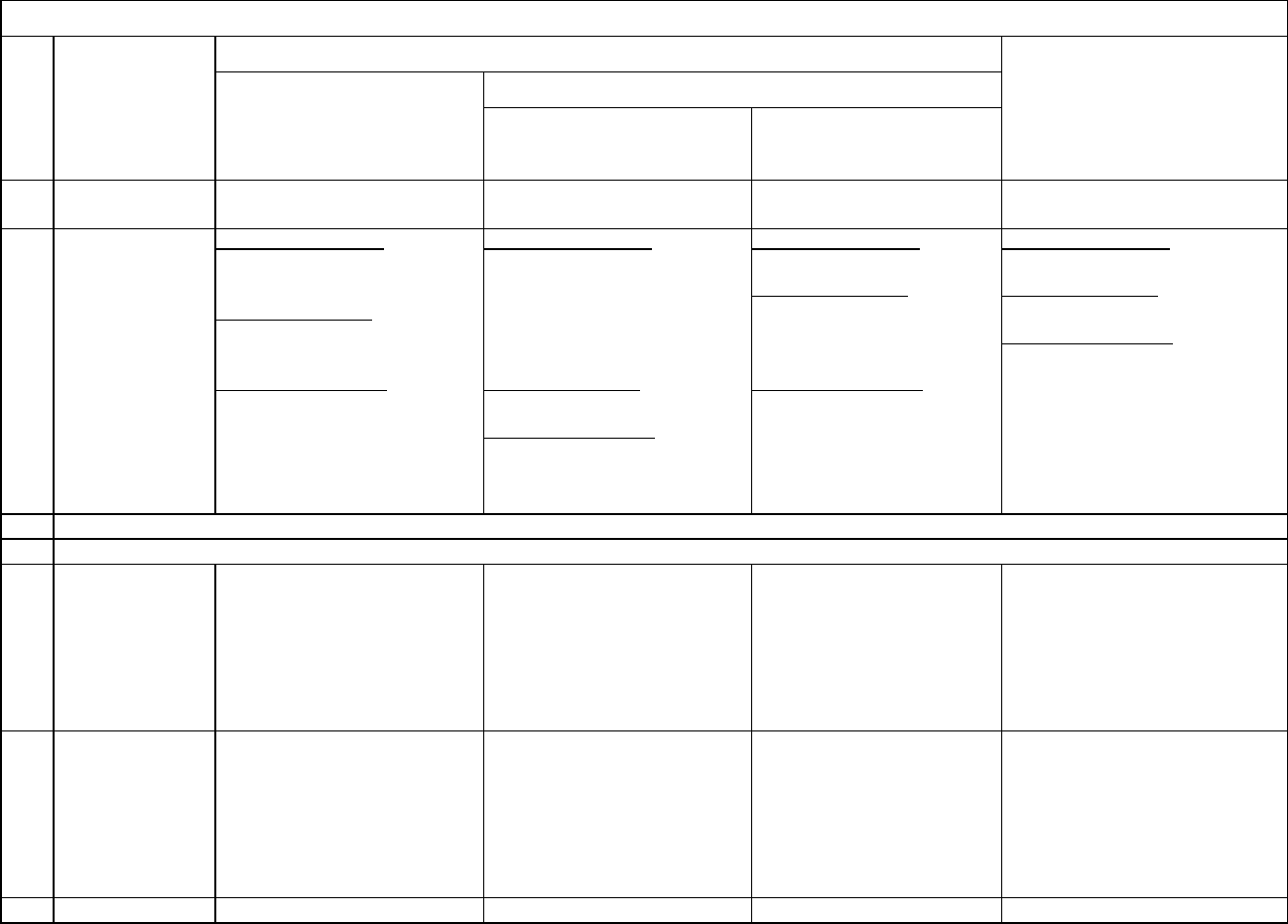

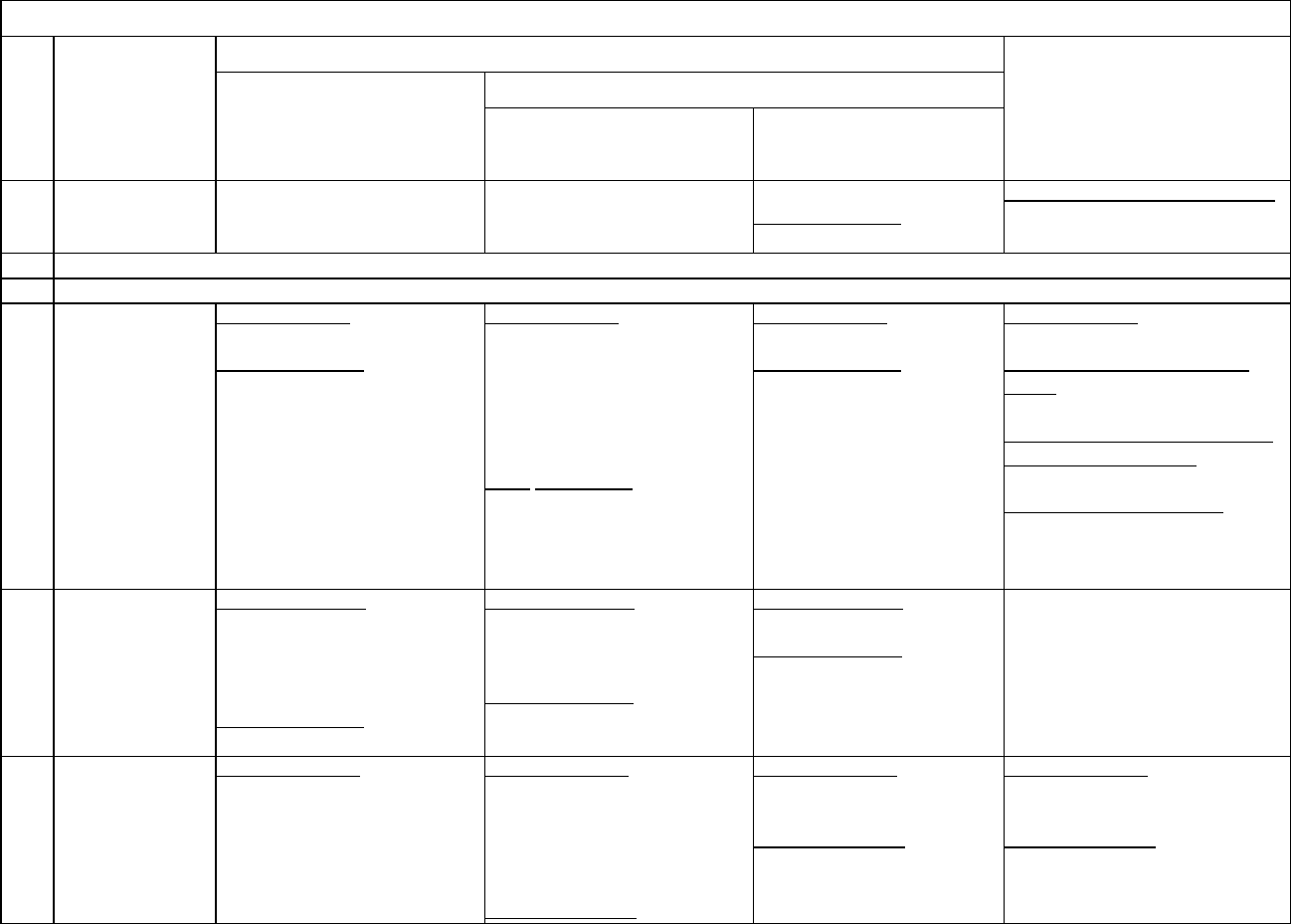

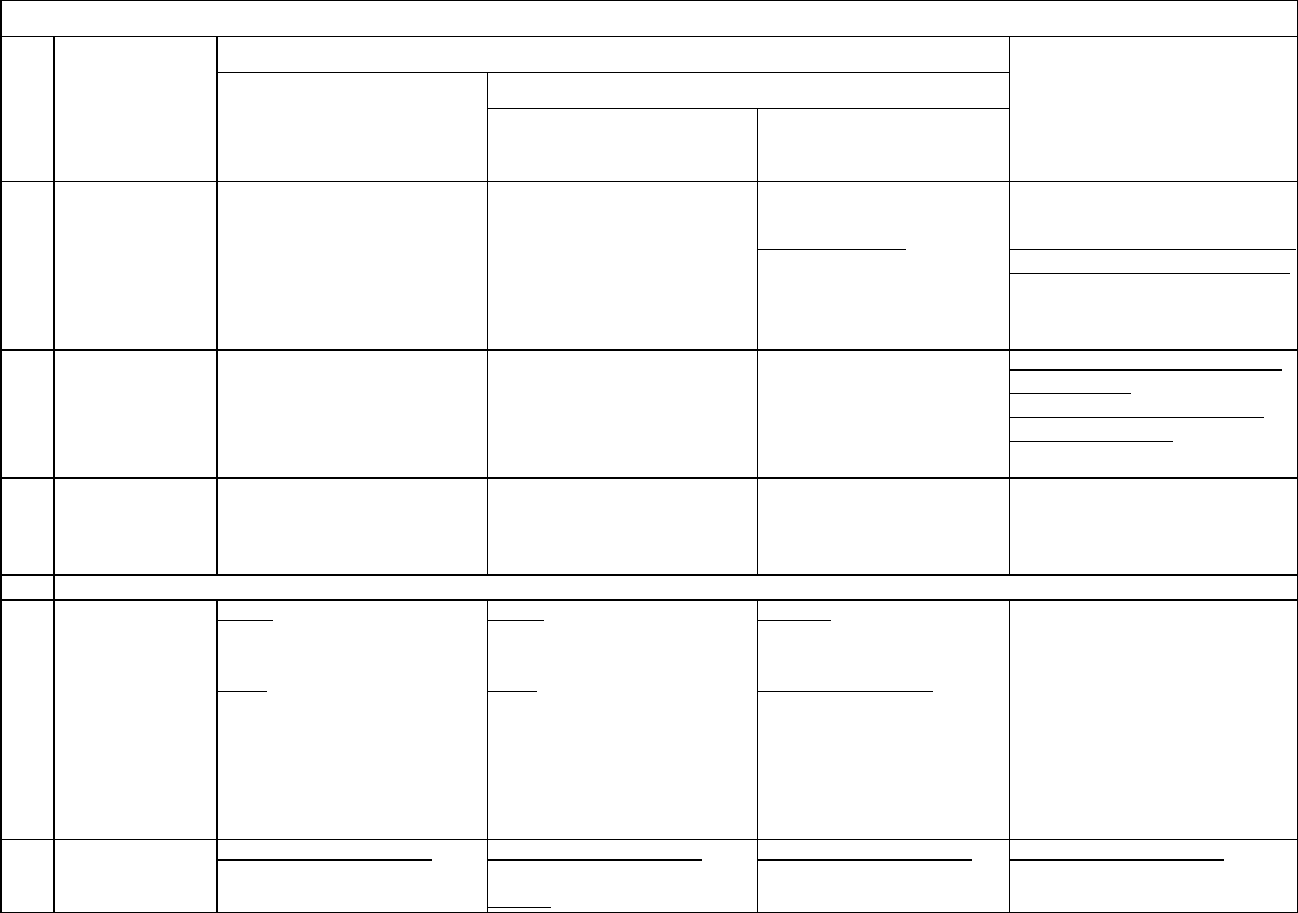

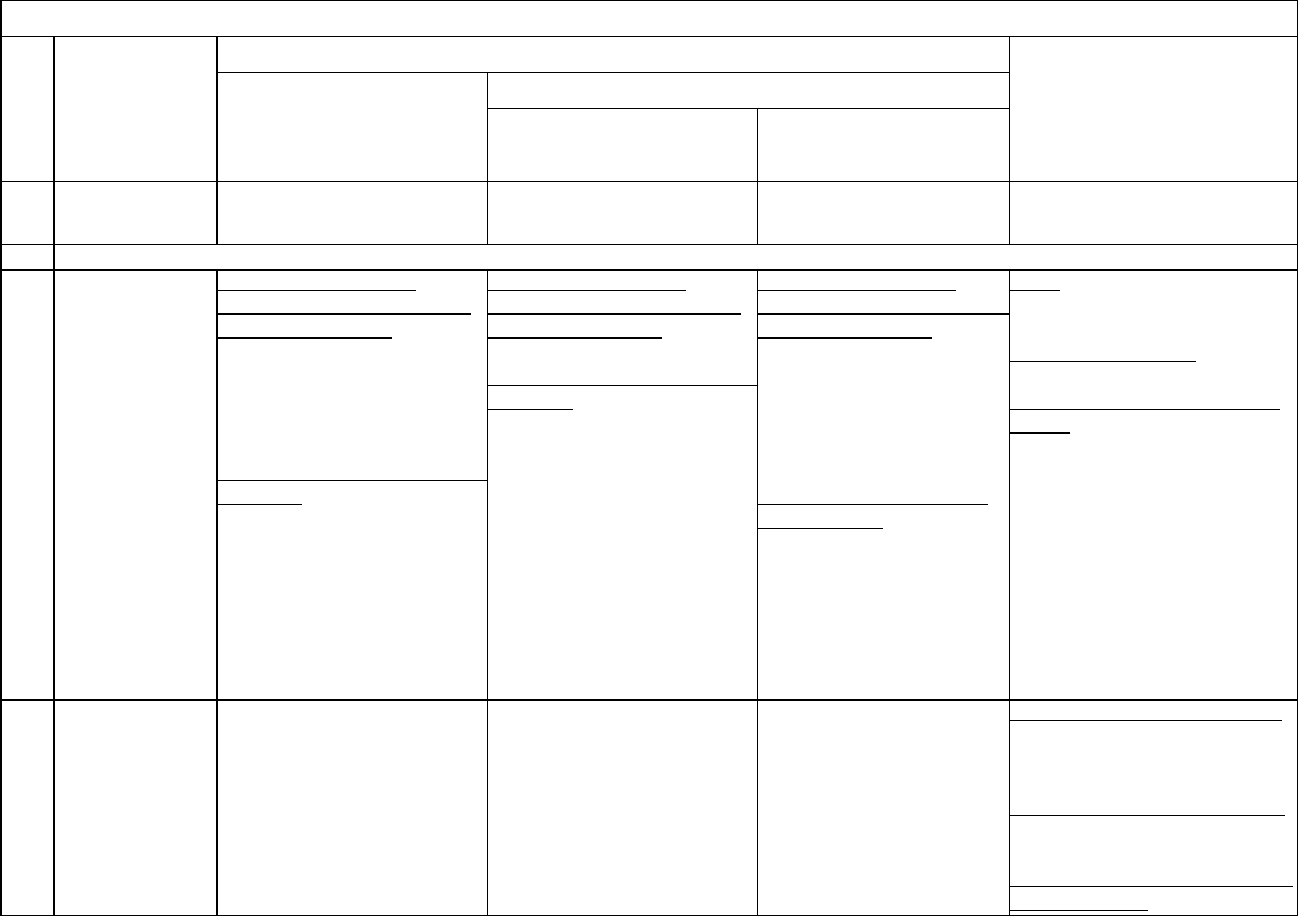

Table 5.1—Content of PCE

Category of expenditure

Comments

Market-based purchases of new goods and of services by

hou

seholds from business, from government, and from

nonpro

fit institutions serving households (NPISHs) and

pur

chases of the services of paid household workers

Includes the full value of financed purchases.

I

ncludes net outlays for health and casualty insurance.

I

ncludes direct and indirect commissions on securities

t

ransactions.

I

ncludes purchases directly financed by government social

bene

fits, such as Medicaid.

E

xcludes services (other than owner-occupied housing)

t

hat are produced by households for their own use.

E

xcludes expenses associated with operating an

un

incorporated business.

E

xcludes services provided directly at government-owned

f

acilities (such as Veterans’ Administration hospitals).

E

xcludes finance charges.

E

xcludes purchases of dwellings and major improvements to

d

wellings.

E

xcludes expenses associated with owner-occupied

hou

sing—such as maintenance and repair, mortgage

f

inancing, and property insurance.

Excludes purchases of illegal goods and services.

Costs incurred by NPISHs in providing services to

hou

seholds less sales by NPISHs to households (final

consumption expenditures by NPISHs)

Costs consist of current operating expenses, including

c

onsumption of fixed capital.

Excludes purchases of structures and equipment.

Net purchases of used goods by households from business

an

d from government

Transactions between households are not reflected in PCE

be

cause they cancel in the aggregation of the personal sector.

Purchases of goods and services abroad by U.S. residents

These transactions are included in PCE in the category

“

foreign travel and other, net.” They are not included in the

various detailed PCE components.

Purchases imputed to keep PCE invariant to whether:

Ho

using and institutional structures and equipment are rented

o

r owned

E

mployees are paid in cash or in kind

F

arm products are sold or consumed on farms

S

aving, lending, and borrowing are direct or are

i

ntermediated

Fi

nancial and insurance service charges are explicit or implicit

Estimates for the following PCE components are entirely

i

mputed: the space rent of nonfarm owner-occupied housing,

f

arm products consumed on farms, wages and salaries paid in

k

ind, private workers’ compensation, services furnished

w

ithout payment by financial intermediaries except life

i

nsurance carriers, and the expenses associated with life

i

nsurance and pension plans.

O

ther imputations include the imputed rental value of buildings

an

d equipment owned and used by NPISHs

(

included in their current operating expenditures), the

s

pace rent of owner-occupied farm housing (included in the

ren

tal value of farm housing), the imputed value of employer-

pa

id medical care and hospitalization insurance, and the

i

mputed value of premium supplements for property and

c

asualty insurance.

PCE records purchases for personal use by U.S. residents, wherever the purchases

take place. Thus, the payments by U.S. residents to foreign residents for passenger fares

and travel services and the purchases by U.S. residents while traveling, working, or

attending school outside the United States are included in PCE—though they are not

included in U.S. production. In PCE, these expenditures are recorded collectively as

“Foreign travel by U.S. residents” in the category “Net foreign travel”; they are not

distributed among the individual PCE categories.

3

In the NIPAs, these expenditures are

3

For the results of research aimed at better separating spending by nonresidents from spending by

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-4

also recorded as imports of goods and services; thus, the PCE and import entries cancel

out in deriving GDP.

4

Conversely, the payments by foreign residents to U.S. residents for travel services

and the purchases by foreign residents while traveling, working, attending school, or

receiving medical treatment in the United States are not included in PCE—though they

are included in U.S. production. However, these expenditures are included in the source

data that underlie the estimates of most individual PCE categories, where they are

indistinguishable from expenditures made by U.S. residents.

5

In order to exclude these

expenditures from PCE, they are recorded collectively as “Less: Expenditures in the

United States by nonresidents” in the category “Net foreign travel”; this entry negates the

expenditures by foreign residents that are embedded in the source data. In the NIPAs, the

expenditures by foreign residents are also recorded as exports of goods and services; thus,

they are included in deriving GDP.

PCE is classified by type of product as follows. Goods consist primarily of

tangible commodities that can be stored or inventoried, but they also include certain

intangible products, such as software. Durable goods are goods that have an average

useful life of at least 3 years. Nondurable goods are goods that have an average useful life

of less than 3 years. Services are commodities that cannot be stored or inventoried and

that are usually consumed at the place and time of purchase.

In the 2009 comprehensive update of the NIPAs, BEA introduced a new

classification system for PCE.

6

This system reflects long-term changes in consumption

patterns due to shifts in consumer demographics, income, and tastes; to the increased

importance of services; and to the introduction of a wide variety of new products. The

system follows recommendations for the classification of household and nonprofit

consumption by the international System of National Accounts (SNA), thus improving

consistency with international standards.

PCE by type of product is classified into the following broad categories:

•

Durable goods: motor vehicles and parts, furnishings and durable household

equipment, recreational goods and vehicles, and other durable goods.

•

Nondurable goods: food and beverages purchased for off-premises consumption,

U.S. residents in the detailed PCE statistics, see Michael Armah and Teresita Teensma, “Research

Spotlight: Estimates of Categories of Personal Consumption Expenditures Adjusted for Net Foreign

Travel Spending,” Survey 92 (April 2012): 13–21.

4

The portions of travel and passenger fare imports accounted for by business and by government are

not offset in PCE. Rather, these purchases are recorded as business intermediate expenditures and as

government consumption expenditures, respectively.

5

Passenger fares paid by foreign residents to U.S. carriers for transportation to and from the United States

are not included in any of the PCE categories; these expenditures are recorded as exports in the NIPAs.

Foreign residents’ expenditures for transportation within the United States are recorded in both exports and

PCE for public transportation.

6

See Clinton P. McCully and Teresita D. Teensma, “Preview of the 2009 Comprehensive Revision of the

National Income and Product Accounts: New Classifications for Personal Consumption Expenditures,”

Survey 88 (May 2008): 6–17.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-5

clothing and footwear, gasoline and other energy goods, and other nondurable goods.

•

Services: housing and utilities, health care, transportation services, recreation

services, food services and accommodations, financial services and insurance, and

other services.

PCE by function is classified into the following broad categories:

•

Food and beverages purchased for off-premises consumption

•

Clothing, footwear, and related services

•

Housing, utilities, and fuels

•

Furnishings, household equipment, and routine household maintenance

•

Health

•

Transportation

•

Communication

•

Recreation

•

Education

•

Food service and accommodations

•

Financial services and insurance

•

Other goods and services

•

Net foreign travel and expenditures abroad by U.S. residents

In addition, household consumption expenditures and the final consumption

expenditures of NPISHs are now shown separately in the PCE tables. Household

consumption expenditures comprise purchases from business, government, and the rest of

the world and from NPISHs (which are included in the health, recreation, education, and

“other goods and services” categories). Final consumption expenditures of NPISHs are

measured as gross output less own-account investment and less sales to households and

other sectors (see the technical note).

Recording in the NIPAs

As described in chapter 2, the NIPAs can be viewed as aggregations of accounts

belonging to individual transactors in the economy. Thus, PCE represents the final

demand for goods and services by households and NPISHs. In the seven summary

accounts of the NIPAs, PCE appears in the Domestic Income and Product Account

(Account 1), where it is the largest component of final demand, and in the Personal

Income and Outlay Account (Account 3), where it is the dominant outlay.

In the NIPAs, PCE by major type of product is presented in NIPA table group 2.3,

and more detailed information by type of product is presented in NIPA table group 2.4.

This presentation is based on the classification of the PCE categories into durable goods,

nondurable goods, and services (for more information, see the section “Type of product”

in chapter 2). PCE by function is presented in NIPA table group 2.5. This presentation is

based on the classification of the PCE categories into broad expenditure categories (for

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-6

more information, see “Function” in chapter 2). PCE by type of product on a monthly

basis is presented in NIPA table group 2.8. In addition, separate annual estimates for the

income and outlays of households and of NPISHs are provided in NIPA table group 2.9.

The following is a list of the principal NIPA tables that present the PCE estimates:

2.3.1 Percent Change From Preceding Period in Real Personal Consumption

Expenditures by Major Type of Product

2.3.2 Contributions to Percent Change in Real Personal Consumption Expenditures by

Major Type of Product

2.3.3 Real Personal Consumption Expenditures by Major Type of Product, Quantity

Indexes

2.3.4 Price Indexes for Personal Consumption Expenditures by Major Type of Product

2.3.5 Personal Consumption Expenditures by Major Type of Product

2.3.6 Real Personal Consumption Expenditures by Major Type of Product, Chained

Dollars

2.3.7 Percent Change from Preceding Period in Prices for Personal Consumption

Expenditures by Major Type of Product

2.4.3 Real Personal Consumption Expenditures by Type of Product, Quantity Indexes

2.4.4 Price Indexes for Personal Consumption Expenditures by Type of Product

2.4.5 Personal Consumption Expenditures by Type of Product

2.4.6 Real Personal Consumption Expenditures by Type of Product, Chained Dollars

2.5.3 Real Personal Consumption Expenditures by Function, Quantity Indexes

2.5.4 Price Indexes for Personal Consumption Expenditures by Function

2.5.5 Personal Consumption Expenditures by Function

2.5.6 Real Personal Consumption Expenditures by Function, Chained Dollars

2.8.1 Percent Change From Preceding Period in Real Personal Consumption

Expenditures by Major Type of Product, Monthly

2.8.3 Real Personal Consumption Expenditures by Major Type of Product, Monthly,

Quantity Indexes

2.8.4 Price Indexes for Personal Consumption Expenditures by Major Type of Product,

Monthly

2.8.5 Personal Consumption Expenditures by Major Type of Product, Monthly

2.8.6 Real Personal Consumption Expenditures by Major Type of Product, Monthly,

Chained Dollars

2.8.7 Percent Change from Preceding Period in Prices for Personal Consumption

Expenditures by Major Type of Product, Monthly

2.9 Personal Income and Its Disposition by Households and by Nonprofit

Institutions Serving Households

BEA also prepares estimates of PCE that are not seasonally adjusted; these are available in

Section 8 of the NIPA Interactive Data Tables. The tables present nominal, or “current-

dollar” measures, “real,” or inflation-adjusted measures, and price indexes.

Additionally, BEA prepares “Underlying Detail Tables” for PCE by type of product that

provide current-dollar, chained-dollar, and price estimates at a greater level of detail than

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-7

are shown in the above tables.

7

BEA does not include these detailed estimates in the

published tables because their quality is significantly lower than that of the higher-level

categories of which they are a part. In particular, these detailed estimates are more likely

to be based on judgmental trends or on less reliable source data.

Overview of Source Data and Estimating Methods

As described earlier, the NIPA estimates, including those for PCE, are prepared

using a wide variety of source data (see “Chapter 3: Principal Source Data”) and using

estimating methods that adjust the source data to the required NIPA concepts and that fill

in gaps in coverage and timing (see “Chapter 4: Estimating Methods”). For PCE, the

estimates are based on statistical reports, primarily from the U.S. Census Bureau but also

from other government agencies; on administrative and regulatory agency reports; and on

reports from private organizations, such as trade associations. The following are among

the principal source data used for the PCE estimates: BEA’s Benchmark Input-Output (I-

O) Accounts, which are based primarily on the Census Bureau’s Economic Censuses, and

BEA’s International Transactions Accounts; the Census Bureau’s Annual Retail Trade

Surveys, Service Annual Surveys, Quarterly Services Reports, and Monthly Retail Trade

Surveys; and the Bureau of Labor Statistics’ Consumer Price Indexes.

Tables 5.A (PCE for goods) and 5.B (PCE for services) following the main text

summarize the source data and estimating methods that are used to prepare the current-

dollar benchmark, nonbenchmark, and current quarterly estimates and the quantity and

price estimates for the categories of PCE as shown by type of product in NIPA table

group 2.4. The source data and methods for the current quarterly estimates reflect both

seasonally adjusted and not seasonally adjusted estimates unless otherwise noted.

Benchmark-year estimates

The source data used for the PCE estimates are complete only for “benchmark”

years—that is, years in which the benchmark I-O accounts are used to establish the level

of PCE and of its components during a comprehensive update. The I-O accounts show the

domestic output of each commodity and its disposition—either as intermediate

consumption by industries or as purchases by final users, including consumers. In the I-O

accounts, PCE is presented as the sum of detailed commodities—goods and services—

purchased by persons.

8

These commodities are then grouped into the PCE categories

shown in the NIPA tables.

9

7

Go to www.bea.gov; select “Tools,” “Interactive Data,” then “GDP and Personal Income,” “Access

Underlying Detail Tables,” “Begin Using the Data,” and “Section 2 – Personal Consumption

Expenditures.”

8

For more information on the preparation of the I-O benchmark accounts, see U.S. Bureau of Economic

Analysis, Concepts and Methods of the U.S. Input-Output Accounts, April 2009; ; go to www.bea.gov

, and

select “Resources,” “Methodologies,” and scroll down to “Industry.”

9

A complete listing of the commodities underlying each PCE product category is available at

www.bea.gov; under “Help,” select “Frequently Asked Questions,” then search for

“What is the I-O

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-8

Two methods are used in preparing the benchmark estimates of PCE: commodity-

flow and direct estimation. Direct estimates are made for the PCE categories that, by

definition, are purchased only by persons: food furnished to employees (including the

military and food produced and consumed on farms), standard clothing issued to military

personnel, net expenditures abroad by U.S. residents, the rental value of owner- and

tenant-occupied dwellings, services of workers employed by households, health

insurance, and expense of handing life insurance and pension plans. In addition, direct

estimates are made for expenditures in the United States by nonresidents—which include

personal, business, and government expenditures and which are subtracted in their

entirety in determining PCE.

For most PCE categories, purchases by persons are estimated using the

commodity-flow method (see the section “Commodity-flow method” in chapter 4).

Generally, this method begins with the value of domestic output based on data from the

economic census—such as manufacturers’ shipments for most goods, revenue for

utilities, receipts for most services, and commissions for securities brokerage.

10

Next, the

domestic supply of each commodity—the amount available for domestic consumption—

is estimated by adding imports and subtracting exports and inventory change. Then, this

supply, denominated in producers’ prices, is allocated among domestic purchasers. The

value of consumer purchases is then converted from producers’ prices to purchasers’

prices by adding wholesale margins and taxes, transportation costs, and retail margins and

taxes.

11

For some categories, variations of this method are used. For new motor vehicles

and for motor vehicle fuels, the domestic supply is converted to purchasers’ prices and

then allocated among persons, business, and government based on trade source data. For

electricity and for natural gas, residential revenue data provide direct estimates of

purchases by persons. For prescription drugs, retail and health services sales from the

economic census are allocated to PCE using Census Bureau data on sales by class of

customer. For purchased meals and beverages (excluding school sales), food services

sales from the economic census are allocated to PCE by type of eating place.

Nonbenchmark-year estimates

In years other than the benchmark years, the PCE estimates are mainly prepared

using indicator series to represent the pattern of expenditures (see the section

“Interpolation and extrapolation using an indicator series” in chapter 4). The estimates for

most categories of PCE goods are prepared using the retail control method. The estimates

commodity composition of the National Income and Product Accounts (NIPA) PCE categories?”

10

Three adjustments are made to the economic census data to bring the coverage of industries to levels

that reflect all of their economic activities. The nonemployer adjustment extends the economic census

coverage to establishments without employees or payrolls. The tax-misreporting adjustment corrects for

the underreporting of income and for illegal nonfiling or late filing of tax returns. The tips or gratuity

adjustment corrects for underreporting of receipts in certain industries, such as accommodation, food

service

s, taxi services, and beauty salons. For more information, see Concepts and Methods of the U.S.

Input-Output Accounts, chapter 5, pages 6–7.

11

See Concepts and Methods of the U.S. Input-Output Accounts, chapter 8.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-9

for the remaining categories—motor vehicles; food furnished to employees; food

produced and consumed on farms; tobacco; standard clothing issued to military

personnel; motor vehicle fuels, lubricants, and fluids; and net expenditures abroad by

U.S. residents—are prepared separately (see tables 5.A and 5.B; for motor vehicles and

motor vehicle fuels, see also the technical note).

The retail control method provides the indicator series used in interpolating and

extrapolating the total for most goods, and it provides the “control total” to which the

categories included in the retail control group must sum. This method is implemented as

follows:

1. The estimate of total PCE for most goods is derived by extrapolation from the

benchmark-year estimate using a retail control total of sales by most kinds of business

from the annual retail trade survey.

2. The estimates for prescription drugs are prepared by extrapolation using data from

IMS Health Inc.

3. The estimates for audio discs, tapes, vinyl, and permanent digital downloads are

prepared by extrapolation using data from the Recording Industry Association of

America.

4. The estimates for the rest of the detailed PCE categories are prepared by extrapolation

using estimates of retail sales by corresponding product lines that, in turn, are based

on commodity sales data from the most recent economic census. For goods bought at

grocery stores, the economic census allocations are updated annually using retail

point-of-sale scanner data from Information Resources, Inc.

12

For goods bought at

radio, television, and electronics stores, at computer and software stores, and at

camera and photographic supply stores, the allocations are updated using retail point-

of-sale scanner data from NPD Group.

13

For goods bought at electronic shopping and

mail order retailers, the allocations are updated using annual merchandise line sales

from the Census Bureau E-commerce Report and retail point-of-sale scanner data

from NPD Group.

5. The expenditures estimates for the categories in step 3 are adjusted proportionately so

that their sum plus the expenditures for prescription drugs and for audio discs, tapes,

vinyl, and permanent digital downloads is equal to the retail control total in step 1.

(For a general illustration of this method, see the section “Retail control method”

in chapter 4.)

A variety of sources and methods are used to construct the indicator series for the

PCE services categories. For many services, the service annual survey is the primary data

source.

12

See Eugene P. Seskin and Shelly Smith, “Annual Revision of the National Income and Product

Accounts,” Survey 88 (August 2008): 18.

13

See Clinton P. McCully and Steven Payson, “Preview of the 2009 Comprehensive Revision of the

NIPAs: Statistical Changes,” Survey 89 (May 2009): 9.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-10

Current quarterly and monthly estimates

The seasonally adjusted current dollar quarterly and monthly estimates for most

PCE categories are prepared by using seasonally adjusted indicator series to extrapolate

from the annual estimates. Most goods categories are estimated by the retail control

method using data on retail sales from the monthly retail trade survey (MRTS).

14

The rest

of the goods categories are estimated using other indicator series.

For many services categories, the indicator series are based on data from the

Census Bureau’s Quarterly Services Report. For the remaining categories, the current

estimates are extrapolated based on other source data or on judgmental trends. In general,

the real-dollar series for these categories are extrapolated using the rate of change in

population and a projected rate of change in real per capita consumption based on the

results of the most recent NIPA annual update. The real-dollar estimates are then

converted to current dollars using the appropriate monthly price indexes.

The not seasonally adjusted estimates are derived using the same methods as the

seasonally adjusted estimates, using the not seasonally adjusted versions of the same

indicators

Quantity and price estimates

The estimates of quantities purchased, or real spending, for most of the detailed

PCE categories are prepared by deflation. In this method, the quantities are calculated by

dividing the current-dollar value of the component by an appropriate price index (with the

reference-year value set to 100). For most PCE categories, the closest matching price

index is a consumer price index or indexes. In addition, the quantity estimates for some

detailed components are prepared by quantity extrapolation or by direct valuation. (For

descriptions of the three methods, see the section “Estimates for detailed components” in

chapter 4.)

The aggregate PCE measures are calculated from the detailed components as

chain-type quantity and price indexes (for information about these calculations, see the

section “Estimates for NIPA aggregates” in chapter 4). BEA also prepares measures of

real PCE and its components in a dollar-denominated form, designated “chained-dollar”

estimates (see “Chained-dollar measures” in chapter 4).

.

14

For the advance quarterly estimate, the source data for the third month are from the Census Bureau’s

advance monthly retail sales survey because the MRTS data are not yet available.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-11

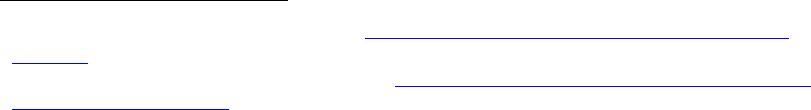

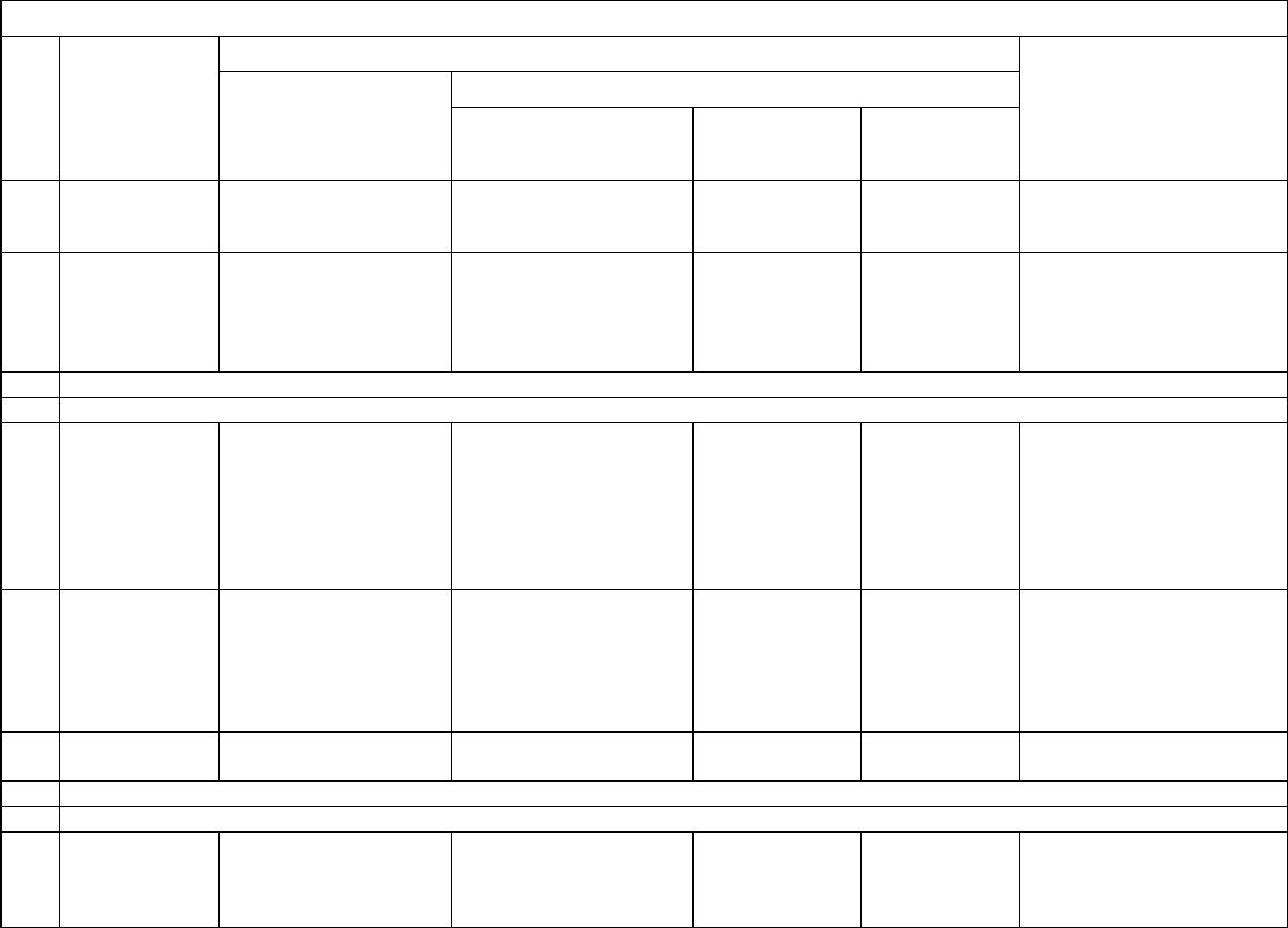

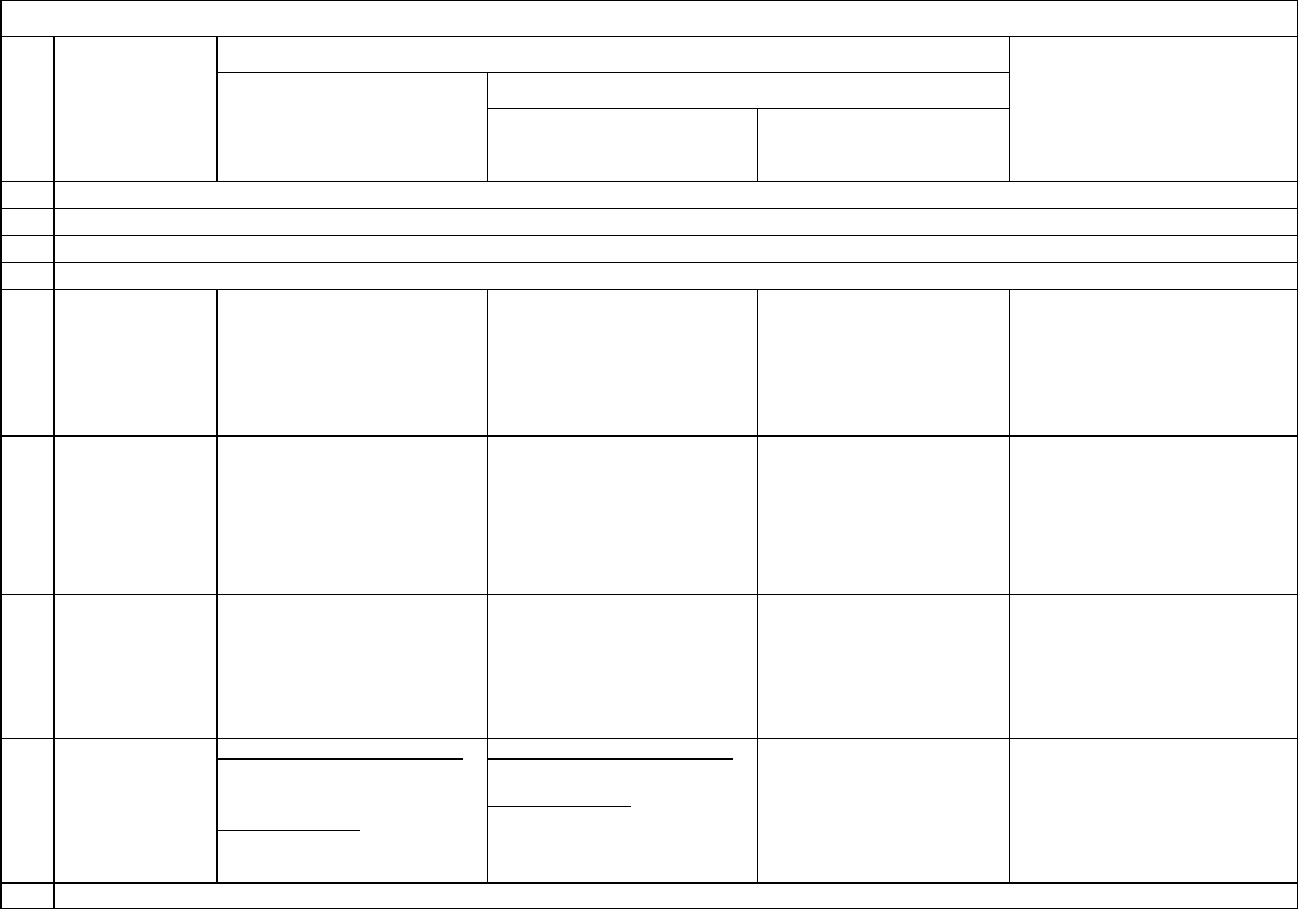

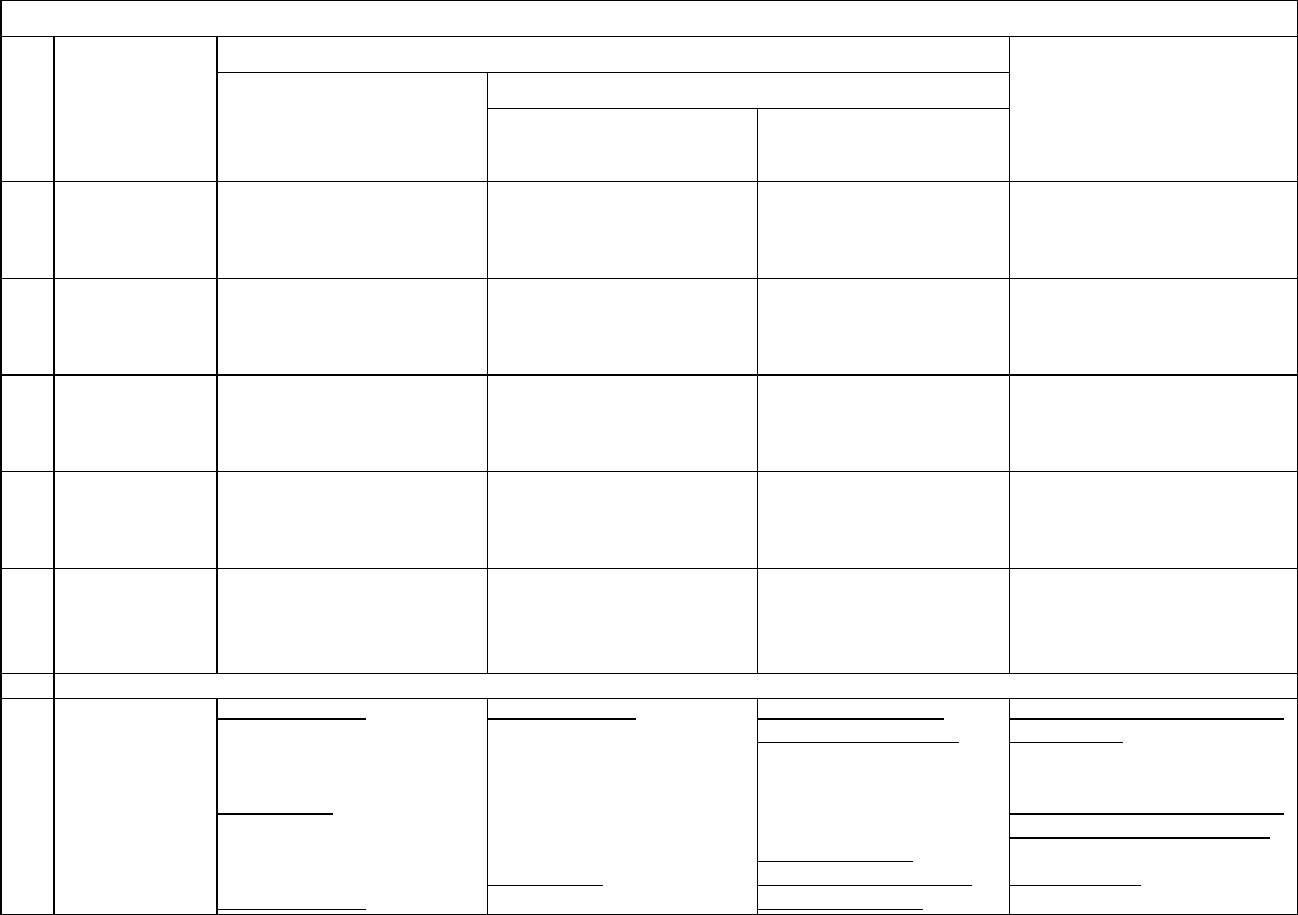

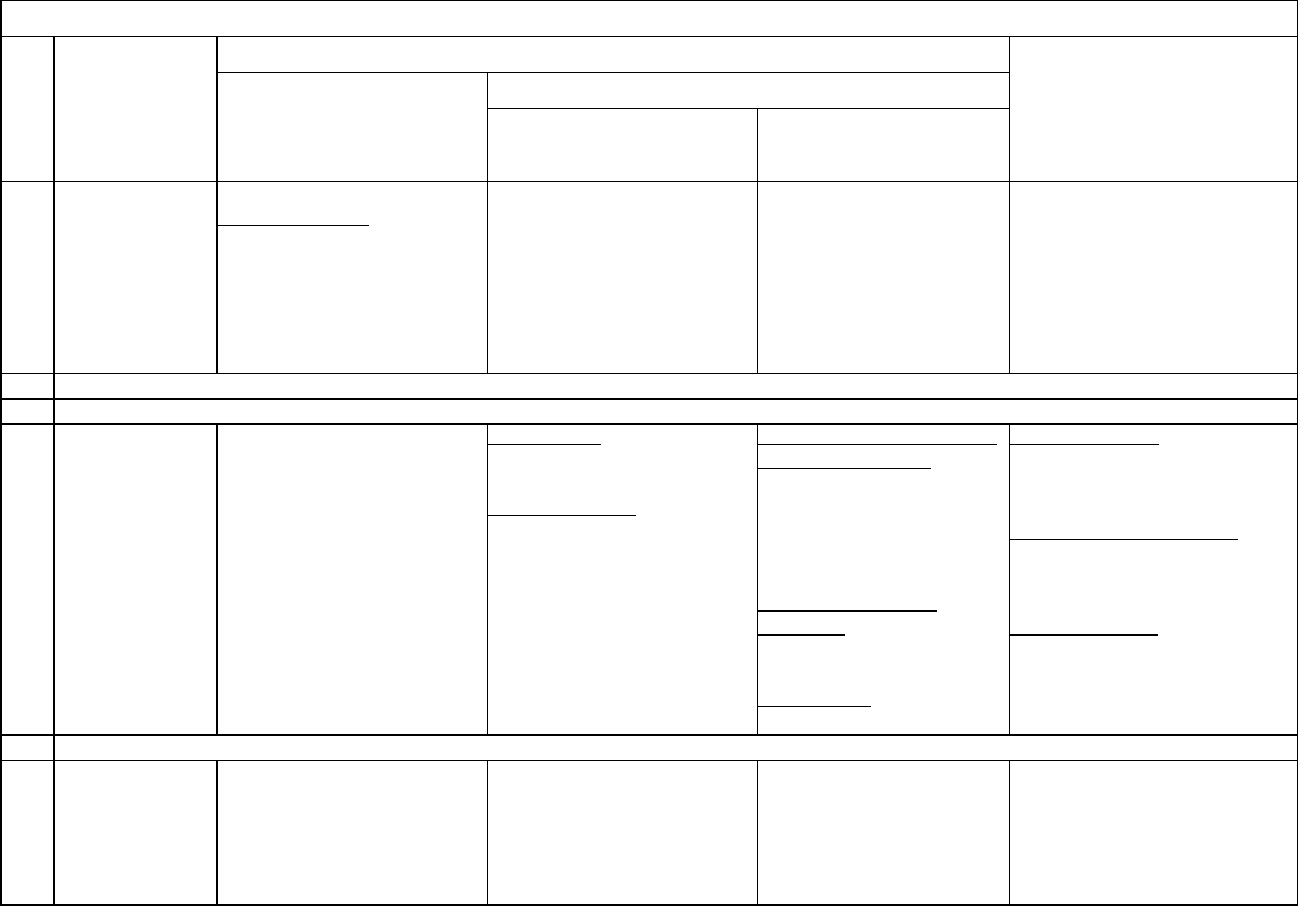

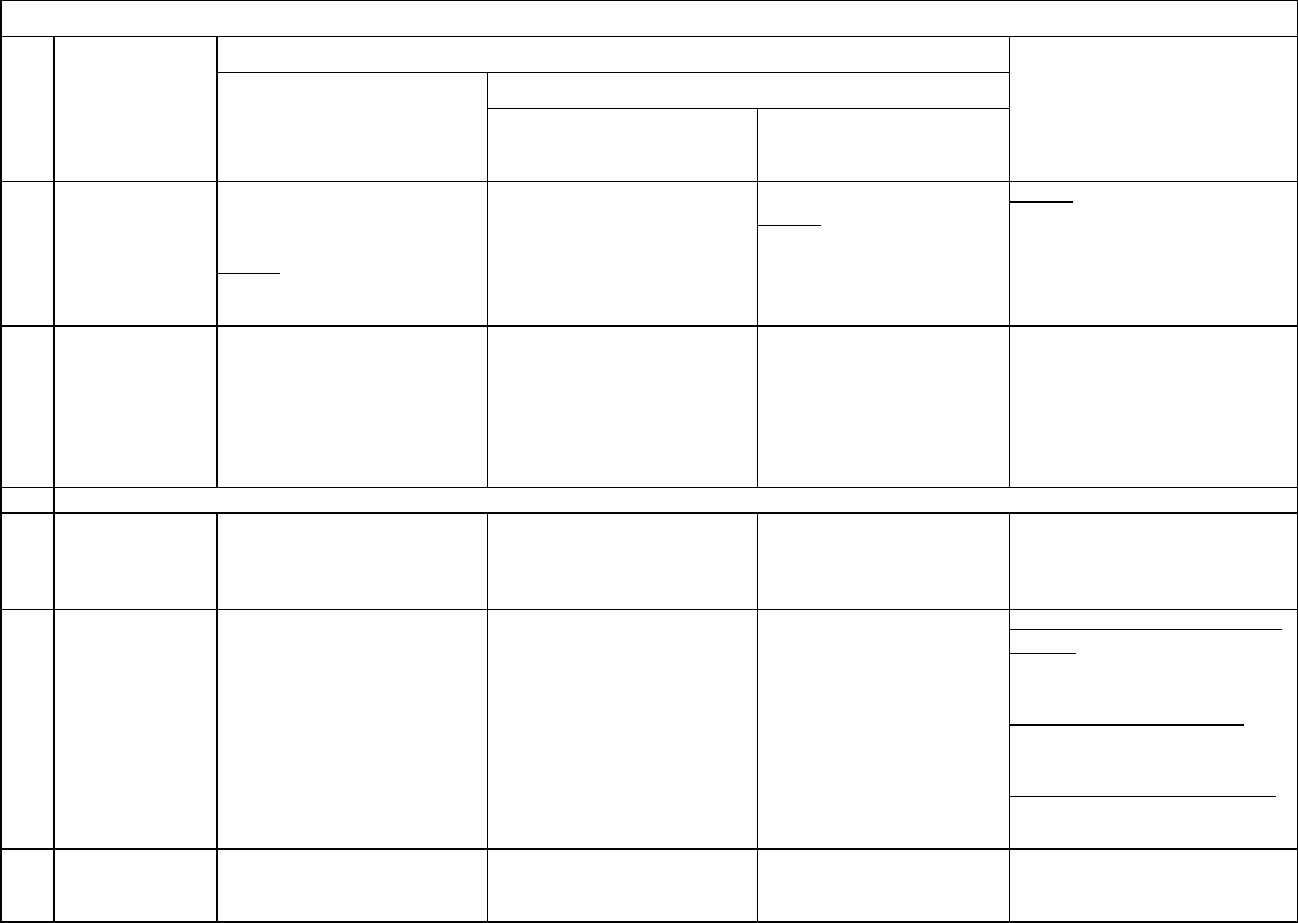

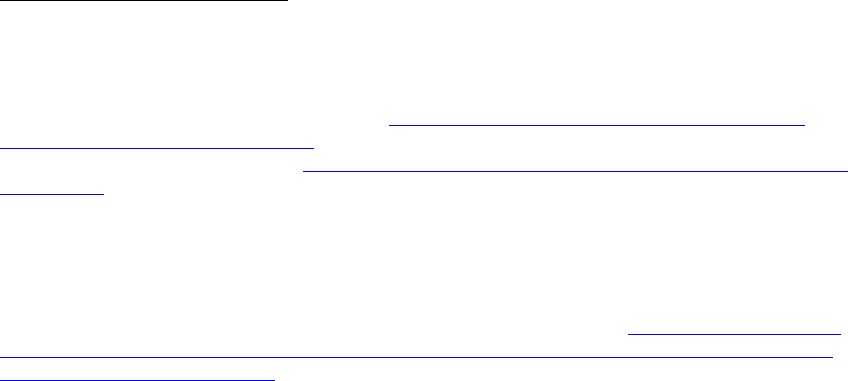

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

2

Goods:

3

Durable goods:

4

Motor vehicles and parts:

5

New motor vehicles

[For more detail,

see the technical

note “Special

Estimates.”]

Based on unit data from

Wards’ Automotive Reports

and registration data from

R.L. Polk & Co. times

average price data from J.D.

Power and Assoc.

Same as for benchmark year.

Same as for

benchmark year.

Same as for

benchmark year.

CPI for new cars and CPI for new

trucks.

6

Net purchases of

used

motor

vehicles [For more

detail, see the

technical note

“Special

Estimates.”]

Dealers’ margins: retail sales

from EC and margin rate

from ARTS.

Net transactions

:

commodity

-flow method,

starting with manufacturers’

shipments from EC.

Dealers' margins:

extr

apolation based on

Census gross margins for

used vehicle dealers and

wholesale margins for motor

vehicle and motor vehicle

parts and supplies, except

MSBOs.

Net transactions

: quantities

based on vehicles in

operation data from R.L. Polk

& Co. and average p

rices

based on National Automobile

Dealers Association (NADA).

Dealers' margins:

extrapolation based

on retail sales of

used vehicle dealers

from MRTS.

N

et transactions:

same as for

nonbenchmark year.

Dealers’ margins:

sa

me as for most

r

ecent year.

Net

transactions:

extrapolation by

retail sales of used

vehicle dealers

from MRTS.

Dealers’ margins: PPI for used

vehicle sales at new car dealers.

Net transactions

: CPI for used

cars and trucks.

.

7

Motor vehicle parts

and accessories

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for tires and CPI for vehicle

parts and equip

ment other than

tires.

8

Furnishings and durable household equipment:

9

Furniture and

Commodity-flow method,

Retail control method, using

Retail control

Same as for most

CPI for furniture and bedding,

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-12

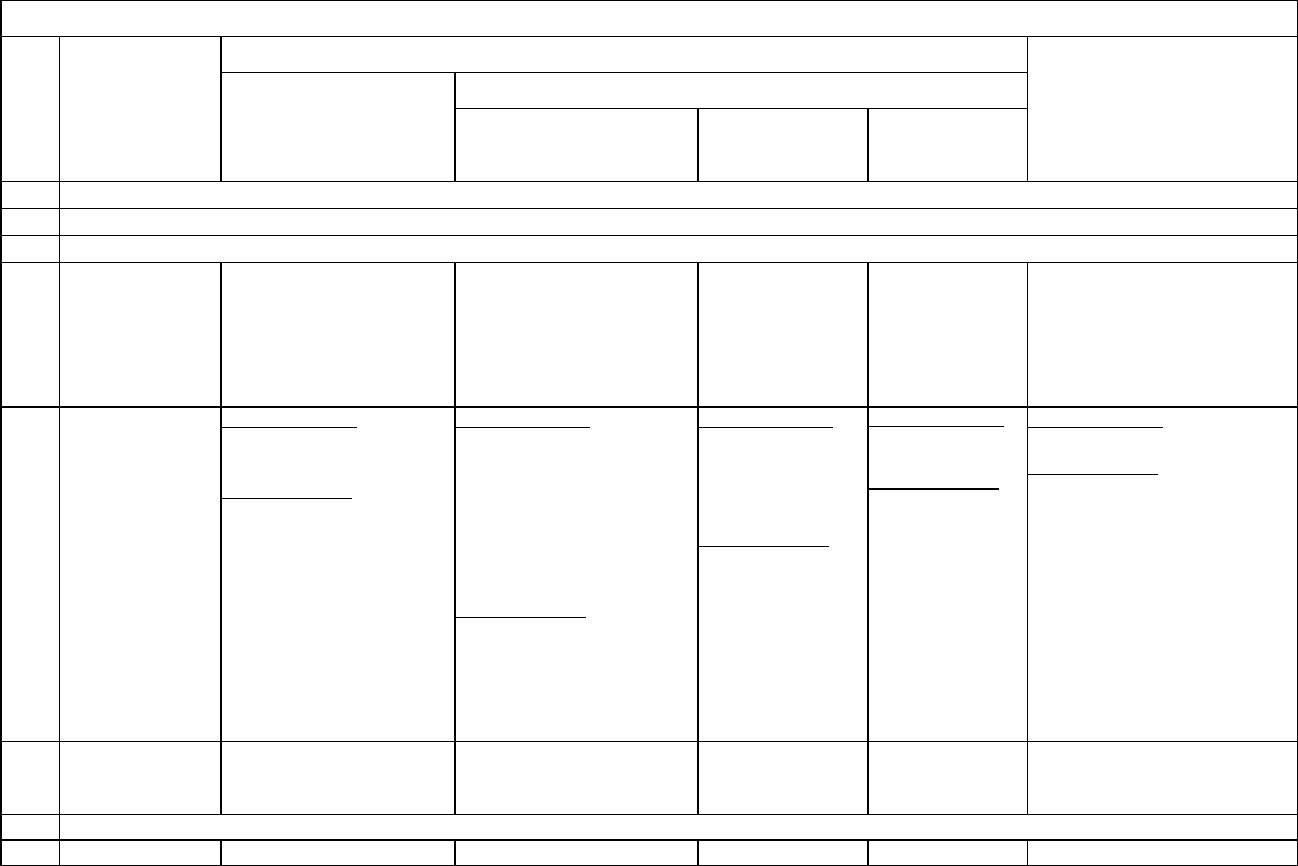

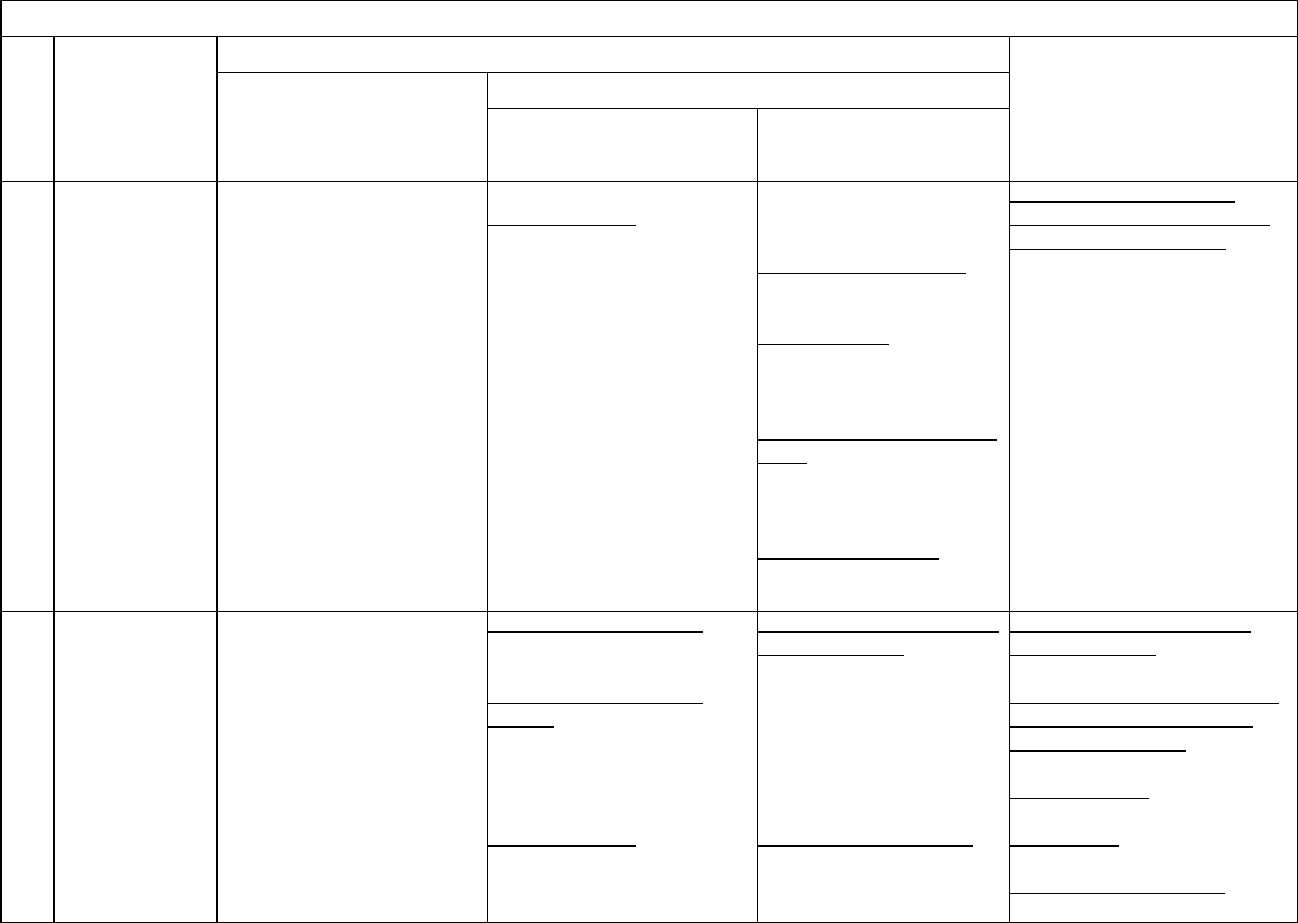

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

furnishings

starting with manufacturers’

shipments from EC.

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

method, using retail

sales from MRTS.

recent year.

CPI for clocks, lamps, and

decorator items, CPI for floor

coverings, and C

PI for window

coverings.

10

Household

appliances

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

r

etail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for major appliances and CPI

for other appliances.

11

Glassware,

tableware, and

household utensils

Commodity-flow method,

starting with

manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for dishes and flatware and

CPI for nonelectric cookware and

tableware.

12

Tools and

equipment for

house and garden

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent

year.

CPI for tools, hardware, and

supplies and CPI for outdoor

equipment and supplies.

13

Recreational goods and vehicles:

14

Video, audio,

photographic, and

information

processing

equipment and

media

Commodity-flow method,

starting with

manufacturers’

shipments from EC. For

computers

/tablets,

peripherals, and software,

the consumer share is based

on retail “class of customer”

data from EC.

For most components, retail

co

ntrol method, using retail

s

ales from ARTS. For audio

discs

, tapes, vinyl, and

permanent

digital downloads,

Recording Industry

Association of America

industry data on sales of

physical music and

permanent digital downloads.

C

omposition of goods sold

pa

rtly based on scanner data

fr

om NPD group and Census

E

-commerce Report.

For most

components, r

etail

co

ntrol method,

u

sing retail

sal

es from MRTS.

For

audio discs,

tapes, vinyl, and

permanent digital

downloads, same as

for nonbenchmark

year.

For most

components, s

ame

a

s for most recent

y

ear. For audio

discs, tapes, vinyl,

and permanent

digital downloads

,

extrapolated using

Nielsen quantity

data on music

sales times the CPI

for

recorded music

and music

subscriptions.

CPI for televisions, CPI for other

v

ideo equipment, CPI for audio

equi

pment, CPI for recorded

music and music subscriptions

,

CPI

for video discs and other

me

dia, CPI for

pho

tographic equipment, CPI for

pe

rsonal computers and

pe

ripheral equipment, CPI for

co

mputer software and

ac

cessories, and CPI for

t

elephone hardware, calculators,

an

d other consumer information

i

tems.

15

Sporting

Commodity-flow method,

Retail control method, using

Retail control

Same as for most

CPI for sports equipment.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-13

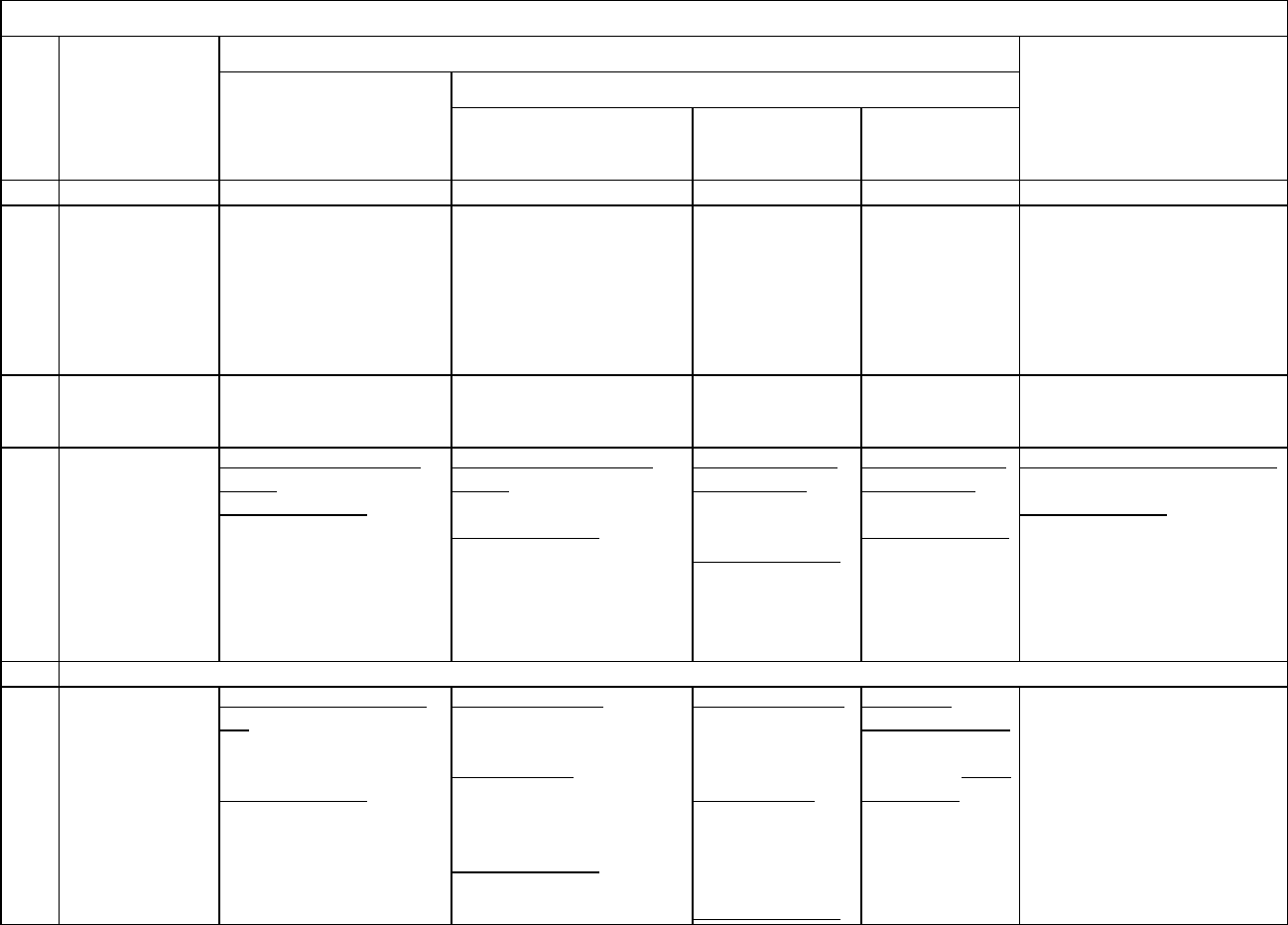

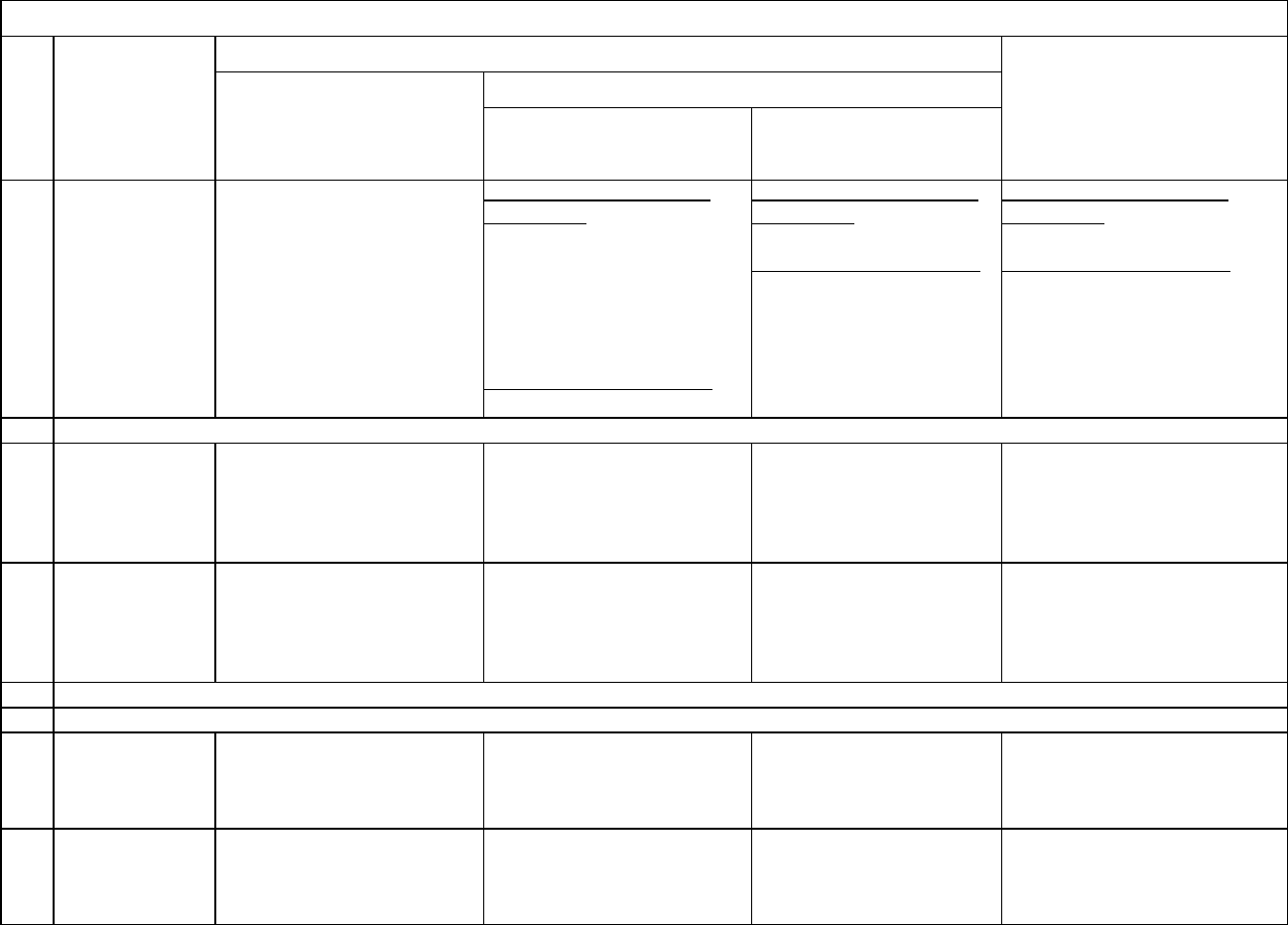

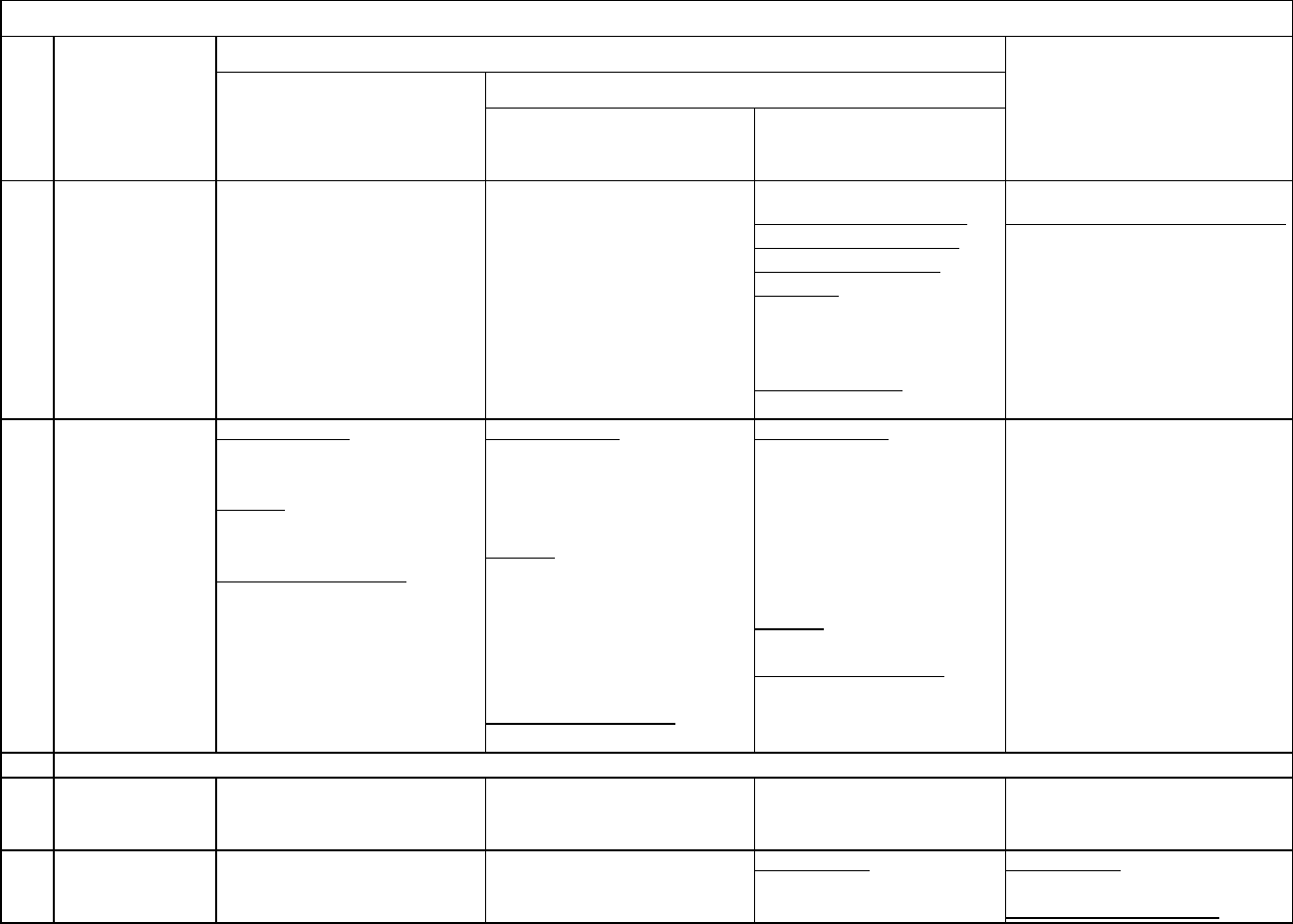

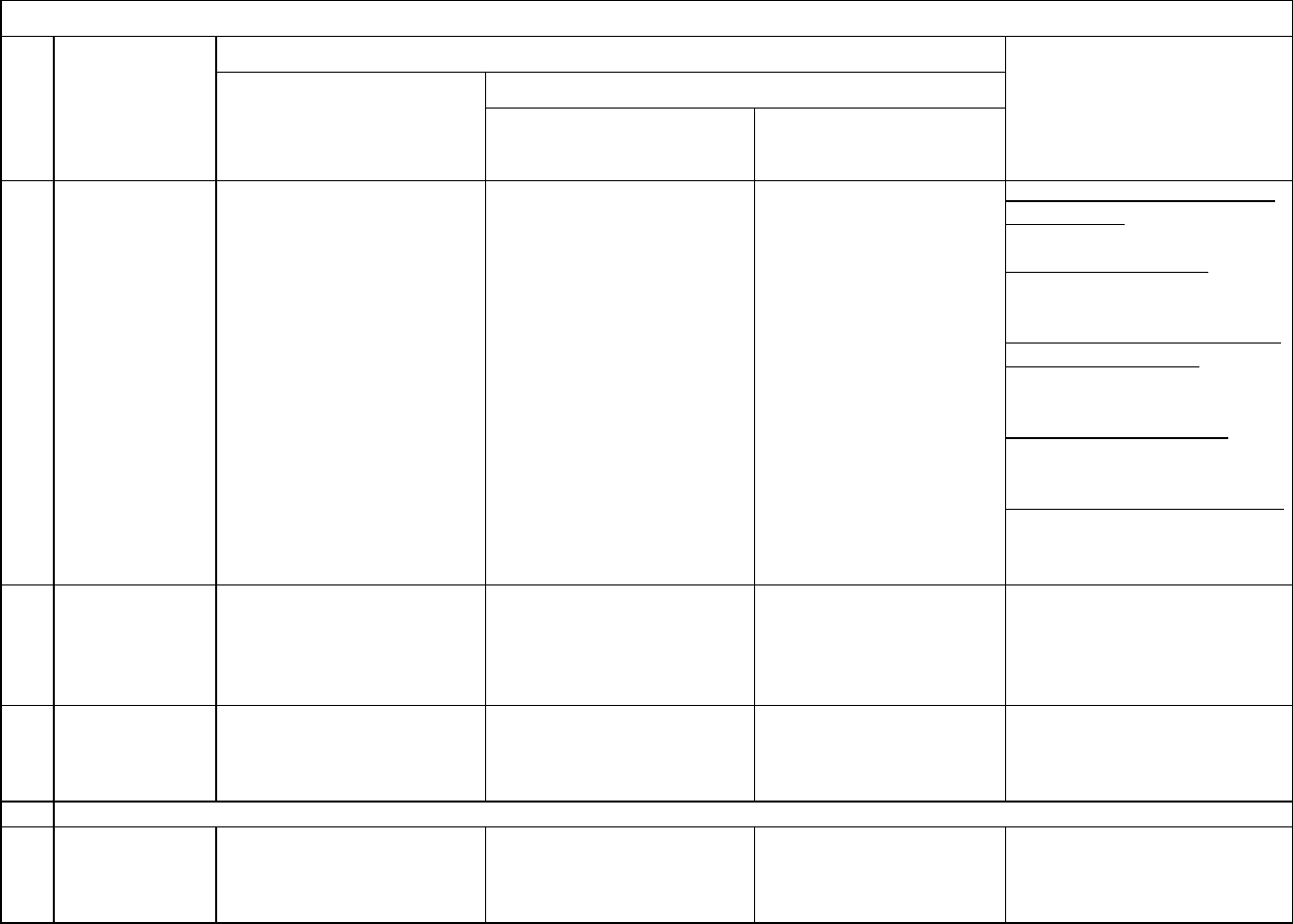

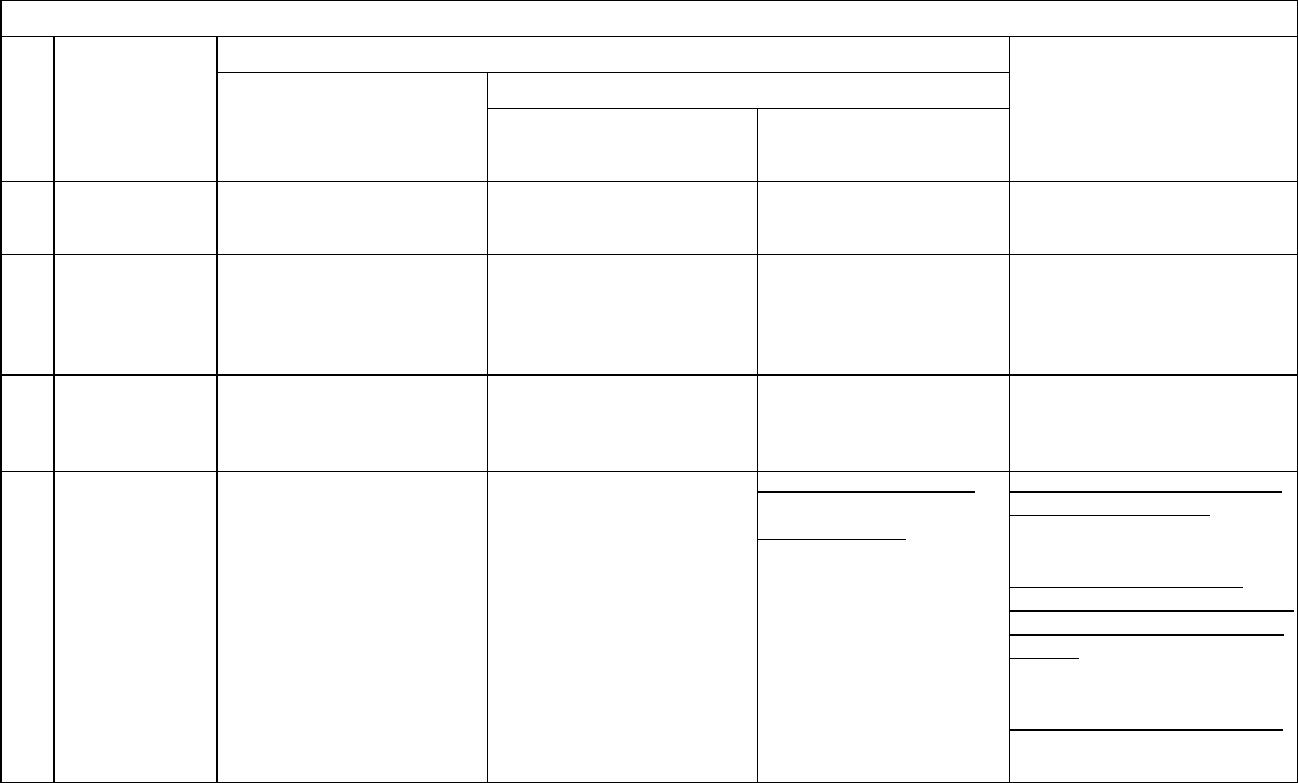

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

equipment,

supplies, guns, and

ammunition

starting with manufacturers’

shipments from EC.

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

method, using retail

sales from MRTS.

recent year.

16

Sports and

recreational

vehicles

Commodity-flow method,

starting with manufacturers’

shipments

from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for new motorcycles and CPI

for sports vehicles including

bicycles.

17

Recreational books

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for recreational books.

18

Musical instruments

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for music instruments and

accessories.

19

Other durable goods:

20

Jewelry and

watches

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for jewelry and CPI for

watches.

21

Therapeutic

appliances and

equipment

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method,

using retail

sales from MRTS.

Same as for most

recent year.

CPI for medical equipment and

supplies and CPI for eyeglasses

and eye care.

22

Educational books

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for educational books and

supplies.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-14

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

23

Luggage and

similar personal

items

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for miscellaneous personal

goods.

24

Telephone and

related

communication

equipment

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on scanner data

from NPD

group.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for telephone hardware,

calculators, and other consumer

information items.

25

Nondurable goods:

26

Food and beverages purchased for off-premises consumption:

27

Food and

nonalcoholic

beverages

purchased for off

-

premises

consumption

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

largely based on scanner data

from Information Resources,

Inc. and from Fresh Look

Marketing Group.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

Detailed price components of the

CPI for food at home.

28

Alcoholic

beverages

purchased for off

-

premises

consumption

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on scanner data

from Information R

esources,

Inc.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for distilled spirits at home,

CPI for wine at home, and CPI

for beer, ale, and other malt

beverages at ho

me.

29

Food produced and

consumed on farms

Data from U.S. Department

of Agriculture (USDA).

Same as for benchmark year.

Same as for

benchmark year.

Judgmental trend.

BEA composite index of USDA

prices received by farmers.

30

Clothing and footwear:

31

Garments:

32

Women’s and girls’

clothing

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E-

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for women’s and girls’

apparel.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-15

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

commerce Report.

33

Men’s and boys’

clothing

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for men’s and boys’ apparel.

34

Children’s and

infants’ clothing

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for infants’ and toddlers’

apparel.

35

Other clothing

materials and

footwear

Standard clothing issued

military

: federal budget data.

Other components

:

commodity

-flow method,

starting with manufacturers’

shipments from EC.

Standard clothing issued

military

: same as for

benchmark year.

Other components

: retail

control method, using retail

sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Standard clothing

issued military: same

as for benchmark

year.

Other components

:

retail control method,

using retail sales

from MRTS.

Standard clothing

issued military

:

judgmental trend.

Other components:

same as for most

recent year.

Standard clothing issued military:

PPI for apparel.

Other components

: CPI for

sewing machines, fabri

c, and

supplies and CPI for footwear.

36

Gasoline and other energy goods:

37

Motor vehicle fuels,

lubricants, and

fluids [For more

detail on gasoline

and other motor

fuel, see the

technical note

“Special

Estimates.”]

Gasoline and other motor

fuel

: Primarily EC receipts

data on automotive fuels

sold at gasoline stations.

Other components

:

commodity

-flow method,

starting with manufacturers’

shipments from EC.

Nondiesel gasoline:

information on quantities from

EIA and on prices from BLS.

Di

esel gasoline: information

on household purchases from

BLS

Consumer Expenditure

S

urvey.

Other components

:

manufacturers’ shipments

from Census Bureau annual

Nondiesel gasoline:

same as for

nonbenchmark

years.

Diesel gasoline

:

inform

ation on

quantities from EIA

and on prices from

BLS.

Other components

:

Diesel and

nondiesel gasoline:

same as for most

recent year.

Other

components: same

as for most recent

yea

r.

CPI for motor fuel and CPI for

motor oil, coolants, and fluids.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-16

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

survey of manufactures.

motor fuel quantities

from EIA times CPI

for motor oil,

coolants, and fluids.

38

Fuel oil and other

fuels

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method,

using retail

sales from MRTS.

Same as for most

recent year.

CPI for fuel oil and CPI for

propane, kerosene, and firewood.

39

Other nondurable goods:

40

Pharmaceutical and

other medical

products

Prescription and

nonprescription drugs

: EC

data on product

-line sales.

Other components

:

commodity

-flow method,

starting with manufacturers’

shipments from EC.

Prescription drugs: value of

sales to consumers from IMS

Health, Inc.

Other components

: retail

control method, using retail

sales from ARTS

.

Composition of goods sold

partly based on Census E

-

commerce Report.

Prescription drugs:

same as for

nonbenchmark

years.

Other components

:

retail control method,

using retail sales

from MRTS.

Same as for most

recent year.

CPI for prescription drugs, CPI

for nonprescription drugs, and

CPI for medical equipment and

supplies.

41

Recreational items

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for toys, CPI for pets and pet

products, CPI for indoor plants

and flowers, and CPI for film and

pho

tographic supplies.

42

Household supplies

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for household cleaning

products, CPI for household

paper products, CPI for other

linens, CPI for sewing machines,

fabric, and supplies, and CPI for

miscellaneous household

products.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-17

Table 5.A—Summary of Methodology Used to Prepare Estimates of PCE for Goods

Line in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years except

the most recent year

Most recent year

Current quarterly

estimates**

43

Personal care

products

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for hair, dental, shaving, and

miscellaneous personal care

products and CPI for cosmetics,

perfume, bath, nail preparations,

and implements.

44

Tobacco products

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Nielsen point-of-sale data for

tobacco and smoking

products.

Same as for

nonbenchmark

years.

Same as for

nonbenchmark

years.

CPI for tobacco and smoking

products.

45

Magazines,

newspapers, and

stationery

Commodity-flow method,

starting with manufacturers’

shipments from EC.

Retail control method, using

retail sales from ARTS.

Composition of goods sold

partly based on Census E

-

commerce Report.

Retail control

method, using retail

sales from MRTS.

Same as for most

recent year.

CPI for newspapers and

magazines and CPI for

stationery, stationery supplies,

and gift wrap.

46

Net expenditures

abroad by U.S.

residents.

BEA international

transactions accounts

estimates (based on BEA

model).

Same as for benchmark year.

Same as for

benchmark year.

Same as for

benchmark year.

Personal remittances in kind to

non

residents: CPI for

co

mmodities.

O

ther components: BEA price

i

ndex for installation support

services.

* The description “Same as for benchmark year” indicates that the estimate is prepared using a methodology similar to that used for the benchmark

estimate rather than by using an indicator series to interpolate or extrapolate the benchmark estimate.

** For the components that use MRTS for the advance quarterly estimate, the source data for the third month of the quarter are from the Census

Bureau’s Advance Monthly Retail Sales for Retail and Food Services because the MRTS data are not yet available. For some other components, the

source data may be available for only the first 2 months of the quarter; in such cases, the estimates for the third month are based on judgmental trend.

ARTS Annual Retail Trade Survey, Census Bureau

BLS Bureau of Labor Statistics

CES Current Employment Statistics, BLS

CPI Consumer Price Index, BLS

EC Economic Census, Census Bureau

MSBO Manufacturer Sales Branches and Offices

MRTS Monthly Retail Trade Survey, Census Bureau

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-18

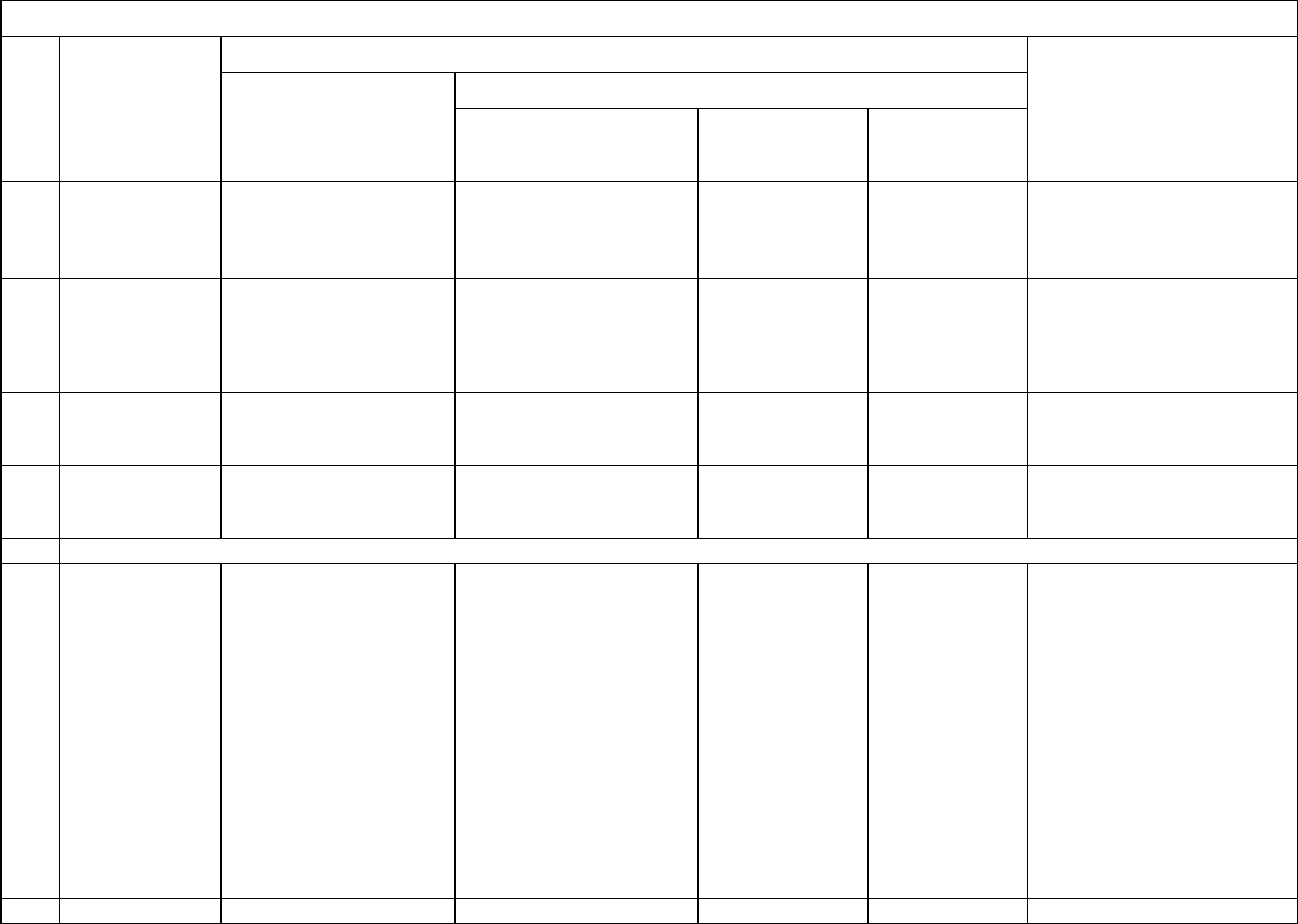

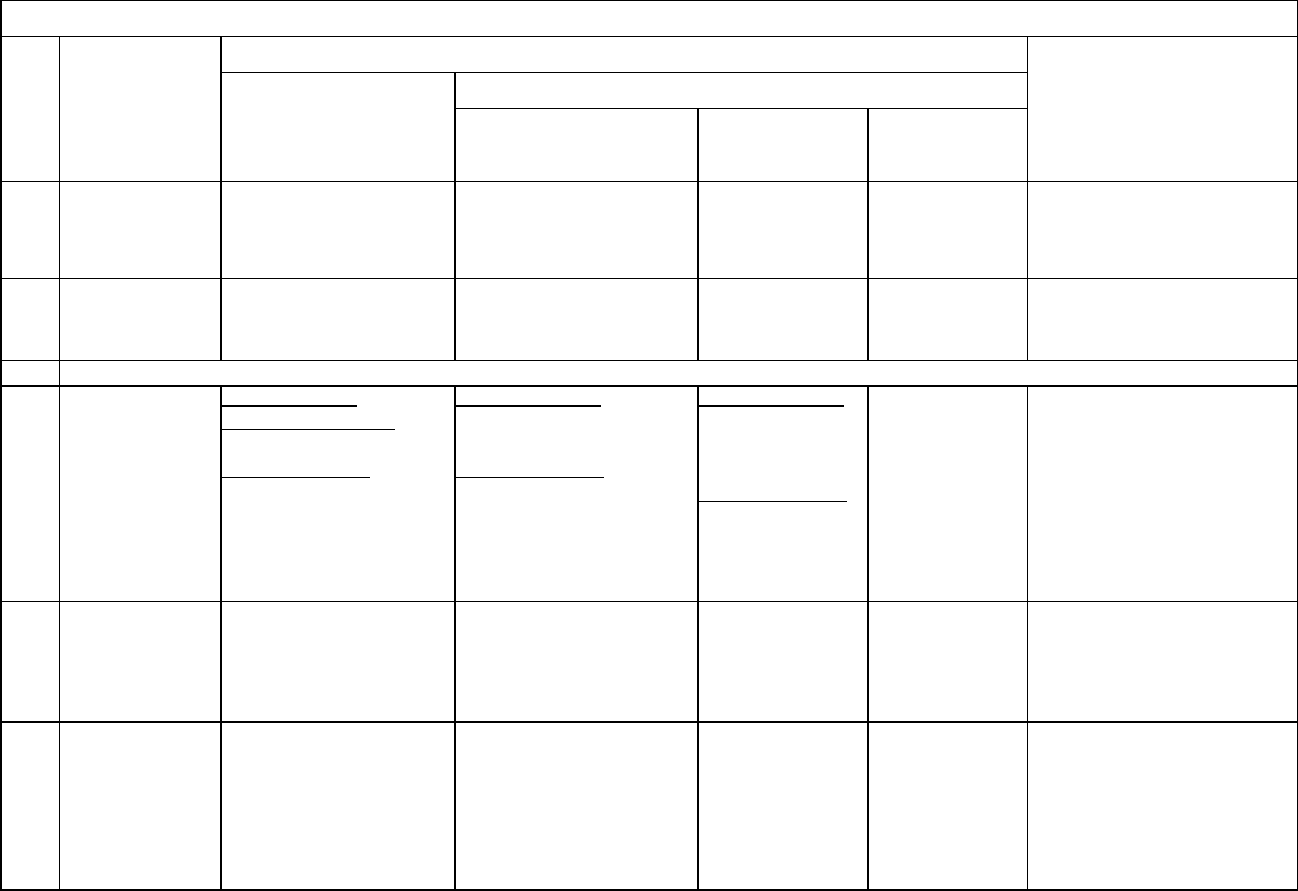

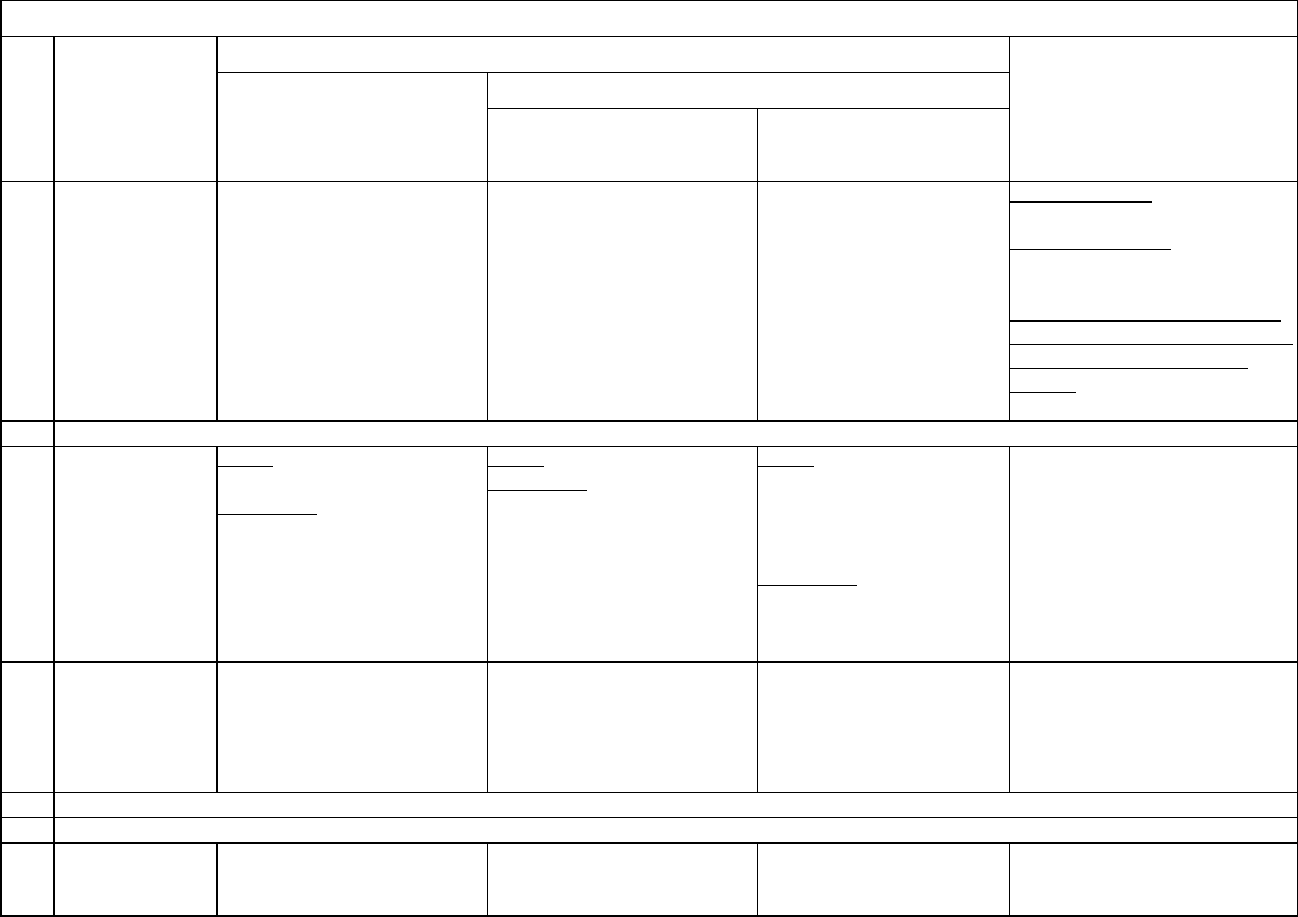

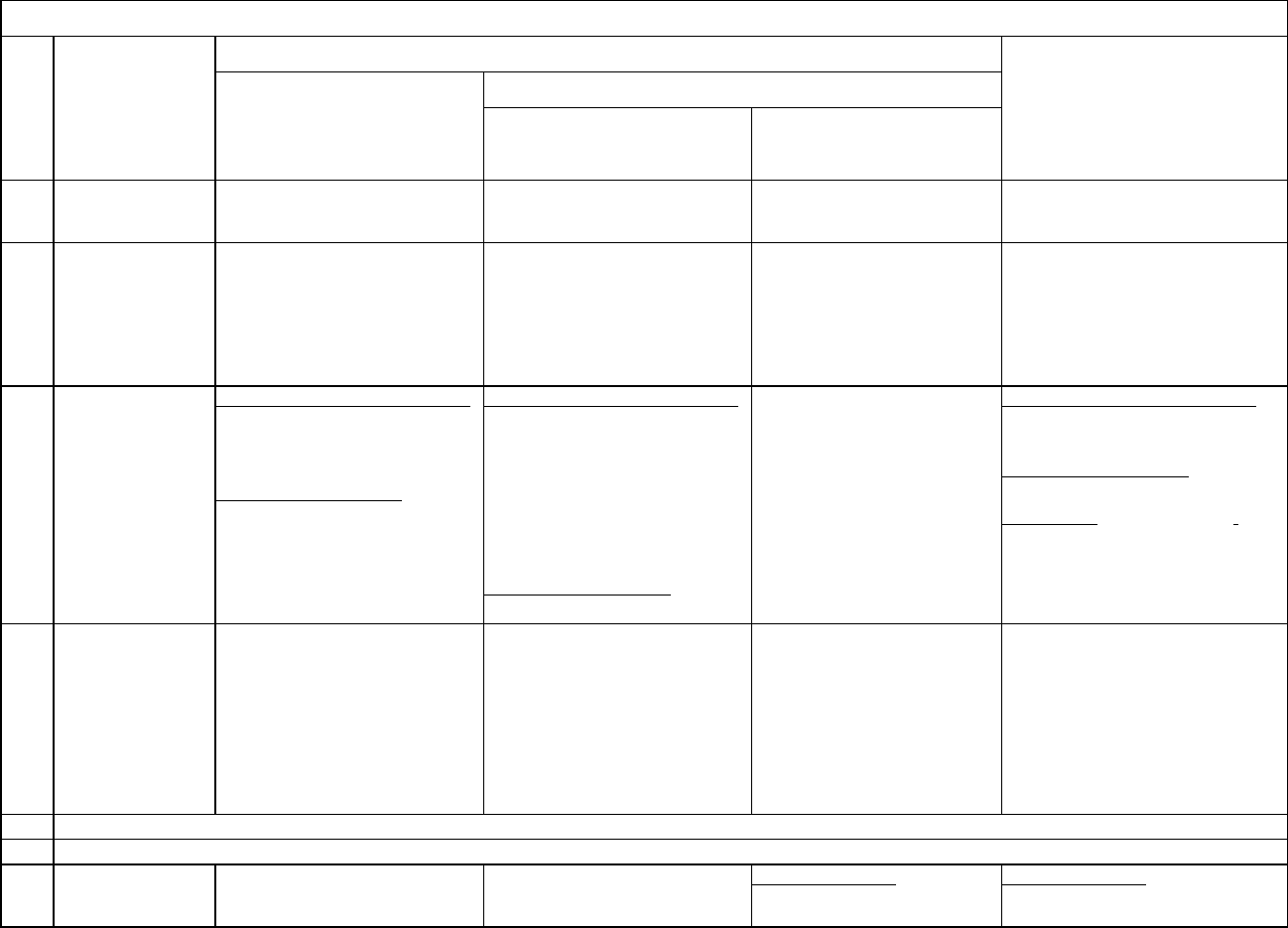

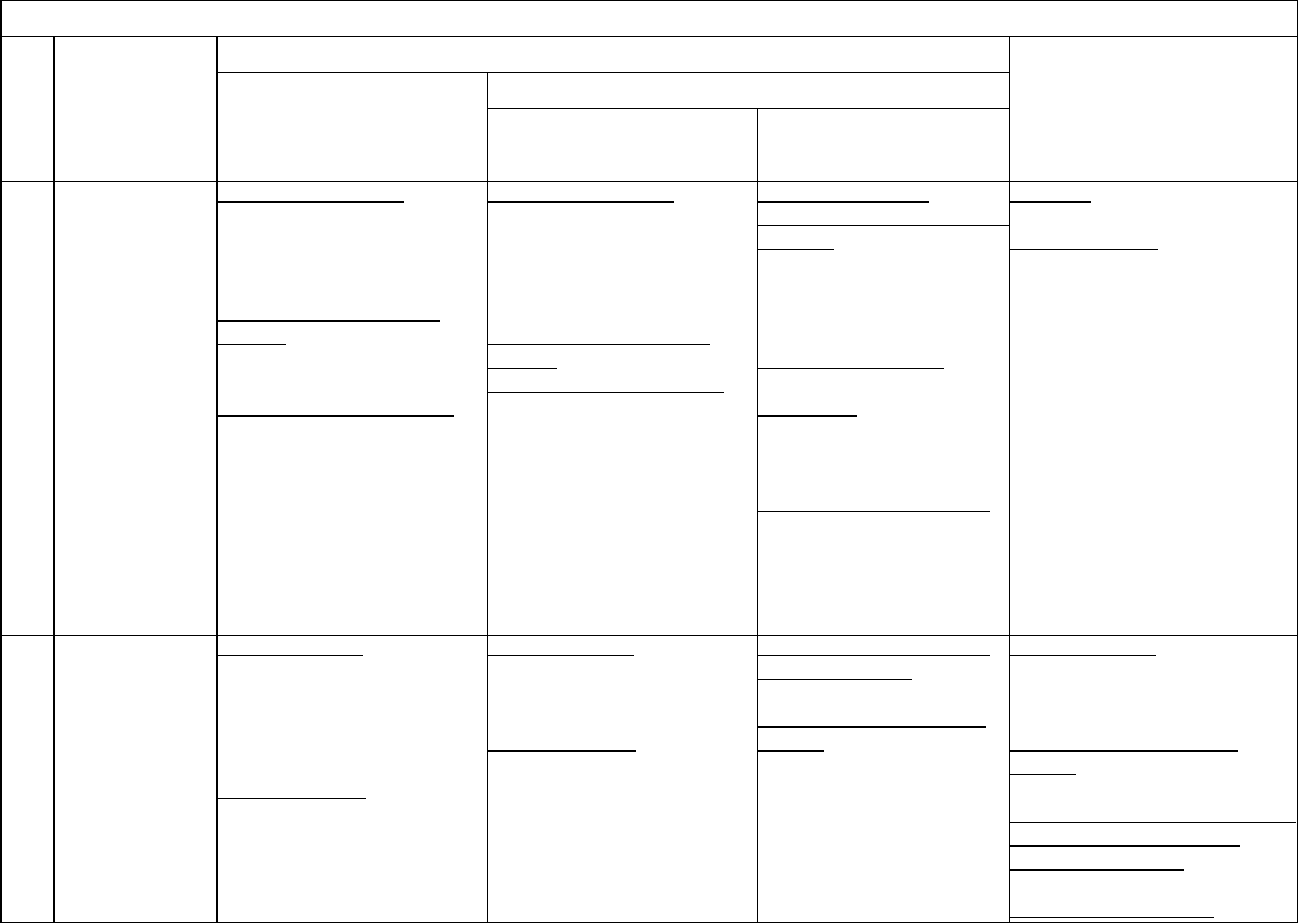

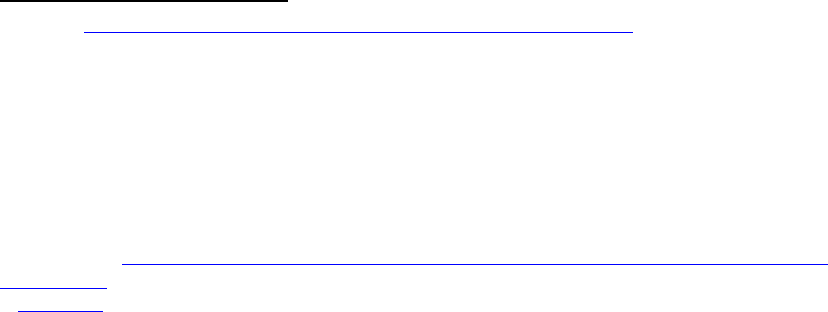

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

47

Services:

48

Household consumption expenditures:

49

Housing and utilities:

50

Housing:

51

Rental of tenant-

occupied nonfarm

housing [For more

detail, see the

technical note

“Special

Estimates.”]

Unit stocks and average rent

based on Census Bureau

decennial census of housing.

Unit stocks based on Census

Bure

au biennial American

housing survey or on Census

Bureau current population

survey; average rent based on

CPI for rent of primary residence.

Unit stocks adjusted using

Census Bureau data on

housing completions; average

rent same as for

nonbenchmark years.

Tenant-occupied stationary and

mobile homes:

CPI for rent of

primary residence

.

Tenant landlord durables:

CPI for

major appliances

.

52

Imputed rental of

owner

-occupied

nonfarm housing

[For more detail,

see the technical

note “Special

Estimates.”]

Unit stocks based on Census

Bureau decennial census of

housing; average annual rent

based on Census Bureau

residential finance survey.

Unit stocks based on Census

Bureau biennial American

housing survey or on Census

Bureau current population

s

urvey; average rent based on

CPI for owners’ equivalent rent of

primary residence.

Unit stocks adjusted using

Census Bureau data on

housing completions; average

rent same as for

nonbenchmark years.

CPI for owners’ equivalent rent of

primary

residence.

53

Rental value of farm

dwellings

Gross rental value of farm

dwellings from USDA.

Same as for benchmark year.

Judgmental trend.

Quantity extrapolation using real-

dollar net stock of farm housing

from BEA capital stock estimates.

For current quarterly based on CPI

for owners’ equivalent rent of

primary residence.

54

Group housing

Rooming and boarding houses:

commodity

-flow method, starting

with receipts from EC.

Employee lodging

: QCEW

employment times CPI for rent of

primar

y residence.

Rooming and boarding houses:

QCEW wage data.

Employee lodging

: same as for

benchmark year.

Judgmental trend.

CPI for rent of primary residence.

55

Household utilities:

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-19

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

56

Water supply and

sanitation

Commodity-flow method, starting

with water, sewerage, and waste

collection receipts from EC and

from COG.

Water supply and sewerage

maintenance

: for third most

recent year, GF receipts adjusted

from fiscal year to calendar year

basis; for second most recent

year, GF receipts and

judgmental

trend; for most recent year,

judgmental trend.

Garbage and trash collection

:

SAS receipts data.

Water supply and sewerage

maintenance

: same as for

most recent year.

Garbage and trash collection

:

for

second and third estimate,

QSR

total receipts data; for

advance estimate

, judgmental

trend.

Water supply and sewerage

maintenance

: CPI for water and

sewerage maintenance.

Garbage and trash collection

: CPI

for garbage and trash collection.

57

Electricity and gas:

58

Electricity

Variation of commodity-flow

method, using annual residential

revenue from EIA.

Same as for benchmark year,

except most recent year based

on residential revenue from

monthly EIA survey.

EIA data on kilowatt-hour sales

to residential customers and on

cents per kilowatt hour, both

adjusted by BEA from a billing

to a usage basis.

CPI for electricity.

59

Natural gas

Variation of commodity-flow

method, using EIA annual

residential unit and price data.

Same as for benchmark year.

EIA data on cubic-feet sales of

gas to residential customers

and on cents per cubic foot,

both adjusted by BEA from a

billing to a usage basis.

CPI for utility (piped) gas service.

60

Health care:

61

Outpatient services:

62

Physician services

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For second and third

estimate

s, QSR receipts data;

for

advance estimate,

judgmental trend.

PPI for offices of physicians.

63

Dental services

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For third estimate, QSR

receipts data; for second and

advance estimates, judgmental

trend.

CPI for dental services.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-20

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

64

Paramedical

services

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For second and third

estimate

s, QSR receipts data;

for

advance estimates, CES

data on employment, hours,

and earnings.

Home health care: PPI for home

health care services

.

Medical laboratories

: PPI for

medical laboratories

and PPI for

diagnostic imaging centers

.

Specialty outpatient care facilities

and health and allied services, and

all other professional medical

services

: CPI for services by other

medical

professionals.

65

Hospitals and nursing home services:

66

Hospitals

Private: commodity-flow method,

starting with receipts from EC.

Government

: commodity-flow

method, starting with receipts

from COG and federal agency

data.

Private: SAS receipts data.

Government: federal agency data

and for third most recent year,

GF receipts adjusted from a fiscal

year basis to a calendar year

basis; for second most recent

year, GF receipts and judgmental

trend; for most recent year,

judgmental trend.

Private: for second and third

estimate

s, QSR receipts data;

for

advance estimates, CES

employment, hours, and

earnings.

Government

:

same as for most

recent year

.

PPI for hospitals.

67

Nursing homes

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For second and third

estimate

s, QSR receipts data;

for

advance estimate, CES

employment, hours, and

earnings.

PPI for nursing care facilities.

68

Transportation services:

69

Motor vehicle services:

70

Motor vehicle

maintenance and

repair

Commodity-flow method, starting

with receipts from EC.

SAS, National Automobile

Dealers Assn. (NADA), and

ARTS receipts data, except most

For third estimate, QSR

receipts data; for second and

advance estimates, judgmental

CPI for motor vehicle maintenance

and repair.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-21

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

recent year based on SAS,

NADA, and MRTS receipts data.

trend.

71

Other motor vehicle

services

Motor vehicle leasing: BLS

co

nsumer expenditures survey

data.

Motor vehicle rental

: commodity-

flow method, starting with

receipts from EC.

Parking fees and tolls

:

commodity

-flow method, starting

with state and local government

enterprise receipts from Federal

Highway Administration.

Motor vehicle leasing: same as

for benchmark year, except most

recent year based on

personal

lease registrations from R.L. Polk

& Co. and on BEA estimate of

average expenditures.

Motor vehicle rental

: SAS

receipts data.

Parking fees and tolls

: same as

for b

enchmark year, except most

recent year based on judgmental

trend.

Motor vehicle leasing: same as

for most recent year.

Motor vehicle rental

: for third

estimate,

QSR receipts data;

for second and advance

estimates, judgmental trend.

Parking fees and tolls: same as

for most recent year.

Motor vehicle leasing: CPI for

leased cars and trucks.

Motor vehicle rental

: CPI for car

and truck rental.

Parking fees and tolls

: CPI for

parking fees and tolls.

72

Public transportation:

73

Ground transportation:

Railway

Commodity-flow method, starting

with passenger revenue from

Amtrak annual report

, S&L

government data on Alaska

Railroad, and Class 1

railroad

passenger data from the Surface

Transportation Board.

Passenger revenue from Amtrak

monthly reports.

Same as for nonbenchmark

years.

CPI for other intercity

transportation

.

Intracity mass

transit

Commodity-flow method, starting

with

receipts from American

Public Transit Assn. (APTA).

Data on receipts from APTA and

from SAS,

except most recent

year based on number of

passenger trips from APTA times

CPI for intracity

mass transit and

on SAS receipts data

.

For second and third

estimate

s, APTA trips data

times CPI for intracity mass

transit and

QSR receipts data;

for

advance estimate, APTA

trips data times CPI for intracity

mass transit.

CPI for intracity transportation.

Taxicabs and ride

Variation of commodity-flow

Information on household

For third estimate, QSR

CPI for intracity transportation.

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-22

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

sharing services

method, based primarily on BLS

consumer expenditures survey

data on taxi fares and limo

services receipts.

purchases from BLS Consumer

Expenditure Survey

; for most

recent

year, judgmental trend.

receipts data; for second and

advance estimates, judgmental

trend.

Intercity bus

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For third estimate, QSR

receipts data; for second and

advance estimates, passenger

revenue data from Greyhound

.

CPI for other intercity

transportation

.

Other road

transportation

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For third estimate, QSR

receipts data; for second and

advance estimates, judgmental

trend.

CPI for other intercity

transportation

.

74

Air transportation

Commodity-flow method, starting

with

receipts from EC.

SAS receipts data.

For second and third

estimate

s, QSR receipts data;

f

or advance estimates,

judgmental trend.

PPI for domestic scheduled

passenger air transportation.

75

Water

transportation

Commodity-flow method, starting

with receipts from EC.

SAS receipts data.

For third estimate, QSR

receipts data; for second and

advance estimates, judgmental

trend.

CPI for other intercity

transportation

.

76

Recreation services:

77

Membership clubs,

sports centers,

parks, theaters, and

museums

High school sports: commodity-

flow method, starting with sales

data from Census Bureau census

of governments.

College sports

: commodity-flow

method, starting with

National

Collegiate Athletic Assn. (NCAA)

sales data.

Other components: commodity-

High school sports: for third most

recent year, GF receipts adjusted

from a fiscal year basis to a

calendar year basis; for

second

most recent year, GF receipts

and judgmental trend; for most

recent year, judgmental trend.

College sports

: NCAA

admissions times CPI for

Membership clubs and

participant sports cent

ers: for

third estimate,

QSR receipts

data; for second and advance

estimates, CES employment,

hours, and earnings.

Amusement parks,

campgrounds, and related

recreational services: for third

Membership clubs and participant

sports centers

: CPI for club dues

and fees for participant sports and

group exercises

;

Amusement parks, campgrounds,

and related recreational services

:

CPI for

other recreation services;

Spectator sports

:

CPI for admission

to sporting events;

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-23

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

flow method, starting with

receipts from EC.

admission to sporting events.

Other components

: SAS receipts

data.

estimate, QSR receipts data;

for second and advance

estimates, jud

gmental trend.

Motion picture admissions: box

office receipts from

Boxofficemojo

.com.

Spectator sports

: for third

estimate,

QSR receipts data;

for second and advance

estimates, judgmental trend.

Live entertainment other than

sports

: for third estimate, QSR

receipts data; for second and

advance estimates, judgmental

trend.

Museums and libraries

: CES

employment, hours, and

earnings.

Motion picture theaters, live

entertainment, excluding sports,

and museums and libraries

:

CPI for

ad

mission to movies, theaters, and

concerts.

78

Audio-video,

photographic, and

information

processing

equipment services

Commodity-flow method, starting

with receipts from EC.

Video streaming and rental: SAS

receipts data and company

revenue

reports.

Audi

o streaming and radio

services

: Recording Industry

Association of America industry

data on paid subscription

streaming and company revenue

reports.

Other components

: SAS receipts

data.

Cable, satellite, and other live

television services

: for second

and

third estimates, QSR

residential receipts data

and

HarrisX data on live streaming

revenues

; for advance

estimate

, judgmental trend

and

HarrisX data on live streaming

revenues

.

Video streaming and

rental:

for

video streaming, HarrisX data

o

n on-demand streaming

revenues; for video rental,

Cable, satellite, and other live

television services

: CPI for cable

and satellite television service

;

Repair

and rental of audio-visual,

photographic, and information

processing equipment

: CPI for

video and audio

;

Photo processing

: CPI for film

processing

;

Photo studios

: CPI for

photographer fees

;

Video

streaming and rental:

CPI for

rental of video discs and other

CHAPTER 5: PERSONAL CONSUMPTION EXPENDITURES

5-24

Table 5.B—Summary of Methodology Used to Prepare Estimates of PCE for Services

Line

in

NIPA

table

group

2.4

Component

Current-dollar estimates

Quantity and price estimates

(Quantity estimate prepared by

deflating with price index unless

otherwise indicated)

Benchmark year

Indicator series used to interpolate and extrapolate*

Nonbenchmark years

Current quarterly estimates

judgmental trend.

Repair

and rental of audio-

visual, photographic, and

information processing

equipment

: for third estimate,

QSR

receipts data; for second

and advance estimates,

judgmental trend.

Other components: judgmental

trend.

media.

Audi

o streaming and radio services

:

CPI

for recorded music and music

subscriptions

.

79

Gambling

Casino gambling: commodity-flow

method, starting with receipts

from EC.

Lotteries