AUTHORS

Sofia Lopez, Action Center on Race and the Economy;

Samantha Kaan, Action Center on Race and the Economy;

Jordan Ash, Private Equity Stakeholder Project.

HOW AMERICA'S LARGEST

SINGLE-FAMILY LANDLORDS

PUT PROFIT OVER PEOPLE

THE NATIONAL

RENTAL HOME COUNCIL

CONTRIBUTORS

Amee Chew, Center for Popular Democracy;

Katie Goldstein, Center for Popular Democracy;

Liliana Baiman, Center for Popular Democracy

THE NATIONAL RENTAL HOME COUNCIL/2 THE NATIONAL RENTAL HOME COUNCIL/3

Introduction

Over the past decade, housing in the U.S. has become increasingly consolidated

into the hands of corporations, while rents and home prices have skyrocketed

to unprecedented levels. Tenants in single-family rental (SFR) homes are facing a

particularly tight squeeze; nationally, rents in this type of housing have increased more

than 13% over the past year, and in metro areas like Miami and Phoenix single-family

rents have increased a staggering 39% and 19%, respectively.

1

Unsurprisingly, the metro areas facing the highest single-family rent increases are the

same communities where the largest single-family rental companies have the greatest

presence, and where the 2008 foreclosure crisis wreaked havoc on homeowners,

especially homeowners of color. Increasingly, these SFR corporations have sought to

shape public policy and perceptions of the housing market to secure unchecked growth

and profit.

To advance their interests, the largest SFR landlords rely on the National Rental Home

Council (NRHC), a public relations tool that deflects scrutiny and portrays the SFR

industry as the benevolent saviors of the housing market. Throughout its history the

NRHC leadership has been dominated by the largest SFR companies in the country. As

landlords, large corporate rental companies are associated with high eviction rates,

2

underinvestment in maintenance, steep fines for tenants, large rent increases, and

aggressive buying tactics that lock would-be homeowners out of the market.

3

Rather than accept their talking points, we should investigate what these companies say

to their investors and what their tenants say about living in these homes. Based on these

companies’ track records, we should all be concerned about their ambitious plans for

continued expansion, and the billions of dollars investors have flooded the rental market

with over the past year.

4

THE NATIONAL RENTAL HOME COUNCIL/3

The Rise of the

Single-Family Rental Home

Industry and the Creation

of the National Rental

Home Council

The consolidation of single-family rentals

into the hands of investor landlords began

in the aermath of the 2008 foreclosure

crisis. As recently as 2011, before home

prices hit rock boom, no single entity owned

over 1,000 SFR units,

5

but by 2021, corporate

landlords had acquired an estimated 350,000

homes across the country.

6

The five largest

SFR operators, who comprise the leadership

of the National Rental Home Council,

cumulatively own or operate almost 300,000

homes and have come under increasing

scrutiny for their negative impacts on the

housing market.

7

The foreclosure crisis and the federal

response created the perfect conditions for

rapid consolidation, transferring thousands

of homes, especially from households of

color trapped by predatory debt, to Wall

Street-backed landlords, oen through

government-subsidized acquisitions aer

mass foreclosures. Without question, the

SFR industry would not exist in its current

form if not for vital support from Fannie

Mae, Freddie Mac and the Federal Housing

Administration to large corporate landlords.

In addition to incredibly generous loan terms,

Fannie, Freddie and the Federal Housing

Administration auctioned non-performing

mortgages to investors in such high volumes

that by 2016, 95 percent of Fannie and

Freddie’s distressed loans went to Wall

Street investors.

8

Mergers and acquisitions of smaller

companies have also been a critical source

of growth for the largest SFR companies. For

example, in 2017, Invitation Homes merged

with Starwood Capital, which had previously

merged with Colony American Homes, to

become the largest SFR operator in

the country.

9

The largest SFR companies made a bet

that the foreclosure crisis would lock broad

swathes of the country out of homeownership,

creating a captive pool of renters. In a 2016

pitch to investors, Pretium Partners, the parent

company of Progress Residential, explicitly

said, “We believe tight credit availability is

preventing new households from being able to

obtain mortgages to purchase their first home

. . . Households that have been unable to

obtain mortgages have become renters, thus

driving high occupancy rates and robust

rent growth.”

10

The five largest SFR

operators,

cumulatively own or

operate almost 300,000

homes and have come

under increasing

scrutiny for their

negative impacts on

the housing market.

THE NATIONAL RENTAL HOME COUNCIL/4 THE NATIONAL RENTAL HOME COUNCIL/5

In this context, Invitation Homes, American

Homes 4 Rent, Progress Residential, Starwood

and Colony American Homes joined together

to form the NRHC in 2014.

11

This came amid

growing scrutiny and weeks aer California

Congressman Mark Takano called for federal

regulators to investigate the SFR industry and

the practice of selling rent-backed securities.

12

The new group partnered with the lobbying

and public relations firm Glover Park Group

(now Finsbury Glover Hering), which was

founded by Clinton-Gore administration

veterans and has close ties with the private

equity, banking, and real estate industries.

13

Continuing this trend, following increasing

scrutiny, in 2022 Pretium Partners hired a

former Glover Park director and ex-NFL

communications head, Jocelyn Moore, as their

newest Senior Managing Director leading

corporate affairs.

14

Growth and

Corporate

Consolidation in

Single-Family Rentals

The Wall Street-backed segment of the SFR

industry has grown dramatically over the past

decade, while families across the country have

struggled with displacement, loss of their

homes, and financial devastation since the

foreclosure crisis. Amidst job losses and mass

death during the COVID-19 pandemic, the

buying frenzy has only accelerated.

Many across the industry have remarked that

SFRs have proven to be a resilient or profitable

asset class, expressing recent speculation

that Wall Street-backed landlords could own

as much as 50% of all SFRs within the next

five years,

15

or, more conservatively, that in-

vestor-ownership of SFRs could reach 40% of

market share by 2030.

16

The Chief Executive

of Tricon Residential, estimates institutional

ownership of SFRs will increase by about one

million homes in the next decade.

17

Recent research indicates that large inves-

tors have only spent about one-quarter of the

$89 billion they have raised to invest in SFR

and build-for-rent homes,

18

which, based on

the largest companies’ harmful track record,

should concern us all.

The Chief

Executive

of Tricon

Residential,

estimates

institutional

ownership

of SFRs will

increase by

about one

million homes

in the next

decade.

THE NATIONAL RENTAL HOME COUNCIL/5

The National

Rental Home

Council

Founded in 2014, the NRHC is the primary lobbying and advocacy group for the SFR industry.

Like more established real estate trade groups such as the National Multifamily Housing Council

and the National Association of Realtors, the NRHC exerts influence both directly, by lobbying

for legislation and donating to elected officials, and indirectly, by repeating talking points to the

press that reinforce their desired narrative about their industry.

The NRHC has nearly 80 member companies and claims to speak for the whole SFR industry,

including “mom and pop” landlords, but there are only four companies that have almost

exclusively occupied the organization’s leadership positions since its founding: Invitation Homes,

Progress Residential, American Homes 4 Rent, and Tricon Residential. Executives from these

four corporations have consistently held the President, Vice-President, Secretary, and Treasurer

positions. By 2020, the FirstKey Homes CEO had joined the board, and is currently the

NRHC chair.

19

This tight grip suggests that the NRHC prioritized unrestricted growth and continued dominance

for these five companies, who already account for almost 300,000 of the estimated 350,000

corporate-owned SFR homes across the country.

20

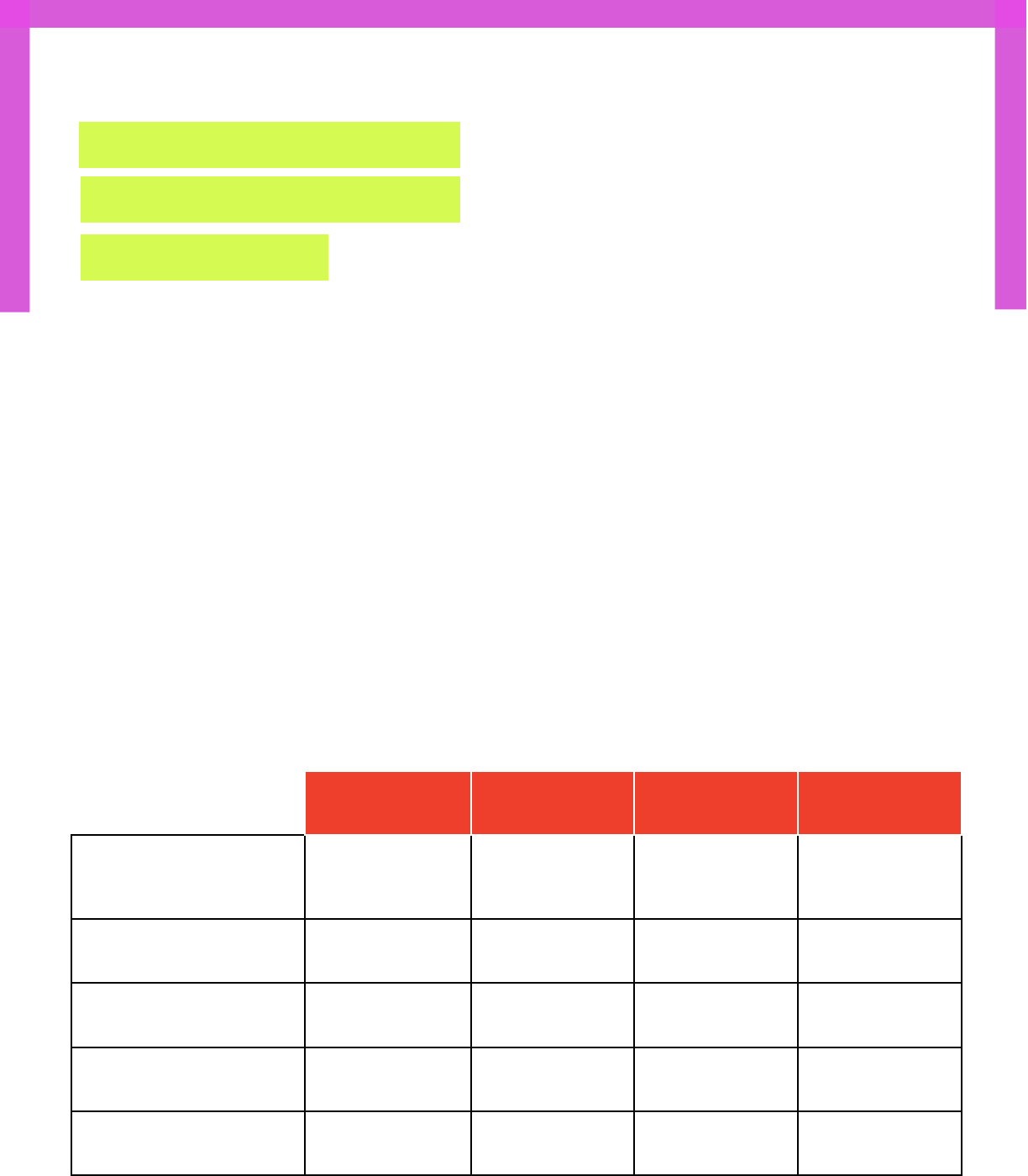

2020

21

2019

22

2018

23

2017

24

Invitation Homes Treasurer

Treasurer and

Director

Treasurer

and Director

President and

Treasurer

American Homes

4 Rent

Vice-President Vice-President Vice-President Director

Progress Residential Secretary

Secretary and

Director

Secretary and

Director

Secretary

Tricon Residential President President President Director

FirstKey Homes Director N/A N/A N/A

THE NATIONAL RENTAL HOME COUNCIL/6 THE NATIONAL RENTAL HOME COUNCIL/7

While the public face of the NRHC is one of a

friendly, pro-affordability industry group, the

group’s origins and advocacy indicate that

they push for policies that put their financial

interests above the well-being of their tenants.

The actual policies the NRHC advocates for

are worded vaguely on their website, using

general language about increasing access

to quality and affordable housing. The top

section of their advocacy page is titled

“Renter’s Rights,” which they describe as

policies that improve “access and choice” in

housing and that “encourage our residents to

be good citizens.”

25

Contradicting this seemingly pro-tenant

language, the NRHC lobbies against tenant

protections and policies that would keep

rents affordable. Their website states they

intervene at the state level to combat what

they call “harmful rent control policies,”

26

and they were vocally opposed to the CDC’s

eviction moratorium in 2020.

27

Individually,

the companies who make up the board of the

NRHC have contributed heavily to block rent

control and other forms of tenant protections.

Invitation Homes spent over $1 million in 2018

to block Proposition 10 in California, which

would have loosened rent control preemption;

Blackstone spent another $6 million.

28

Several of the companies in the NRHC’s

leadership have explicitly indicated SFRs

are a good financial investment specifically

due to the increasing inaccessibility of

homeownership.

29

Yet, the NRHC wants to

present a different public image, stating on

their website that SFRs are “not a bet against

homeownership.”

30

Their lobbying activity also indicates they are

more allied with powerful real estate interests

than their public statements suggest. The

NRHC spent $200,000 on lobbying in 2021 in

partnership with three lobbying firms whose

other clients include Invesco (the behemoth

investment management company), the

National Association of Realtors, and the

Association of Real Estate Investment Trusts.

Eight of the 10 individual lobbyists they

worked with in 2021 are part of the revolving

door between government office and lobbying

firms, having previously held roles in

federal government.

31

The National Rental Home

Council’s Anti-Tenant

Policy Advocacy

THE NATIONAL RENTAL HOME COUNCIL/7

We should be deeply concerned about the NRHC’s plans to influence policy at the state and local

level, because their leadership and largest members have a documented history of maximizing

profits at the expense of tenant safety and well-being.

32

Below are short profiles of the largest

NRHC members, showing the massive rent increases, eviction filings, dangerous lack of main-

tenance, steep fines and fees, and more, that these companies have imposed on tenants and

communities.

Invitation Homes

The Corporations

Leading the NRHC

Another example is Marvia Robinson who

asked if Invitation Homes would accept rental

assistance to cover her back-rent during

the pandemic; instead, Invitation Homes

suggested she sell her plasma, hair, or eggs,

or obtain a payday loan.

37

Despite the broad devastation of the COVID-19

pandemic, Invitation Homes recorded their

most profitable year ever in 2020.

38

Invitation

Homes’ profits in 2021 increased 33% or $65.3

million from 2020.

39

In a Q3 2021 investor call,

the company noted that it had raised rental

prices 30% in Phoenix, 29% in Las Vegas,

21% in Tampa, 20% in Atlanta, and 19% in

Jacksonville.

40

Notably, while the company’s

revenue from its rental properties was 9.3%

higher in 2021 than in 2020, the amount the

company spent on property operation and

maintenance increased by just 3.8%.

41

Invitation Homes is the nation’s largest owner

of single-family rental homes with 82,000

properties.

33

Invitation Homes was founded

in 2012 by the Blackstone Group, the largest

private equity firm in the world, specifically

to acquire foreclosed single-family homes

to rent them out.

34

The company expanded

rapidly through 2016 and grew significantly by

merging with Starwood Capital in 2017.

Invitation Homes has fallen under scrutiny

for callous treatment of tenants and deferred

maintenance in the homes it owns. A 2018

Reuters story found that in speaking with

tenants across the U.S., “The picture that

emerges isn’t as much one of exceptional

service as it is one of leaky pipes, vermin,

toxic mold, nonfunctioning appliances and

months-long waits for repairs.”

35

News articles

have detailed horror stories from Invitation

Homes tenants, like one family that became

sick and developed breathing problems aer

Invitation Homes failed to repair a water leak

in the home’s aic, leading to “high levels of

pathogenic mold.”

36

THE NATIONAL RENTAL HOME COUNCIL/8 THE NATIONAL RENTAL HOME COUNCIL/9

Progress Residential and its parent private

equity firm Pretium Partners have grown

exponentially since 2012, and currently own

a portfolio of approximately 80,000 homes

across nearly 40 markets.

42

According

to a December 2021 Washington Post

investigation, Progress has been growing its

portfolio by up to 2,000 homes a month,

43

including their 2021 acquisition of single-

family rental company Front Yard Residential in

partnership with Ares Management,

44

and their

recent purchase of over 2,000 properties from

Zillow’s failed iBuying venture.

45

Pretium’s founder and CEO Don Mullen is

a former Goldman Sachs executive who

famously led a team of mortgage brokers

to bet against the mortgage market during

the 2008 financial crisis. New York Magazine

described Mullen in 2012 as “a guy whose

most famous trade was a successful bet on

the full-scale implosion of the housing market

[who] is now swooping in to pick up the

pieces on the other end.”

46

Like Invitation Homes, Progress Residential

has been the subject of reports of problems

from tenants. Many of the issues relate to

the company’s customer service practices,

47

patchwork repairs,

48

and a strategy of passing

costs onto tenants that normally would be

covered by a landlord.

49

In January 2022, the

city of Columbia Heights, MN, a suburb of

Minneapolis, revoked the rental license of

Pretium Partners’ HavenBrook Homes on the

basis of conditions so horrendous, they “put

residents’ lives at risk,” and notified tenants

they needed to vacate their homes within

45 days because the company had failed to

resolve maintenance issues at

multiple properties.

50

Progress

Residential/Pretium

Partners

In February 2022, Minnesota Aorney General

Keith Ellison announced that he had filed

a lawsuit against Pretium and HavenBrook

Homes for “shameful,” “deceptive,” and

“fraudulent” practices in failing to repair

and maintain their rental homes. Ellison

alleged that the company was in violation

of Minnesota law, claiming to provide high-

quality service while extracting profit from

tenants and leaving them in

“uninhabitable homes.”

51

Additionally, Pretium Partners’ eviction

practices during the COVID-19 pandemic

despite federal and state eviction

moratoriums, and led the U.S. House of

Representatives Select Subcommiee on the

Coronavirus Crisis to launch an investigation

and oversight hearing into Pretium and three

other companies for filing for thousands of

evictions during the pandemic.

52

THE NATIONAL RENTAL HOME COUNCIL/9

American Homes

4 Rent

American Homes 4 Rent owns over 57,000

properties, making it the third largest owner of

single-family rental homes in the U.S.

53

Founded

in 2011, American Homes 4 Rent laid out

their playbook in their 2013 IPO: buying large

volumes of distressed homes at bargain prices,

generating “aractive” cash flow from rents, and

benefiting from future price appreciation.

54

Like its peers, there is no shortage of horror

stories from tenants living in American Homes

4 Rent properties. A 2019 story in The Atlantic

highlighted the problems of several American

Homes 4 Rent tenants, including a Georgia

tenant who filed multiple maintenance requests

for leaking pipes. When the company refused to

make repairs and a pipe finally burst, thousands

of dollars worth of the tenant’s belongings

were ruined. In another case, a Florida tenant

whose home was wired incorrectly said the

company called her a “drama queen” when she

complained that the temperature inside the

house was as high as 100 degrees, a danger to

her four-month-old son. According to the tenant,

American Homes 4 Rent did not send anyone to

make repairs for a week and a half.

55

The Beer

Business Bureau has received 830 complaints

about American Homes 4 Rent over the last

three years.

56

From 2019 to 2021, American Homes 4 Rent’s

rental revenue increased 16.4%,

57

returns

boosted by the fact that they increased rents on

vacant homes by 11% in 2021.

58

On its Q3 2021

earnings call, American Homes 4 Rent COO

Bryan Smith stated, “We’re really excited and

optimistic about the ability to push rents next

year.”

59

In addition to revenue increases from

rent, the company’s fee revenue soared 63.8%

from 2019 to 2021.

60

American Homes 4 Rent’s

2021 profits were $55.7 million higher than in

2020, a 36% increase.

61

Private equity firm Cerberus established a

Private equity firm Cerberus established a

platform in 2008 to buy distressed mort-

gage-backed securities following the financial

crisis.

62

In 2015 Cerberus formed FirstKey

Homes to manage properties it had acquired

through its platform and signaled its intention

to buy more.

63

Today, FirstKey Homes manag-

es Cerberus’ portfolio of 42,000 homes.

64

Cerberus, like many of its peer companies,

appears to be being that many households

will be locked out of homeownership. A former

FirstKey executive stated that the housing

bubble “created a permanent rental class out

there that will continue to drive demand for

these properties in the future.”

65

FirstKey has developed a reputation for “un-

usually aggressive tactics to recover late rent”

in the Memphis, TN area.

66

The Washington

Post examined FirstKey’s business practices in

Shelby County, where Memphis, TN is located,

and found that the company filed for eviction

at twice the rate of other property managers

and threatened renters with eviction at a high-

er rate than any other large property managers

in the area, going to court more than 400 times

in 2018 just in Shelby County.

67

In addition to aggressive eviction filings in

Memphis, The Washington Post reported that

FirstKey had failed to keep its residences up

to code. In 2018, its rate of code violations was

higher than other Memphis-area SFR owners,

earning Cerberus the title of number one resi-

dential code violator.

68

FirstKey Homes

THE NATIONAL RENTAL HOME COUNCIL/10 THE NATIONAL RENTAL HOME COUNCIL/11

Tricon Residential

Canada-based Tricon Residential entered

the single-family rental business in 2008,

with a strategy of buying real estate at steeply

discounted prices.

69

Tricon currently owns and

operates about 30,000 single family rentals

in the U.S. with plans to increase to 50,000

homes by 2024.

70

Tricon has purchased hundreds of homes

in lower income neighborhoods and

communities of color in Charloe, North

Carolina, many of which were occupied by

renters who received Section 8 assistance.

Tricon described a strategy to its investors of

purposefully decreasing the proportion of its

tenants who are on government assistance in

order to “improve tenant quality,” and “[focus]

on raising rents.”

71

Tricon has stated that it

planned to refuse to renew the leases even of

Section 8 tenants who are in “good standing”

in Charloe. The Charloe Housing Authority

and local non-profits called out Tricon for

this behavior and its role in making the city’s

affordable housing crisis worse, by “raising

rents sharply, refusing to renew leases for

some tenants who receive government rental

assistance and buying from Charloe’s rapidly

shrinking supply of cheaper homes.”

72

Tricon’s 2021 profits more than tripled from

2020, skyrocketing from $113 million to $517

million.

73

Tricon told investors this increase

was fueled in part by fees and costs passed

to tenants, like renter’s insurance and air filter

replacements, allowing Tricon to take in $640

per home, per month in this kind of revenue.

74

Tricon anticipates it can grow this figure to

between $850 and $950 monthly per home.

75

The CEO of Toronto-based Tricon has also

said many of its tenants want to own homes,

but “they may have tons of student debt or

medical debt, which we know has swelled

in the U.S. over the last decade and has

made it difficult for many people to qualify

for a mortgage.”

76

Tricon aributes part

of its success to homeownership falling

“increasingly out of reach,” making single

family rentals appealing and drawing immense

investor interest and capital.

77

In 2020, a group of investors led by the

Blackstone Group began a $300 million

investment in Tricon.

78

In announcing the

investment, Tricon said, “Blackstone inherently

understands our business…We are excited to

have the support of one of the world’s largest

real estate investors.”

79

Tricon told investors

this increase was

fueled in part by fees

and costs passed to

tenants, like renter’s

insurance and air filter

replacements, allowing

Tricon to take in $640

per home, per month

in this kind of revenue.

Tricon anticipates it

can grow this figure to

between $850 and $950

monthly per home.

THE NATIONAL RENTAL HOME COUNCIL/11

Demands &

Recommendations

Although industry groups like the National Rental Home Council claim that increasing

corporate ownership of single-family rentals is a positive thing, tenant stories make it

clear what happens when we allow the SFR industry to pursue maximum profits at the

expense of safe, decent, affordable housing for their tenants. The following measures

are necessary steps to fix our current housing nightmare, ensure quality, safe, affordable

housing, and guarantee renters a degree of power in negotiating with the billion-dollar

companies that own their homes.

We call on the National Rental Home Council

to require its members adopt these policies

across their full portfolios:

• Adopt Just Cause Eviction Protections for all tenants;

• Limit rent increases to no more than 3% annually;

• Keep all properties up to habitability standards, and

immediately address any and all issues of health and

safety; and

• Negotiate a grievance procedure with all tenants that

includes:

- Timely responses from management;

- Timely action by management to address issues;and

- Recognition of tenants unions

THE NATIONAL RENTAL HOME COUNCIL/12 THE NATIONAL RENTAL HOME COUNCIL/13

We call on policymakers to enact the following

legislation to protect tenants from predatory

behavior in the housing market, and limit

corporate control over our homes:

Enact broad tenant protections:

• Enact Just Cause Eviction legislation limiting the reasons a landlord can evict tenants.

Establish rent control laws that limit annual rent increases to 3% annually, including mandatory

fines and fees.

• Legally recognize tenants’ right to organize and bargain collectively, and mandate that

landlords recognize and negotiate with tenant unions.

• Eliminate state preemptions that obstruct localities from strengthening the aforementioned

renter protections.Implement and fund Right to Counsel laws, so tenants facing eviction are

guaranteed legal representation and a fair chance to stay in their homes.

Restrict corporate control of housing:

• The widespread use of LLCs has made it difficult for tenants to know who owns their home.

City, state, and national governments must require disclosure of full ownership through

landlord registries.

• Enact anti-speculation taxes and regulations.

• End federal support for Wall Street landlords including repealing Opportunity Zones and 1031

Exchanges; eliminating no-strings, low-cost financing via Fannie and Freddie; and increasing

penalties for landlords who engage in abusive practices.

• Expand public banking as an alternative to Wall Street financing by for-profit investors.

Invest in social and public housing: We desperately need alternatives to profit-driven, Wall

Street control of housing. This requires massive federal investment in social and public housing,

and policies that support tenant ownership, permanent affordability, and tenant power.

Pension funds that invest in real estate and private equity funds that are undermining the rental

housing market need to adopt beer due diligence measures. They should require current and

potential investors to disclose potential harms to tenants, and negotiate tenant protections into

limited partnership agreements (LPAs). Fund trustees and staff should also consider divesting

from harmful investments that lead to tenant evictions in their home states and cities.

THE NATIONAL RENTAL HOME COUNCIL/13

Endnotes

1. Olick, Diana. “Single-family rent prices are surging at a record rate, led by homes in Sun Belt cities like Miami and

Phoenix.” CNBC. 15 Mar 2022. hps://www.cnbc.com/2022/03/15/single-family-rent-prices-are-soaring-led-by-

homes-in-the-sun-belt-.html#:~:text=Single%2Dfamily%20rents%20gained%20a,just%202%25%20the%20

previous%20January.

2. Raymond, Elora and Richard Duckworth. “Housing Instability: Single-Family Evictions in One Atlanta Metro

County.” Federal Reserve Bank of Atlanta. January/February 2017. hps://www.atlantafed.org/community-

development/publications/partners-update/2017/01/170216-housing-instability-single-family-evictions-in-one-

atlanta-metro-county.aspx.

3. Lopez, Sofia. Wrien testimony for the Commiee on Banking, Housing, and Urban Affairs, U.S. Senate on “How

Private Equity Landlords are Changing the Housing Market.” 21 Oct 2021.

hps://www.banking.senate.gov/imo/media/doc/Lopez%20Testimony%2010-21-21.pdf Abood, Maya, et al. Wall

Street Landlords turn American Dream into a Nightmare: Wall Street’s big bet on the home rental market, and the

bad surprises in store for tenants, communities, and the dream of homeownership. 17 January 2018.

hps://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/aachments/original/1516388955/

WallstreetLandlordsFinalReport.pdf?1516388955; Ferrer, Alexander. Beyond Wall Street Landlords: How Private

Equity in the Rental Market Makes Housing Unaffordable, Unstable, and Unhealthy. The Just Recovery Series.

n.d. hps://www.saje.net/wp-content/uploads/2021/03/Final_A-Just-Recovery-Series_Beyond_Wall_Street.pdf

4. Nguyen, Danielle. “The Light: Now Tracking $50+ Billion of Capital Flooding SFR and BFR Sector.”

RealEstateConsulting.com. 28 Jan 2022. hps://www.realestateconsulting.com/now-tracking-50-billion-of-

capital-flooding-sfr-and-b-sector/

5. Christophers, Bre. “How and Why U.S. Single-Family Housing Became an Investor Asset Class.” Journal of

Urban History. 8 July 2021, p. 6. hps://journals.sagepub.com/doi/10.1177/00961442211029601

6. “Pretium: Seing the Record Straight: American Households and Communities Benefit from Professional

Ownership of Single-Family Rental Homes.” 28 July 2021.

hps://pretium.com/wp-content/uploads/2021/07/Pretium-Sets-the-Standard-for-Professional-Single-Family-

Rental-Ownership.pdf

7. Invitation Homes owns approximately 82,000 homes, see: Clark, Patrick. “Single-Family Landlords Eye

Wealthy Renters with High-End Houses.” Bloomberg. 8 March 2022. hps://www.bloomberg.com/news/

articles/2022-03-08/single-family-landlords-eye-wealthy-renters-with-high-end-houses; Pretium Partners (the

parent company of Progress Residential) owns approximately 80,000 homes, see: Rodriguez, James. “Big

investors have set aside more than $50 billion to buy homes across the US and rent them out. Here are the 15

people leading the charge.“ Business Insider. 3 March 2022. hps://www.businessinsider.com/meet-15-power-

players-fueling-wall-streets-single-family-rentals-2022-3; American Homes 4 Rent owns approximately 57,000

homes, see: “American Homes 4 Rent” LinkedIn. Accessed May 7, 2022.

hps://www.linkedin.com/company/ah4r/; FirstKey manages approximately 42,000 homes for Cerberus, see:

FirstKey Homes 2022-SFR1. KBRA, Structured Finance: CMBS/RMBS Pre-Sale Report. 1 April 2022.

hps://www.kbra.com/documents/report/64903/firstkey-homes-2022-sfr1-pre-sale-report, p. 6; Tricon owns

approximately 30,000 homes, see: Lorinc, Jacob. “Tricon CEO Gary Berman on his company’s next moves -

and why he told 60 Minutes millennials don’t necessarily desire to own homes.” Toronto Star. 2 April 2022.

hps://www.thestar.com/business/2022/04/02/you-can-rent-the-american-dream-how-tricon-a-once-obscure-

toronto-company-built-a-corporate-landlord-empire-with-single-family-homes.html. Together these companies

own an estimated 291,000 homes.

8. Mari, Francesca. “A $60 Billion Housing Grab by Wall Street.” New York Times. 22 Oct 2021.

hps://www.nytimes.com/2020/03/04/magazine/wall-street-landlords.html

9. Lane, Ben. “Invitation Homes, Starwood Waypoint Homes merge to create largest single-family landlord.”

Housing Wire. 16 Nov 2017.

hps://www.housingwire.com/articles/41839-invitation-homes-starwood-waypoint-homes-merge-to-create-

largest-single-family-landlord/

10. Dezember, Ryan. “A Onetime Housing Skeptic Plans $1 Billion Bet on Homes.” Wall Street Journal. 5 Oct 2016.

hps://www.wsj.com/articles/a-onetime-housing-skeptic-plans-1-billion-bet-on-homes-1475619217

11. Lane, Ben. “National Rental Home Council names inaugural board of directors.” Housing Wire. 11 Feb 2015.

hps://www.housingwire.com/articles/32903-national-rental-home-council-names-inaugural-board-of-

directors/

12. “REO-to-rental prompts congressman to call for action.” Rexcuadvice.com.

hp://www.rexcuadvice.com/blog/reo-rental-trend-prompts-congressman-call-action

13. Dayen, David. “Wall Street’s wily front group: Inside story of a rental scheme’s secret faceli.” Salon. 2 April

2014.

hps://www.salon.com/2014/04/02/wall_streets_wily_front_group_inside_story_of_a_rental_schemes_

secret_faceli/

14. Pretium Partners. “Pretium appoints Jocelyn Moore to lead corporate affairs.” Press release, 3 Feb 2022.

hps://pretium.com/pretium-appoints-jocelyn-moore-to-lead-corporate-affairs/

15. Campbell, Kyle. “When will single-family rental reach institutional scale?” PERE. 25 Feb 2022.

hps://www.perenews.com/when-will-single-family-rentals-reach-institutional-scale/

16. Ibid.

17. Ibid.

18. Parker, Will. ”Home Builders Bypassing Individual Home Buyers for Deep-Pocketed Investors.” Wall Street

Journal. 11 April 2022. hps://www.wsj.com/articles/home-builders-bypassing-individual-home-buyers-for-

deep-pocketed-investors-11649678401

19. About the NRHC.” National Rental Home Council. n.d.

hps://www.rentalhomecouncil.org/about-the-nrhc/ , accessed May 8, 2022; see note 21.

20. See note 7.

21. Kevin Baldrige, Tricon Residential, President. David Singelyn, American Homes 4 Rent, Vice-President. Chaz

Mueller, Progress Residential, Secretary. Dallas Tanner, Invitation Homes, Treasurer. Colleen Keating, FirstKey

Homes, Director. National Rental Home Council Form 990 for the fiscal year ending Dec. 2020.

hps://projects.propublica.org/nonprofits/organizations/474822520/202121259349302037/full

22. Kevin Baldrige, Tricon Residential, President. David Singelyn, American Homes 4 Rent, Vice-President. Chaz

Mueller, Progress Residential, Secretary. Dallas Tanner, Invitation Homes, Treasurer. John Bartling, Invitation

Homes, President Emeritus. Dana Hamilton, Progress Residential, former Secretary. National Rental Home

Council Form 990 for the fiscal year ending Dec. 2019.

hps://projects.propublica.org/nonprofits/display_990/474822520/10_2020_prefixes_47-52%2F474822520_20

1912_990O_2020103017408727

23. Kevin Baldrige, Tricon Residential, President. David Singelyn, American Homes 4 Rent, Vice-President. Dana

Hamilton, Progress Residential, Secretary. Dallas Tanner, Invitation Homes, Treasurer. John Bartling, Invitation

Homes, President Emeritus. Fred Tuomi, Colony American Homes (now Invitation Homes), Director. National

Rental Home Council Form 990 for the fiscal year ending Dec. 2018.

hps://projects.propublica.org/nonprofits/display_990/474822520/06_2019_prefixes_46-51%2F474822520_2

01812_990O_2019062716446996

24. John Bartling, Invitation Homes, President. No Vice-President in 2017. Jeff Meriggi, Progress Residential,

Secretary. Fred Tuomi, Colony American Homes (now Invitation Homes), Treasurer. Kevin Baldrige, Tricon

Residential, Director. David Singelyn, American Homes 4 Rent, Director. National Rental Home Council Form

990 for the fiscal year ending Dec. 2017.

hps://projects.propublica.org/nonprofits/display_990/474822520/10_2018_prefixes_47-47%2F474822520_20

1712_990O_2018101815806622

25. “Advocacy.” National Renter’s Home Council. Accessed May 10, 2022.

hps://www.rentalhomecouncil.org/advocacy/

26. Ibid.

27. Merle, Renae. “Trump is calling for another moratorium on evictions. Landlords are pushing back.” Washington

Post. 6 Aug 2020. hps://www.washingtonpost.com/business/2020/08/06/trump-eviction-moratorium/

28. McDonald, Patrick Range. “In California, Big Real Estate Spent $77.3 Million to Stop Rent Control.” Housing is

Human Right. 4 Dec 2018.

hps://www.housinghumanright.org/california-big-real-estate-spent-77-million-stop-rent-control/

29. Dezember, Ryan. “A Onetime Housing Skeptic Plans $1 Billion Bet on Homes.” Wall Street Journal. 5 Oct 2016.

hps://www.wsj.com/articles/a-onetime-housing-skeptic-plans-1-billion-bet-on-homes-1475619217; Tricon

Residential Form F-10. 5 October 2021. hps://docoh.com/filing/1584425/0001193125-21-291505/TCN-F10

(page S-13); Frankel, Todd C, and Keating, Dan. “Eviction filings and code complaints: What happened when a

private equity firm became one city’s biggest homeowner.” Washington Post. 25 Dec 2018.

hps://www.washingtonpost.com/business/economy/eviction-filings-and-code-complaints-what-happened-

when-a-private-equity-firm-became-one-citys-biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-

0aa5c2fcc9e4_story.html

30. “Advocacy” National Renter’s Home Council. Accessed May 10, 2022.

hps://www.rentalhomecouncil.org/advocacy/

31. Client Profile: National Rental Home Council, Lobbyists. OpenSecrets. n.d.

hps://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2021&id=d000082003

32. “Giant landlords pursue evictions despite CDC ban.” Reuters. 23 April 2021.

hps://news.yahoo.com/giant-landlords-pursue-evictions-despite-172224571.html., The Office of Aorney

General Keith Ellison. “Aorney General Ellison Sues HavenBrook Homes, One of the Largest Landlords in

Minnesota, for Failing to Repair Rental Homes, violating law,” 10 Feb 2022.

hps://www.ag.state.mn.us/Office/Communications/2022/02/10_HavenBrookHomes.asp., Semuels, Alana.

“When Wall Street is Your Landlord.” 13 Feb 2019.

hps://www.theatlantic.com/technology/archive/2019/02/single-family-landlords-wall-street/582394/, Frankel,

Todd C, and Keating, Dan. “Eviction filings and code complaints: What happened when a private equity firm

became one city’s biggest homeowner.” Washington Post. 25 Dec 2018.

hps://www.washingtonpost.com/business/economy/eviction-filings-and-code-complaints-what-

happened-when-a-private-equity-firm-became-one-citys-biggest-homeowner/2018/12/25/995678d4-02f3-

11e9-b6a9-0aa5c2fcc9e4_story.html., Tricon Residential Form F-10. October 5, 2021. hps://docoh.com/

filing/1584425/0001193125-21-291505/TCN-F10, p. S-21-22.

33. Clark, Patrick. “Single-Family Landlords Eye Wealthy Renters with High-End Houses.” Bloomberg. 8 Mar 2022.

hps://www.bloomberg.com/news/articles/2022-03-08/single-family-landlords-eye-wealthy-renters-with-

high-end-houses

34. Baxter, Annie. “Huge private equity firm claims stake in Twin Cities real estate.” Minnesota Public Radio. 2

Dec 2013. hps://www.mprnews.org/story/2013/12/02/huge-private-equity-firm-claims-stake-in-twin-cities-

real-estate; Abood, Maya, et al. Wall Street Landlords turno American Dream into a Nightmare: Wall Street’s

big bet on the home rental market, and the bad surprises in store for tenants, communities, and the dream of

homeownership. 17 January 2018.

hps://d3n8a8pro7vhmx.cloudfront.net/acceinstitute/pages/100/aachments/original/1516388955/

WallstreetLandlordsFinalReport.pdf?1516388955

35. Conlin, Michelle. “Spiders, sewage and a flurry of fees – the other side of renting a house from Wall Street.”

Reuters. 27 July 2018. hps://www.reuters.com/investigates/special-report/usa-housing-invitation/

36. Keever, Jared. “They answer to their stockholders.” The St. Augustine Record. 27 May 2018.

hps://www.staugustine.com/story/news/local/2018/05/27/they-answer-to-their-stockholders-local-family-

suing-wall-street-backed-landlord/12058212007/

37. “Giant landlords pursue evictions despite CDC ban.” Reuters. 23 April 2021.

hps://news.yahoo.com/giant-landlords-pursue-evictions-despite-172224571.html

38. Colarossi, Natalie. ”U.S. Largest Provider of Single-Family Rent Homes Made Largest Profit Ever Amid

Pandemic. Newsweek. 30 Mar 2021.

hps://www.newsweek.com/us-largest-provider-single-family-rent-homes-made-largest-profit-ever-amid-

pandemic-1579817.

39. Invitation Homes, Inc. SEC Form 10-K for the fiscal year ending December 2021.

hps://d18rn0p25nwr6d.cloudfront.net/CIK-0001687229/d2202ae4-d277-41e8-8e4c-054f343df603.pdf, p. 62.

40. Fields, Desiree and Vergerio, Manon. “Corporate landlords and market power: What does the single-family

rental boom mean for our housing future?” UC Berkeley. 13 April 2022.

hps://escholarship.org/content/qt07d6445s/qt07d6445s.pdf?t=raduym, p. 35.

41. Invitation Homes, Inc. SEC Form 10-K for the fiscal year ending December 2021.

hps://d18rn0p25nwr6d.cloudfront.net/CIK-0001687229/d2202ae4-d277-41e8-8e4c-054f343df603.pdf, p. 62.

42. High Quality Rental Homes in Great School Districts. Progress Residential. Accessed May 7, 2022.

hps://rentprogress.com. Rodriguez, James. “Big Investors have set aside more than $50 billion to buy homes

across the US and rent them out. Here are 15 people leading the charge.” Business Insider. 3 Mar 2022.

hps://www.businessinsider.com/meet-15-power-players-fueling-wall-streets-single-family-rentals-2022-3

43. Whoriskey, Peter; Woodman, Spencer; and Gibbs, Margot. “This block used to be for first-time homebuyers.

Then global investors bought in.” The Washington Post. 15 Dec 2021.

hps://www.washingtonpost.com/business/interactive/2021/investors-rental-foreclosure/

44. Front Yard Residential Form 8-K. 11 Jan 2021. hps://ir.frontyardresidential.com/node/11111/html

45. Clark, Patrick and Buhayar, Noah. “Zillow’s home sales faen inventory for Wall Street landlords.” Los Angeles

Times. 11 Nov 2021. hps://www.latimes.com/business/technology/story/2021-11-11/zillows-home-sales-

faen-inventory-for-wall-street-landlords

46. Roose, Kevin. “Goldman Executive Who Made Millions on Housing Bust Now Wants to Make Millions on

Housing Un-Bust.” New York Magazine. 20 July 2012.

hps://nymag.com/intelligencer/2012/07/goldman-mortgage-chief-gets-it-both-ways.html

47. Albert, Mark. “Paern of complaints against one of largest home renters in U.S.” KOCO News. 20 Nov 2018.

hps://www.koco.com/article/progress-residential-complaints-home-renters-investigation/25020724

48. Cowan, Kellie. “Renters recall ‘nightmare’ experiences with corporate landlord Progress Residential.” Fox 13

News. 7 Mar 2022. hps://www.fox13news.com/news/renters-recall-nightmare-experiences-with-corporate-

landlord-progress-residential

49. See note 43.

50. City of Columbia Heights. “City Statement Regarding HavenBrook Rental License Revocation.” January 20,

2022. hps://www.columbiaheightsmn.gov/news_detail_T17_R581.php.

51. The Office of Aorney General Keith Ellison. “Aorney General Ellison Sues HavenBrook Homes, One of the

Largest Landlords in Minnesota, for Failing to Repair Rental Homes, violating law,” 10 Feb 2022.

hps://www.ag.state.mn.us/Office/Communications/2022/02/10_HavenBrookHomes.asp.

52. Select Subcommiee on the Coronavirus Crisis. “Hybrid Hearing on ‘Oversight of Pandemic Evictions.” 27 July

2021.

hps://coronavirus.house.gov/subcommiee-activity/hearings/hybrid-hearing-oversight-pandemic-evictions-

assessing-abuses; Telford, Taylor and Siegel, Rachel. “House panel targets corporate landlords tied to

thousands of evictions.” Washington Post. 20 July 2021.

hps://www.washingtonpost.com/business/2021/07/20/corporate-landlord-eviction-moratorium/

53. “American Homes 4 Rent” LinkedIn. Accessed May 7, 2022. n.d. hps://www.linkedin.com/company/ah4r/

54. American Homes for Rent SEC Form S-11. 4 June 2013.

hps://www.sec.gov/Archives/edgar/data/1562401/000119312513247145/d547003ds11.htm, p. 3.

55. Semuels, Alana. “When Wall Street is Your Landlord.” 13 Feb 2019.

hps://www.theatlantic.com/technology/archive/2019/02/single-family-landlords-wall-street/582394/

56. “American Homes 4 Rent | Complaints” Beer Business Bureau. Accessed May 7, 2022.

hps://www.bbb.org/us/ca/calabasas/profile/property-management/american-homes-4-rent-1216-264491/

complaints

57. Guion, Payton; Dukes, Tyler; and Rago, Gordon. “Wall Street landlords are optimized for profit, sometimes

squeezing tenants” Charloe Observer. 2 May 2022.

hps://www.charloeobserver.com/news/state/north-carolina/article260940817.html

58. Clark, Patrick. “Rent Surges on Single-Family Homes With Landlords Testing Market.” Bloomberg. 7 May 2021.

hps://www.bloomberg.com/news/articles/2021-05-07/rent-surges-on-single-family-homes-with-landlords-

testing-market

59. American Homes 4 Rent Q3 2021 Earnings Call Transcript. 5 November 2021.

hps://seekingalpha.com/article/4466234-american-homes-4-rent-amh-ceo-david-singelyn-on-q3-2021-

results-earnings-call-transcript

60. See note 57.

61. American Homes 4 Rent, L.P. SEC Form 10-K for the fiscal year ending December 2021.

hps://d18rn0p25nwr6d.cloudfront.net/CIK-0001562401/e5e7b1c3-a30e-45c8-b416-091006d1fc8a.pdf, p. 41

62. Residential Opportunities. Cerberus. Accessed May 7, 2022.

hps://www.cerberus.com/investment-platforms/residential-opportunities/.

63. KBRA “First Key Homes 2022-SFRP 1 re-Sale Report.” 1 April 2022.

hps://www.kbra.com/documents/report/64903/firstkey-homes-2022-sfr1-pre-sale-report, p. 6

64. Ibid.

65. Frankel, Todd C, and Keating, Dan. “Eviction filings and code complaints: What happened when a private

equity firm became one city’s biggest homeowner.” Washington Post. 25 Dec 2018.

hps://www.washingtonpost.com/business/economy/eviction-filings-and-code-complaints-what-happened-

when-a-private-equity-firm-became-one-citys-biggest-homeowner/2018/12/25/995678d4-02f3-11e9-b6a9-

0aa5c2fcc9e4_story.html

66. Ibid.

67. Ibid.

68. Ibid.

69. Tricon Capital. “Tricon Capital to Establish a US $261 million Co-Investment in Tricon IX a Tricon-Managed

Distressed U.S. Land and Homebuilding Fund.” Press release, 22 July 2013.

hps://www.globenewswire.com/news-release/2013/07/22/1350703/0/en/Tricon-Capital-to-Establish-a-US-

261-million-Co-Investment-in-Tricon-IX-a-Tricon-Managed-Distressed-U-S-Land-and-Homebuilding-Fund.html

70. Lorinc, Jacob. “Tricon CEO Gary Berman on his company’s next moves – and why he told 60 Minutes millennials

don’t necessarily desire to own homes.” Toronto Star. 2 April 2022.

hps://www.thestar.com/business/2022/04/02/you-can-rent-the-american-dream-how-tricon-a-once-

obscure-toronto-company-built-a-corporate-landlord-empire-with-single-family-homes.html

71. Clasen-Kelly, Fred; Douglas, Anna; and Renni, Julianna. “Company bought hundreds of houses. Now, poor are

geing ‘priced out,’ critics say.” Charloe Observer. 14 June 2019.

hps://www.charloeobserver.com/news/politics-government/article217082180.html#storylink=cpy 29

72. Ibid.

73. Tricon Residential 2021 Annual Report.

hps://s29.q4cdn.com/296929481/files/doc_financials/2021/ar/Tricon-2021-Annual-Report.pdf, p. 43

74. Tricon Residential SEC Form F-10. October 5, 2021.

hps://docoh.com/filing/1584425/0001193125-21-291505/TCN-F10, p. S-21-22.

75. Ibid.

76. Lorinc, Jacob. “Tricon CEO Gary Berman on his company’s next moves – and why he told 60 Minutes

millennials don’t necessarily desire to own homes.” Toronto Star. 2 April 2022.

hps://www.thestar.com/business/2022/04/02/you-can-rent-the-american-dream-how-tricon-a-once-

obscure-toronto-company-built-a-corporate-landlord-empire-with-single-family-homes.html

THE NATIONAL RENTAL HOME COUNCIL/21

7 7. See note 74, p. S-13.

78. T ricon Residential. “Tricon Announces $300 Million Investment led by Blackstone Real Estate Income Trust,

Inc.” Press release, 27 August 2020. hps://www.newswire.ca/news-releases/tricon-announces-300-million-

investment-led-by-blackstone-real-estate-income-trust-inc--830230040.html

79. Wilcox, Don. “Blackstone makes $395M equity investment in Tricon.” Real Estate News Exchange. 27 Aug 2020.

hps://renx.ca/blackstone-395m-equity-investment-tricon-residential/