A Review of the Domain Name Market in India

Mansi Kedia Richa Sekhani Gangesh Varma

Ujjwal Krishna Raj Kumar Shahi

MAY 2020

A Review of the Domain Name Market in India

Mansi Kedia

Richa Sekhani

Gangesh Varma

Ujjwal Krishna

Raj Kumar Shahi

MAY 2020

Disclaimer:

Opinions and recommendations in the report are exclusively of the author(s) and not of any other individual or institution

including ICRIER. This report has been prepared in good faith on the basis of information available at the date of

publication. All interactions and transactions with industry sponsors and their representatives have been transparent and

conducted in an open, honest and independent manner as enshrined in ICRIER Memorandum of Association. ICRIER does

not accept any corporate funding that comes with a mandated research area which is not in line with ICRIER’s research

agenda. The corporate funding of an ICRIER activity does not, in any way, imply ICRIER’s endorsement of the views of the

sponsoring organization or its products or policies. ICRIER does not conduct research that is focused on any specific

product or service provided by the corporate sponsor.

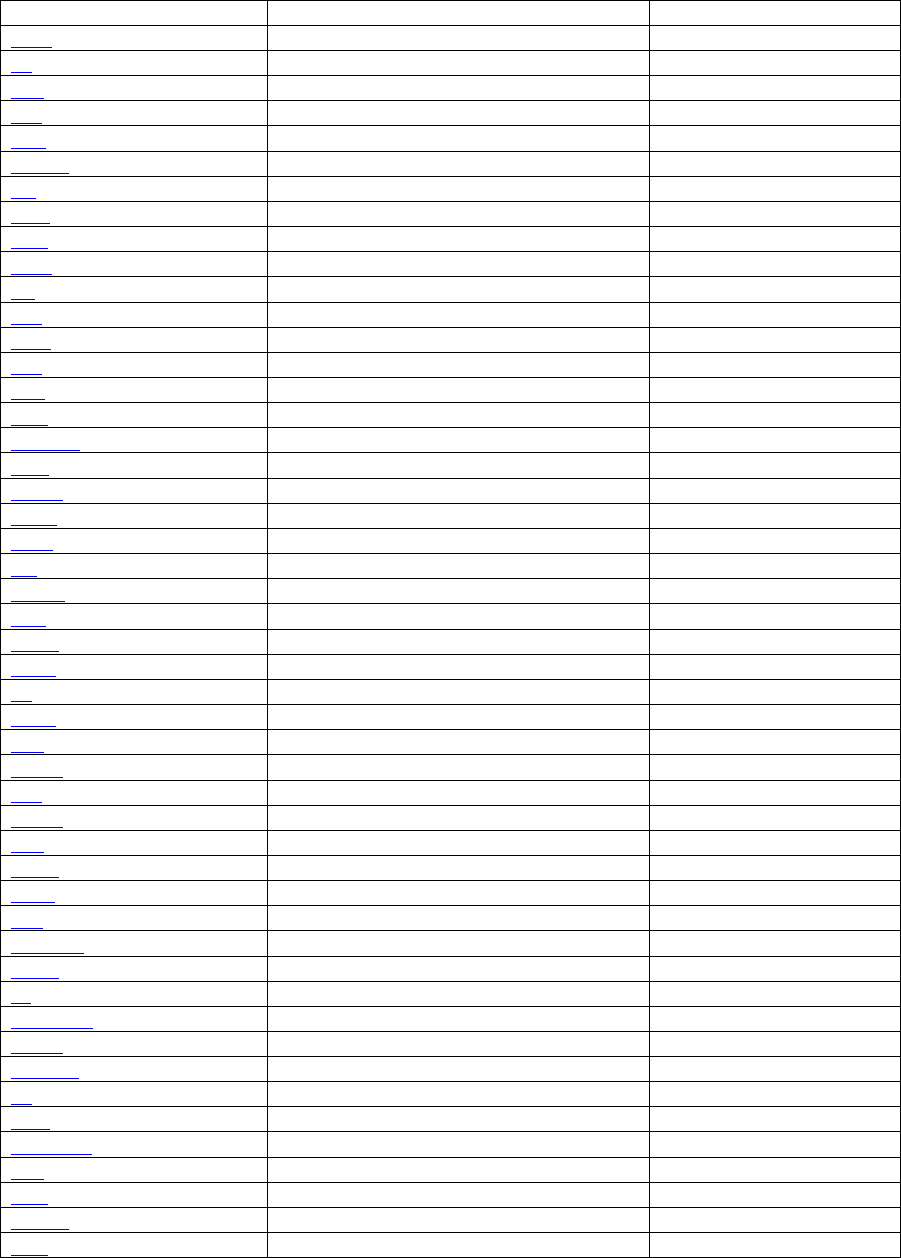

Table of Contents

Acknowledgement ..................................................................................................................... i

Executive Summary ................................................................................................................. ii

1. Introduction ........................................................................................................................ 1

1.1 Industry Value Chain .................................................................................................. 4

1.2 Evolution of domain name market .............................................................................. 5

2. Global Trends in the Domain Name Industry ................................................................. 9

2.1 Top Level Domains (TLD) ........................................................................................ 11

3. Domain Name Market in India ....................................................................................... 14

3.1 Future growth drivers of the Domain Name Industry in India ................................. 17

3.1.1 Smartphone adoption, high internet penetration and growth in data

consumption provide foundation for growth ................................................... 17

3.1.2 Growing online commerce ............................................................................... 18

3.1.3 Growing small and medium business (SMBs) ................................................. 18

3.1.4 Government Initiatives..................................................................................... 19

3.1.5 Favourable demographics and a burgeoning middle class ............................. 19

4. Insights from the Enterprise Survey on the domain name industry in India ............ 20

4.1 Enterprise survey ...................................................................................................... 20

4.1.1 Sample description........................................................................................... 20

4.1.2 Preference for Registrars and Packaged services ........................................... 24

4.1.3 Pricing ............................................................................................................. 25

4.1.4 Awareness on New gTLDs and Internationalised domain names (IDNs) ....... 25

4.2 Individual survey....................................................................................................... 26

4.2.1 Sample description........................................................................................... 26

4.2.2 Individual behavior .......................................................................................... 27

4.2.3 Preference for Registrars and Packaged services ........................................... 29

4.2.4 Pricing ............................................................................................................. 30

4.2.5 Awareness on New gTLDs and Internationalised domain names (IDNs) ....... 31

5. Competition Analysis in India’s Domain Name Industry ............................................ 32

5.1 Competitive rivalry ................................................................................................... 33

5.2 Threat of new entrant ................................................................................................ 37

5.3 Bargaining Power of Suppliers ................................................................................ 38

5.4 Bargaining power of buyer ....................................................................................... 38

5.5 Threat of substitutes .................................................................................................. 40

5.6 Summary of Porter’s Five Forces Analysis .............................................................. 41

6. Conclusions and Policy Recommendations ................................................................... 43

Bibliography ........................................................................................................................... 46

Appendix ................................................................................................................................. 49

List of Figures

Figure 1.1: Anatomy of the Domain Name System (DNS).................................................. 1

Figure 1.2: Value chain of the domain name industry ......................................................... 4

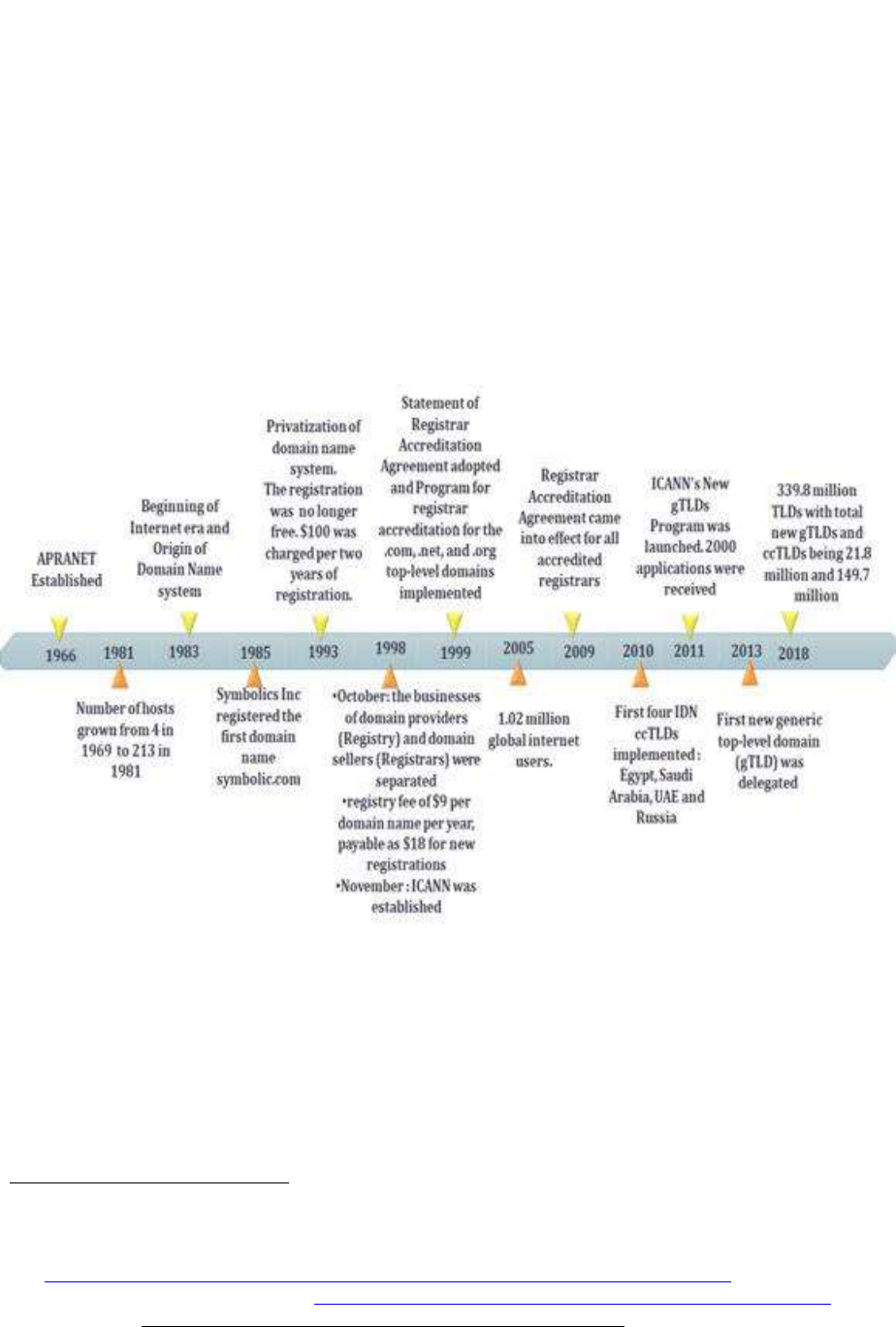

Figure 1.3: Evolution and History of Domain Name System .............................................. 7

Figure 2.1: Cross country comparison (percentage of enterprises owning a website) (2018)

............................................................................................................................ 9

Figure 2.2: Growth in internet users and domain name count across the globe (in

percentage) ....................................................................................................... 10

Figure 2.3: Domain Count (gTLDs) per Region as of December 2019 ............................. 11

Figure 2.4: Combined registrations on .com and .net (in millions) .................................... 12

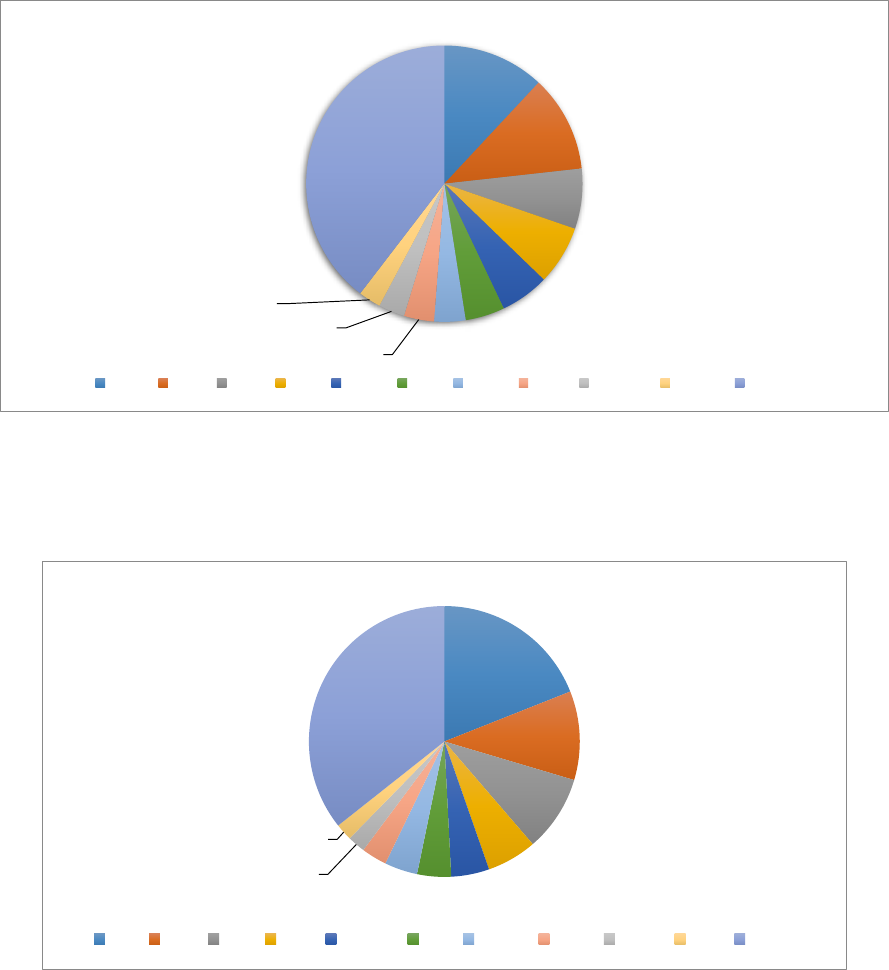

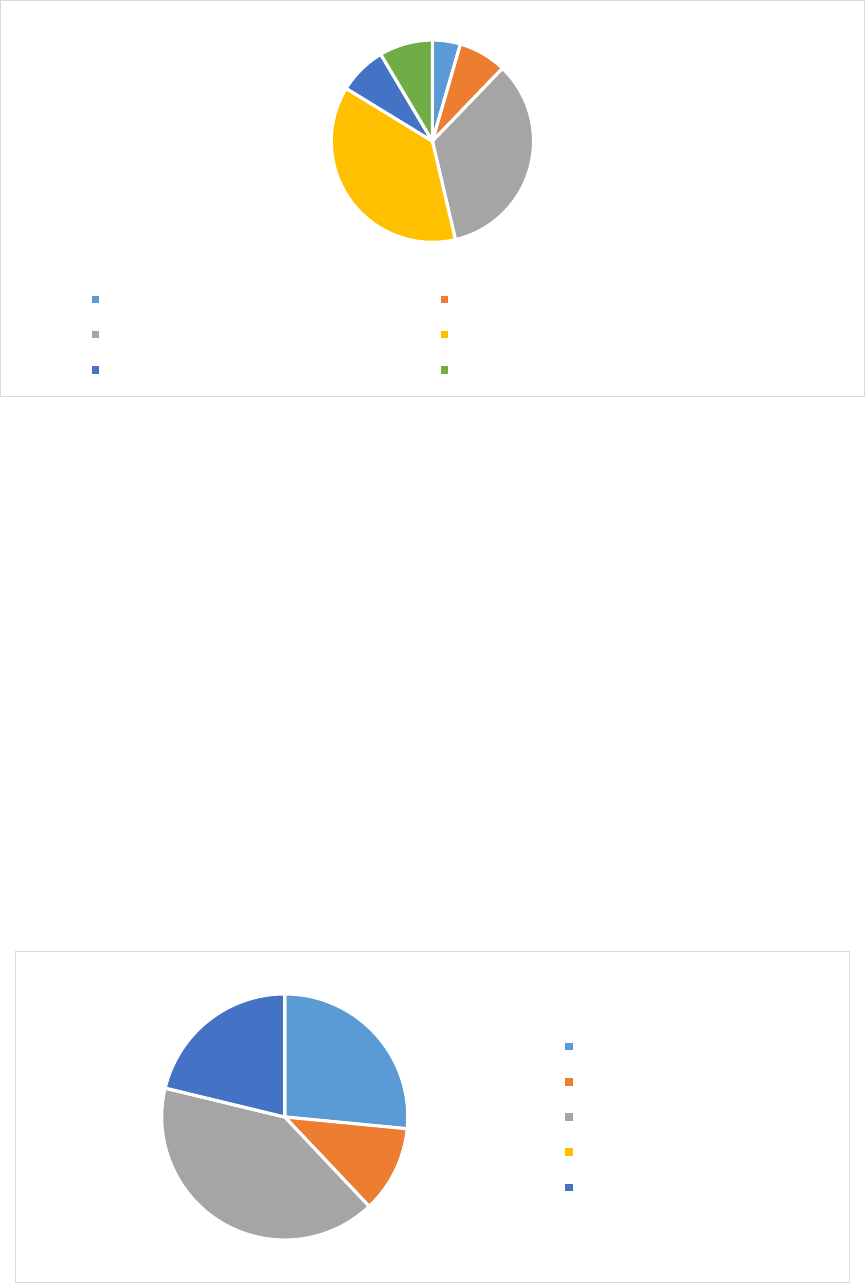

Figure 2.5a: New gTLDs: percentage share as on May 2020 .............................................. 13

Figure 2.5b: New gTLDs: percentage share as on May 2020 .............................................. 13

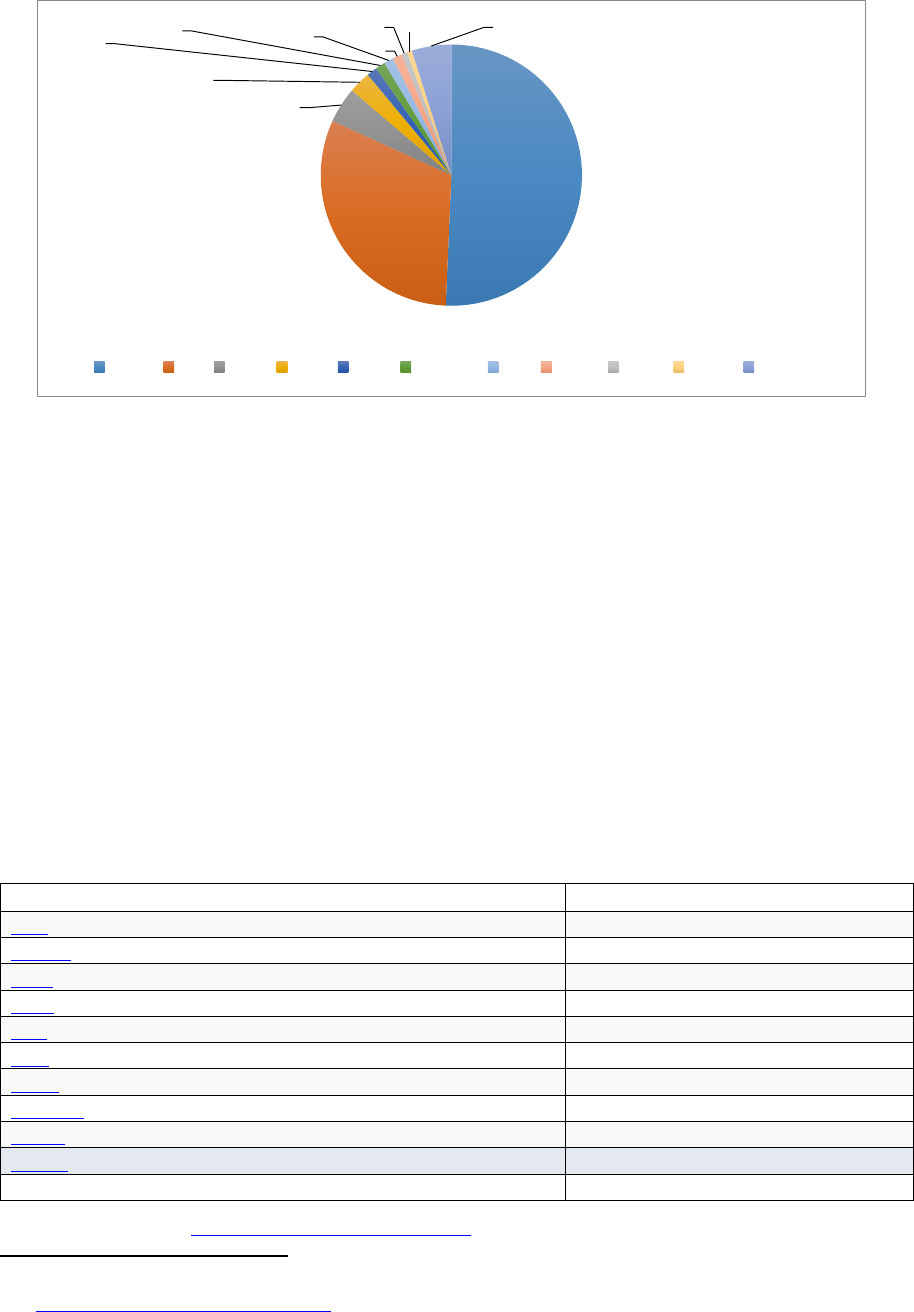

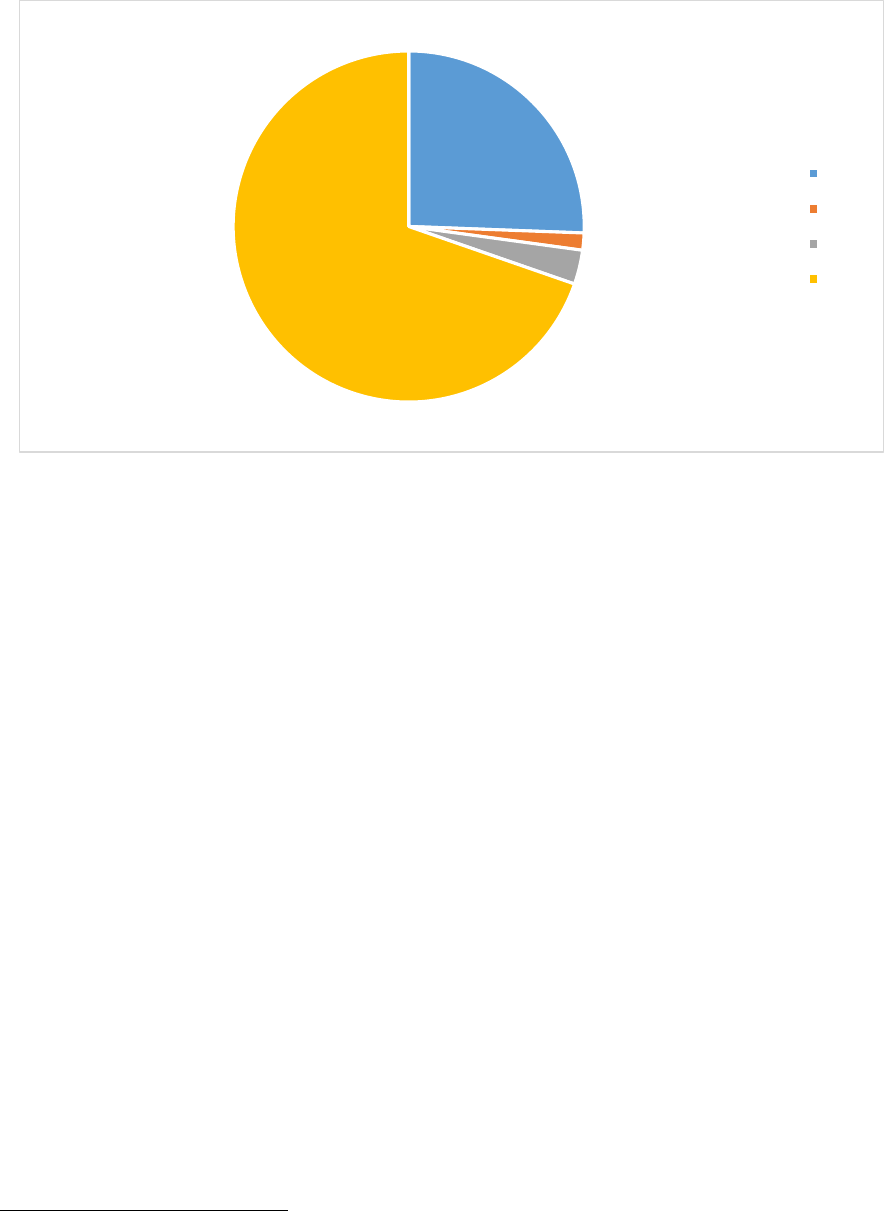

Figure 3.1: Percentage share of Top 10 TLDs in India as on May 2020 ........................... 15

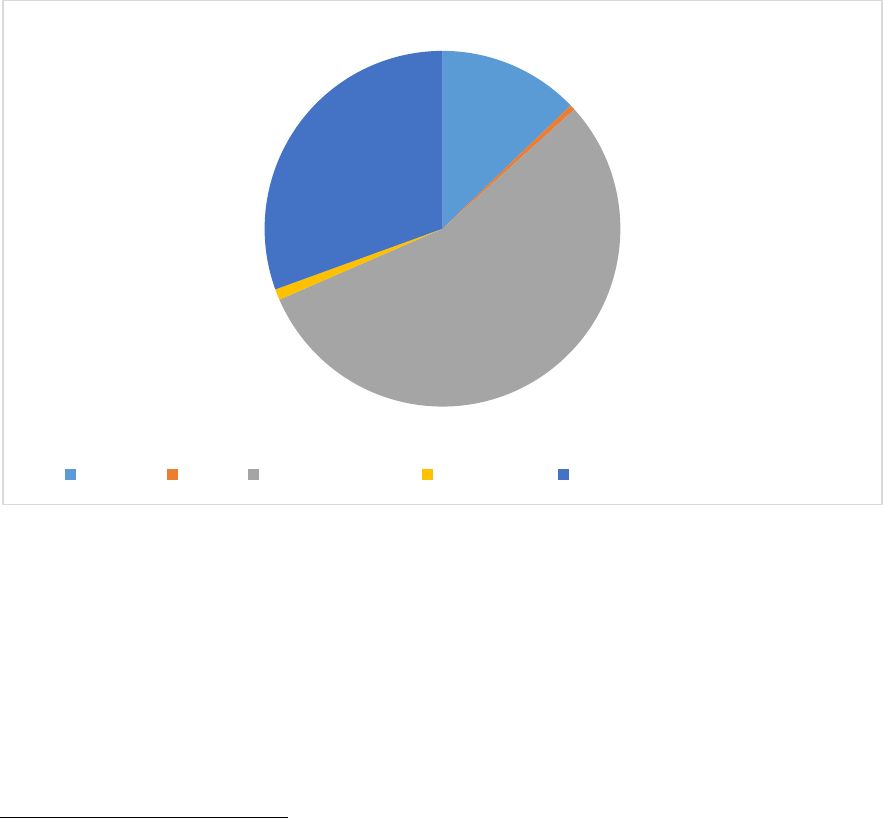

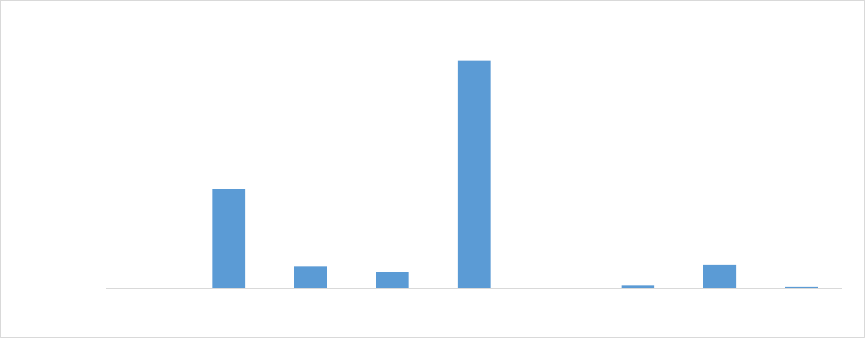

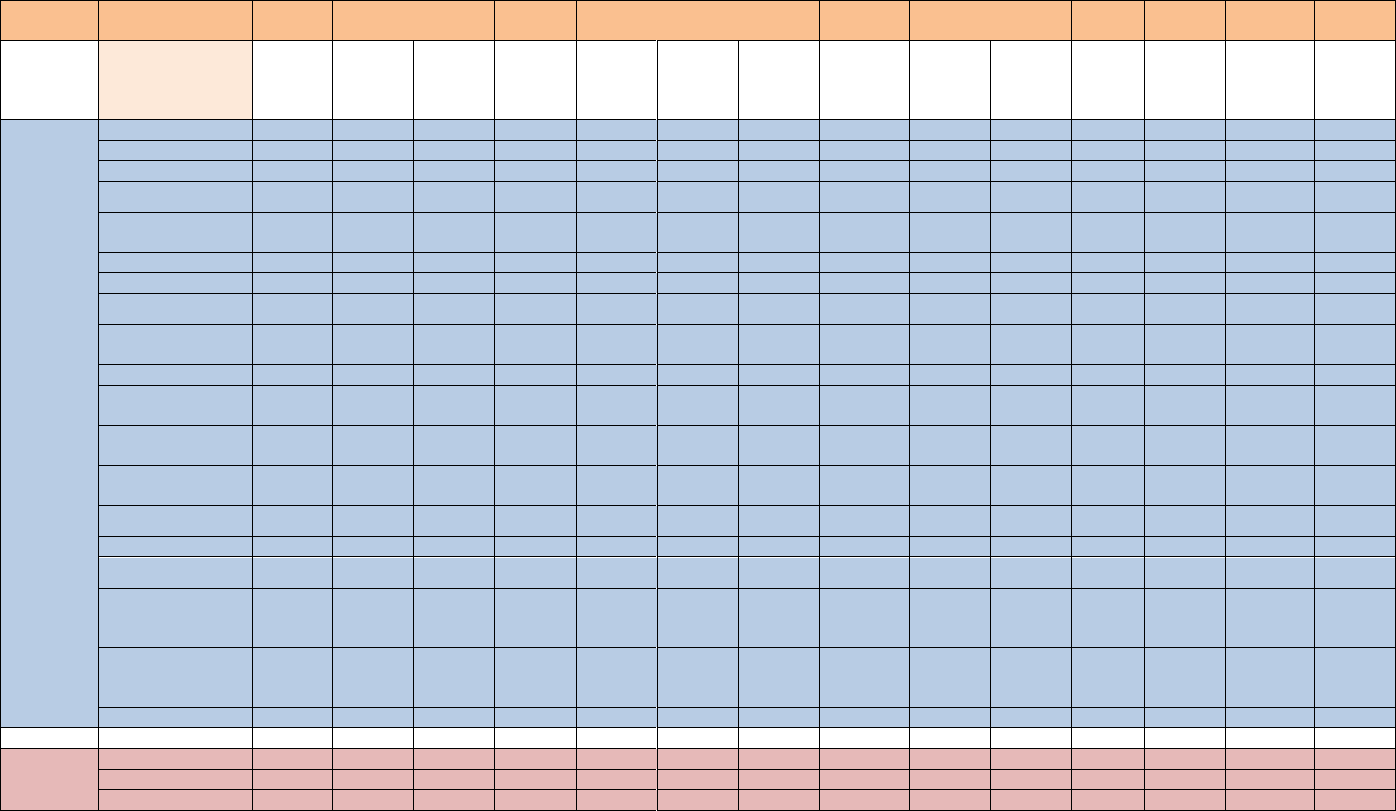

Figure 4.1a: Enterprises in the sample by revenue ............................................................... 21

Figure 4.1b: Enterprises in the sample by revenue ............................................................... 21

Figure 4.3: Enterprises’ reasons for using a domain name ................................................ 22

Figure 4.4: Top level domains registered by enterprises .................................................... 23

Figure 4.5: Additional services purchased by enterprises along with domain name in a

package ............................................................................................................ 24

Figure 4.6: Enterprises’ recognition of new gTLDs ........................................................... 26

Figure 4.7: Distribution of monthly incomes of individuals in the sample ........................ 27

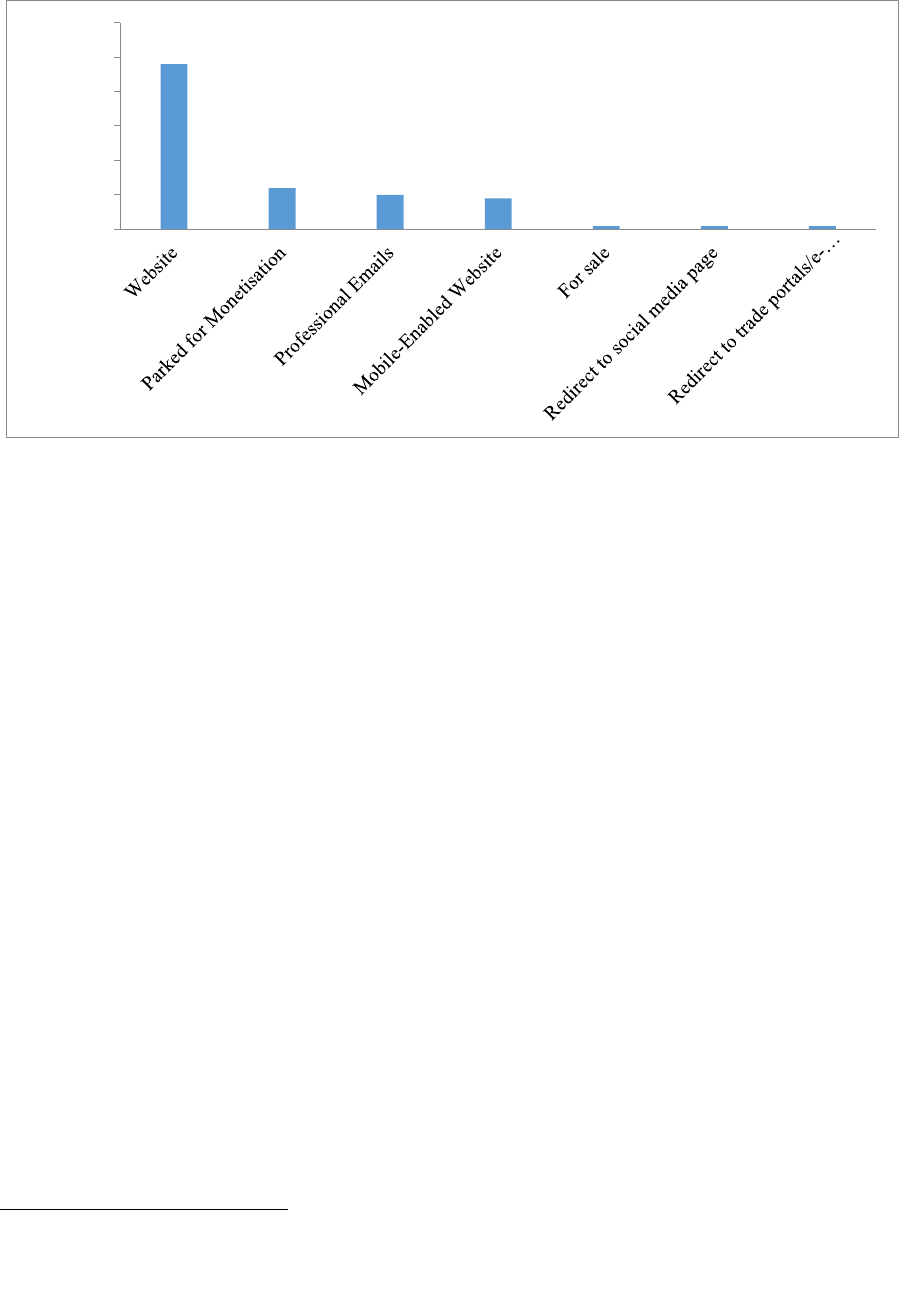

Figure 4.8: Individuals’ reasons for using a domain name ................................................ 27

Figure 4.9: Individual registrations of TLDs ...................................................................... 29

Figure 4.10: Additional services purchased by individuals along with domain name in a

package ............................................................................................................ 30

Figure 4.11: Individuals’ recognition of new gTLDs ........................................................... 31

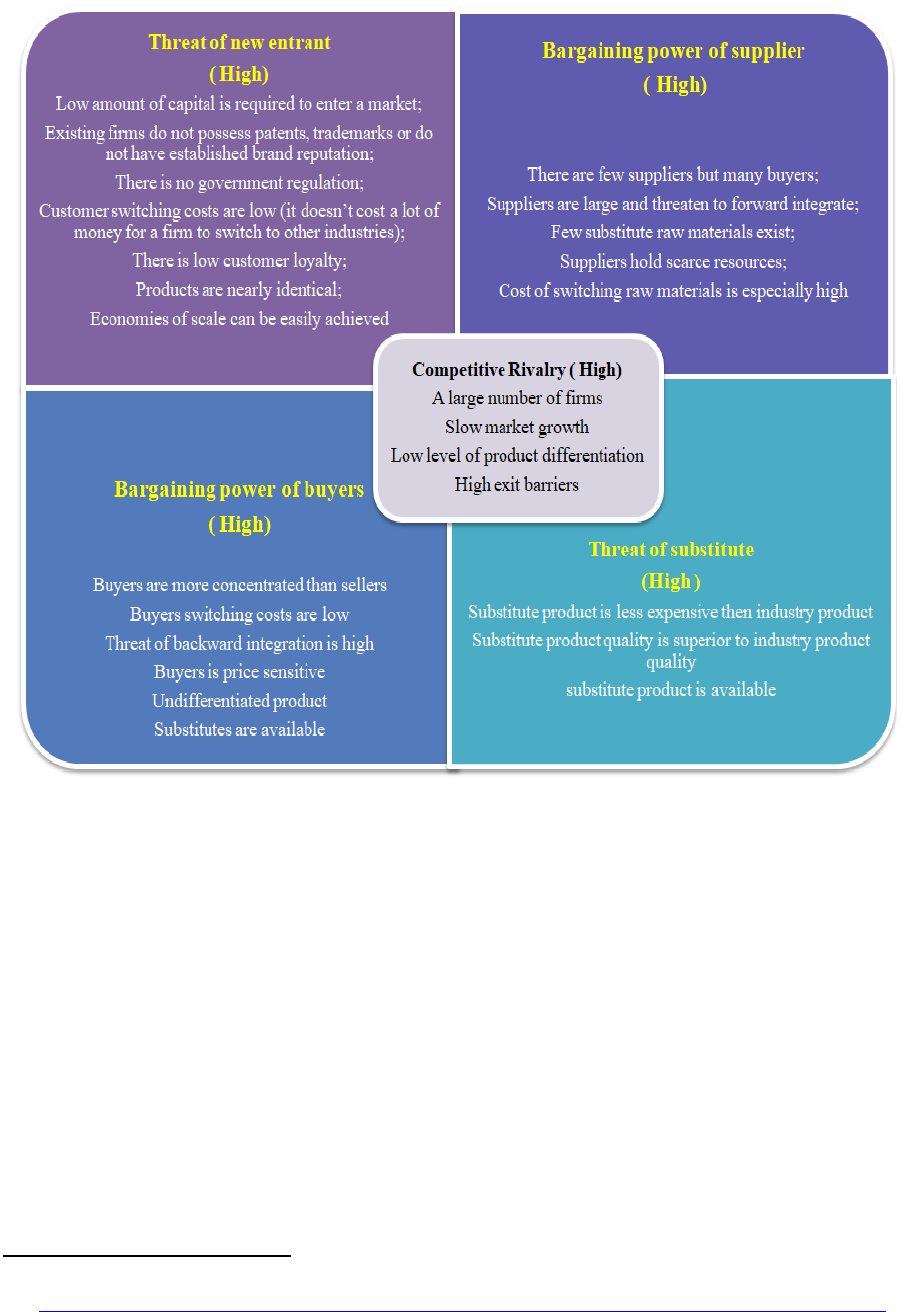

Figure 5.1: Porter’s Five Forces Framework ...................................................................... 33

Figure 5.2: Domain Name Universe in India - Split by Key Attached Services ................ 39

List of Tables

Table 2.1: Top 10 ccTLDs Registrations as on May 2020 ............................................... 12

Table 3.2a: new gTLDs registartions in India percentage share ......................................... 15

Table 3.3: Registrar-wise Percentage of Domains with (Developed) Websites ............... 16

Table 3.4: India’s Digital Economy .................................................................................. 18

Table 5.1a: List of Top 10 Registrars selling gTLDs in India ............................................ 34

Table 5.1b: List of Top 10 Registrars selling new gTLDs in India as of August 14th , 2019

.......................................................................................................................... 34

Table 5.2: Domain Name Services provided by Various Registrars ................................ 36

Table 5.3: Registration, Renewal and Transfer Price charged by registrars for various

domain names (annual price) as on May 28th, 2020 ....................................... 40

Table 5.4: Summary of the Competition Analysis using Five Forces .............................. 42

i

Acknowledgement

We are grateful to The Ministry of Electronics and Information Technology (MEITY) for

giving us this opportunity to undertake a project that evaluates the domain name industry in

India. We would like to thank their teams for their continuous support and guidance in

helping shape the study to its current form.

We are also grateful to the team at Spectrum Research for conducting the survey for

individuals and enterprises. We would like to thank all our stakeholders including The

Internet Corporation for Assigned Names and Numbers (ICANN), National Internet

Exchange of India (NIXI), registries, registrars and registrants for their valuable insights. We

would like to thank Isha Suri and Siddharth Naidu for their extensive and formative support.

Finally, we are grateful to our team at ICRIER for their unending supply of wisdom and time,

making ICRIER a delightful place to reflect on such an engaging and stimulating area of

research. All errors of course remain our own.

ii

Executive Summary

The evolving role of the Internet has resulted in a paradigmatic shift in the way trade and

commerce is now conducted. More and more businesses are going online; the past decade has

witnessed an explosive growth in the number of businesses and individuals who have

invested in a personal webspace. As a result, demand for domain names have increased. As

per the domain name stats, domain name counts were recorded to be 408.5 million across all

top-level domains (TLDs) in May 2020. ccTLDs accounted for 37% of the total registrations

(149.6 million). Amongst gTLDs, .com and .net continue to be market leaders. They have a

combined total of approximately 183.9 million registrations. For new gTLDs, recorded

registrations were 62 million as on May 2020, accounting for approximately 15% of the total

TLDs, with popular ones being. .icu, .top, .xyz, .site and .online

On the back of a vibrant Internet ecosystem in India, thrives a rapidly growing domain name

market. Domain name registrations counts in India increased by 7.1% during the period

2016-17 and recorded a total of 5 million in May 2020. Registrations in India, however,

account for only 1.24 percent of the global market. The popularity of “.com” is also

observable in India. As a legacy TLD it commands almost 51% of the domain name market

in India followed by .in and .org with their respective share being 31.14% and 4.41%

respectively. The preferred nTLDs are .xyz and .online and .ooo. The market shares and

rankings of TLDs change over time, even though the top choices have always remained .com

and .in. The primary reason for this order of preference to is that of the domain reflecting the

activity or the business location. Further familiarity, easy recognition, trust, price

affordability and resale value of the domain also influence the decisions of registrants.

Very similar and interesting findings were revealed in the enterprise and individual survey

analysed in the report. The survey elicited notable trends in usage patterns, industry priorities,

and market perceptions, and also delved into currently underutilised, yet high potential,

categories such as Internationalised Domain Names (IDNs). Price, brand reputation,

recommendation from friends and colleagues, offering free provision of the domain along

with other services by registrars and advertisements influences registrant’s decisions of

buying domain name from a registrar. In terms of awareness, while individual and enterprises

both could recognise the ngTLDs, they were not aware about the nomenclature. Similar but

far more pronounced was the case with IDNs.

The industry trends and findings from the survey has showcased the under penetrated market

of the domain names in India. India presents a huge opportunity for the domain name market

as online businesses trickle down to Tier 2 and Tier 3 cities. However, to help this industry

achieves its maximum potential, marketing strategies of registries and registrars have to be

well aligned. India has seen a steady rise in the number of registries, registrars and resellers

that drive the supply side. While several stakeholders have entered the market, there have

also been prominent exits among registrars and several resellers have shut shop. The ability

of players to enter and exit the market is an indicator of competitiveness and is applicable

universally. The domain name market in India is deeply layered. Besides registrars, there is a

distribution network of resellers and registrants. A priori, the market seems to be competitive.

iii

There are a large number of buyers and sellers, although a centralized database reporting the

exact number of domain name registrations is absent. This is important for market analysis

and is one of the policy recommendations of the study.

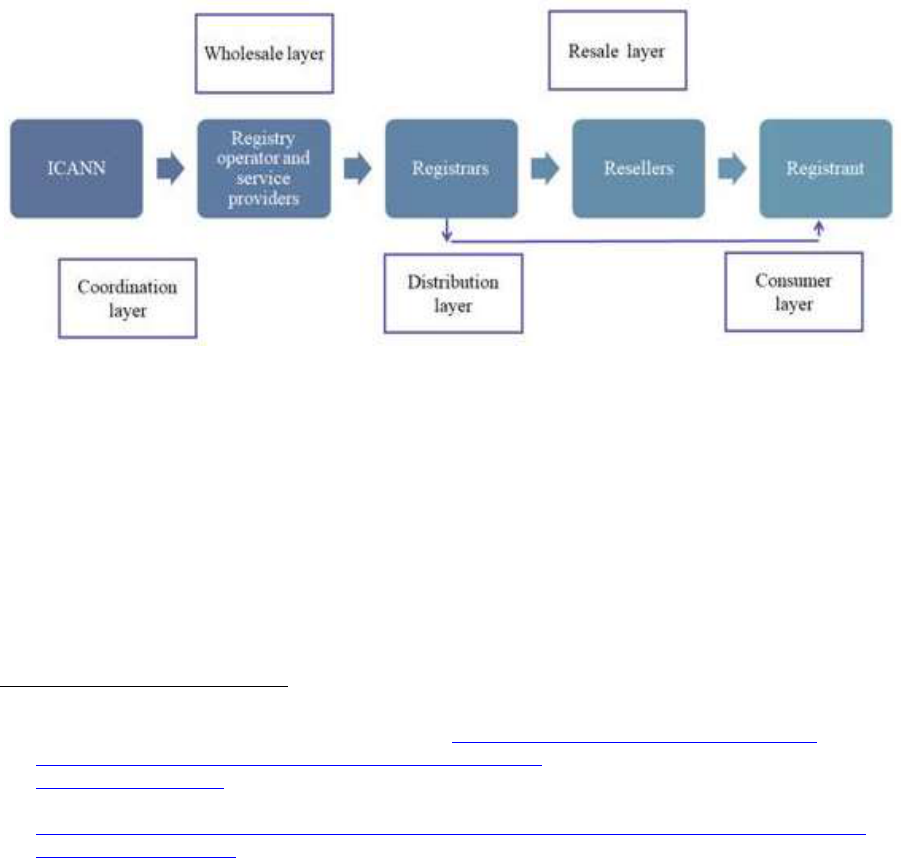

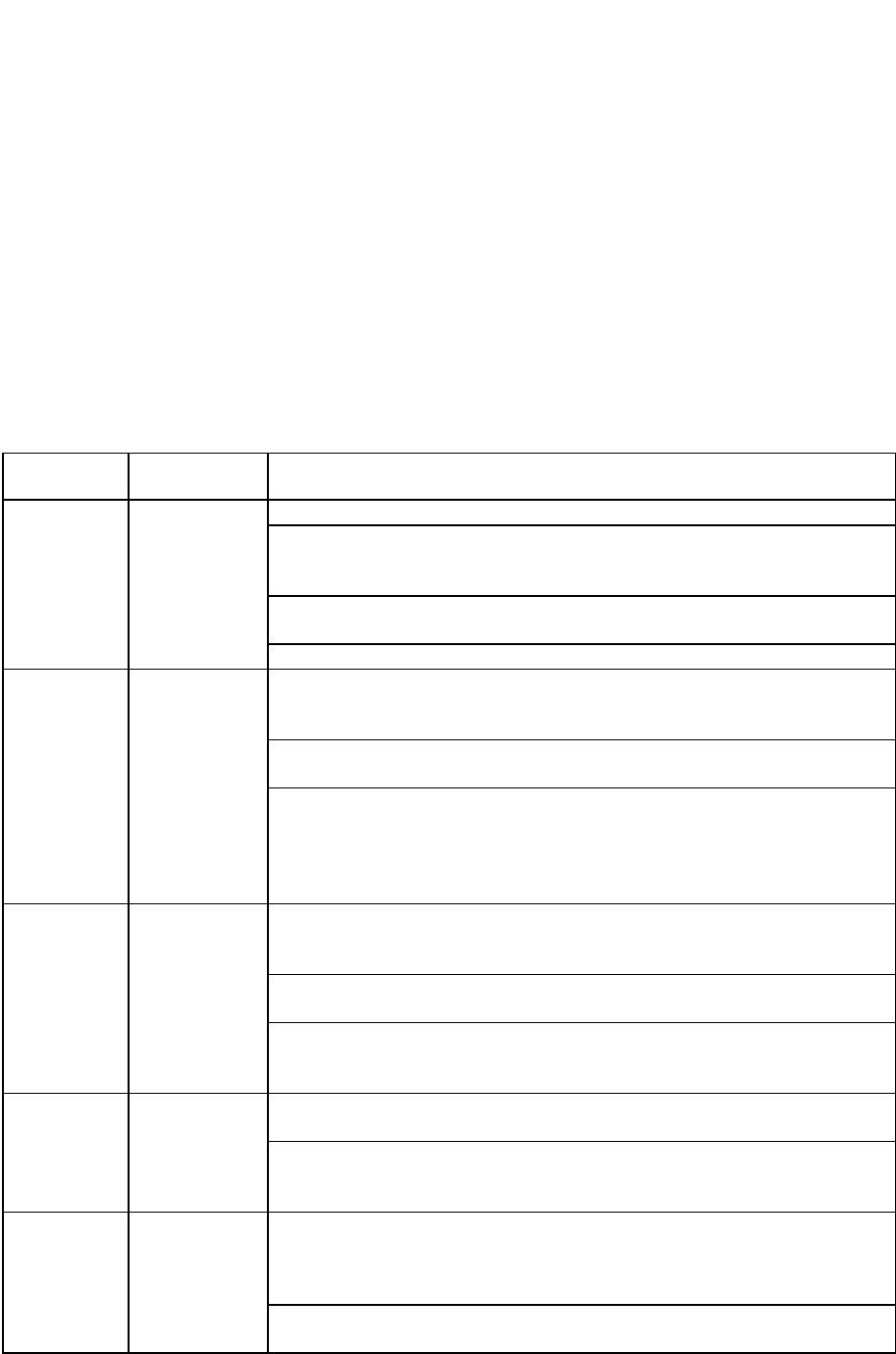

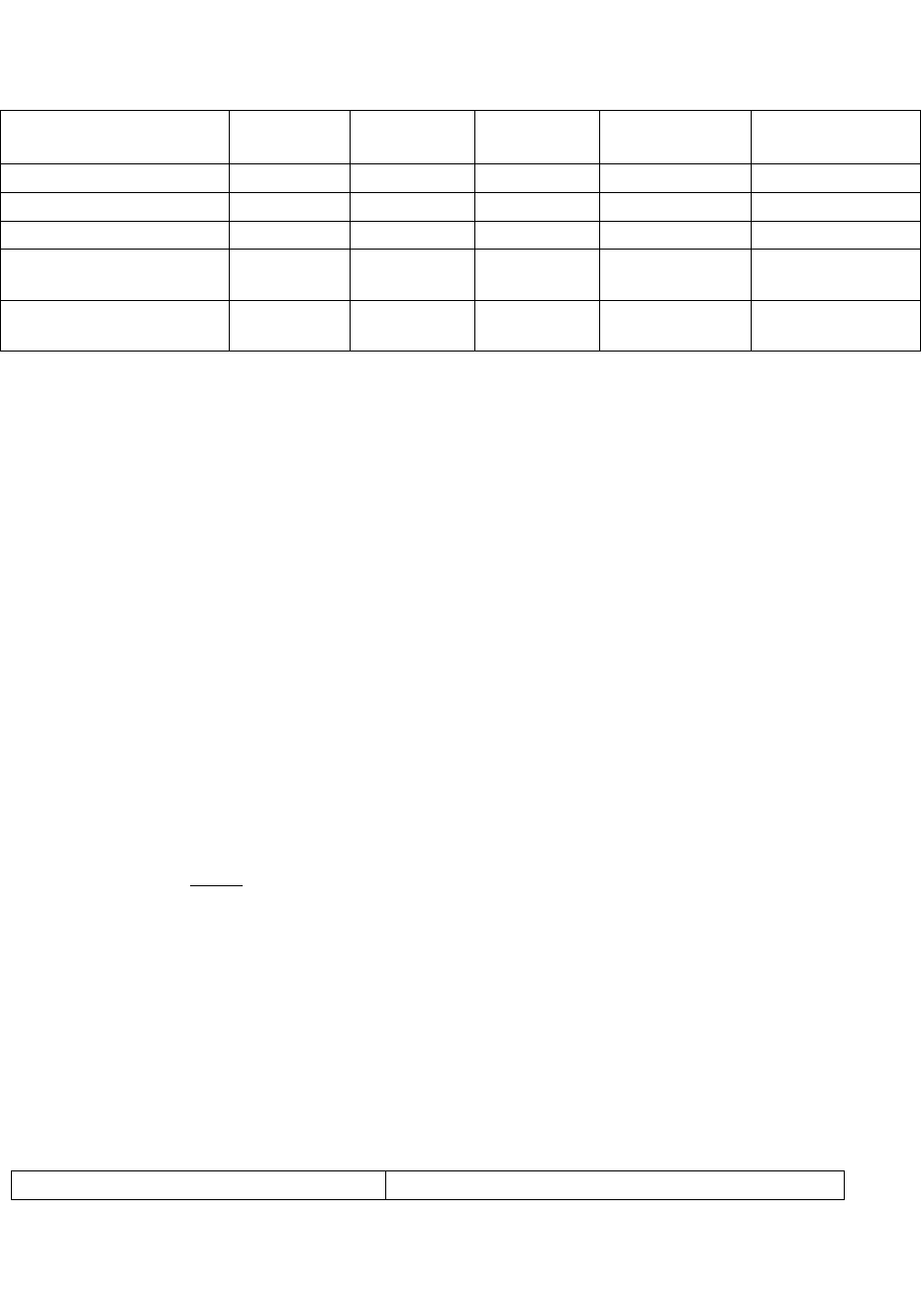

An analysis of competition using Porter’s Five Forces Model in the report finds that the

domain name industry in India is fairly competitive (Medium-High). The presence of a large

number of registrars and registries along with the deeply networked reseller market makes the

industry attractive for new players. There is relative ease in the entry and exit of registrars

and the market is not yet subject to onerous regulations. This makes it an attractive

proposition for new players, who are vying for a share of a rapidly growing market in India.

Registries and registrars are tempted to offer promotions and discounts to acquire new

registrations. However, lack of awareness and technical know-how often limits the

registrant’s ability to bargain at the time of renewal. Met with reasonable services, even price

sensitive registrants hesitate to transfer domains given the actual and perceived costs of

switching. Table below summarizes the analysis where a given factor is ranked as either low,

low to medium, medium, medium to high and high; based on our analysis of how each of

these forces is likely to impact competition.

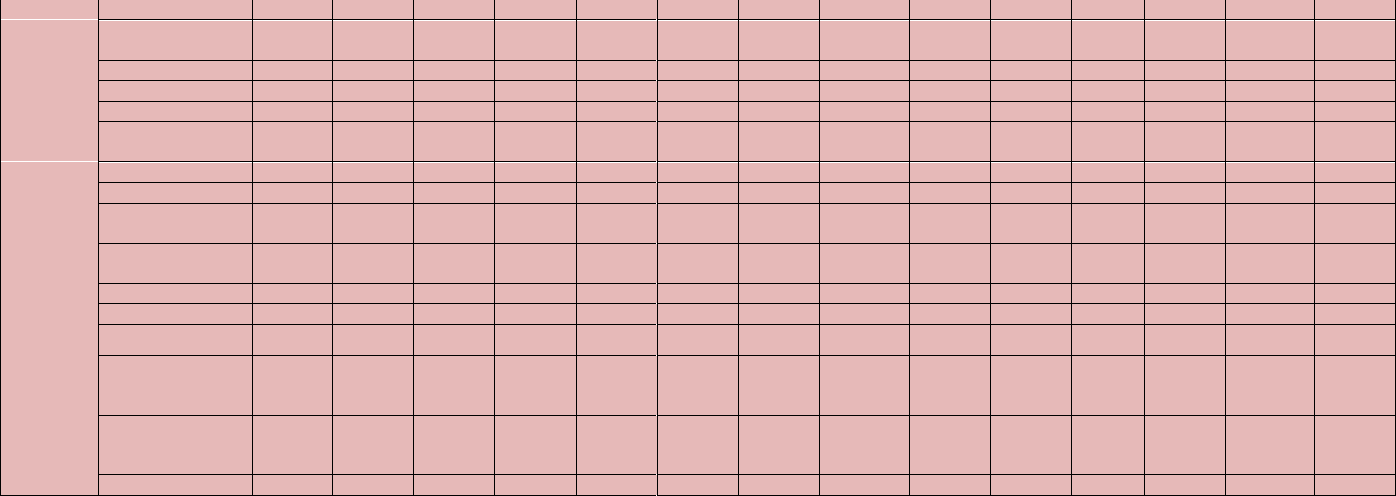

Summary of the Competition Analysis using Five Forces

Porter’s

Five Force

Level of

Competition

Summary Analysis

Competition

Rivalry

Low-medium

Large number of registrars but few of them are dominant.

Registration of new gTLDs are led by two key registrars – Go

Daddy and PDR-who between them control about 80 per cent of

the market share in this category.

Core product sold by most registrars is identical; however,

value-added services are a differentiating mechanism.

The exit barriers are moderate; process is not very tedious.

Threat of

new entrant

Medium

Accreditation process is user friendly and the barrier to entry is

extremely low for ICANN accredited registrars (The compliance

burden on registrars is significantly higher than that for

resellers).

Those selling legacy TLDs are relatively less monitored than

those selling the new generation new gTLDs.

ccTLD registrar involves accreditation from each ccTLD

registries. Documentation requirements and/or nexus rules

require registrants to be physically present within their countries,

involves verification and validation of documents which

ultimately increases the compliance burden for registrars and

their overall cost of operations.

Bargaining

power of

supplier

Medium

Each gTLD is managed by a single registry that is responsible

for maintaining necessary records (as prescribed by ICANN) of

all registered domain names within the TLD that it controls.

iv

Competition in the supplier market of new gTLD is fiercer as

each registry tries to create a niche for itself in the market.

ccTLD registries have mandated citizenship or domestic

incorporation as a criterion to register their domains and there

for can control the users of the domain names through individual

TLD policies.

Bargaining

power of

buyer

Low -Medium

The registrants in the industry can switch registrars the latter has

power to bargain with registrars.

However, lack of awareness about domain names along with

bundled services provided by registrars makes consumers

continue with registrars they originally register with, limiting

their ability to bargain.

Threat of

Substitutes

Low- Medium

With the rise of social media platforms and e-commerce

websites, small companies no longer feel the need to register

their own domain and instead piggy back on that of an existing

platform/ marketplace to advertise its product or service.

However, there is no substitute for highly personalized emails.

Domain name registration becomes necessary for a business

email address

Overall, we could conclude that the level of competition in this industry is medium-high.

While the state of competition can be improved, it may be adequate to produce efficient

outcomes and consumer welfare, at least in the short term. Competition could be increased by

increasing the market size of the industry and initiatives that can promote the registration in

India. The role of policy becomes important to create an enabling ecosystem that will help

take this growth forward. Curating and maintaining a robust database of the industry,

developing strategies to increase consumer awareness, address information asymmetry,

promoting geographic TLDs and domain names in local language, supporting startups and

SMBs and organising an annual domain names conclave to increase India’s participation in

international fora is important to voice priorities that are unique to India.

1

A Review of the Domain Name Market in India

1. Introduction

The evolving role of the Internet has resulted in a paradigmatic shift in the way trade and

commerce is now conducted. More and more businesses are going online; the past decade has

witnessed an explosive growth in the number of businesses and individuals who have

invested in a personal webspace. As a result, demand for domain names have increased

1

.

Domain names, integral to network design, act as an identification string used for naming and

addressing. Every website on the Internet is hosted on a server computer and every device

connected to the internet has to have an Internet Protocol (IP) address. which has a unique

Internet Protocol (IP) address.

2

This IP address is a sequence of characters made up of

numbers. The purpose of domain names is to assignnames to these IP addresses that are easy

to remember. Domain names are simple strings of alphanumeric American Standard Code

for Information Interchange (ASCII)

3

characters, which are not case sensitive. The owner of

the website can choose any name, given that no one else is already using the same name for

another website. Without domain names, one would have to tediously keep track of long

arrays of numbers and enter the complex sequences every time a website has to be visited.

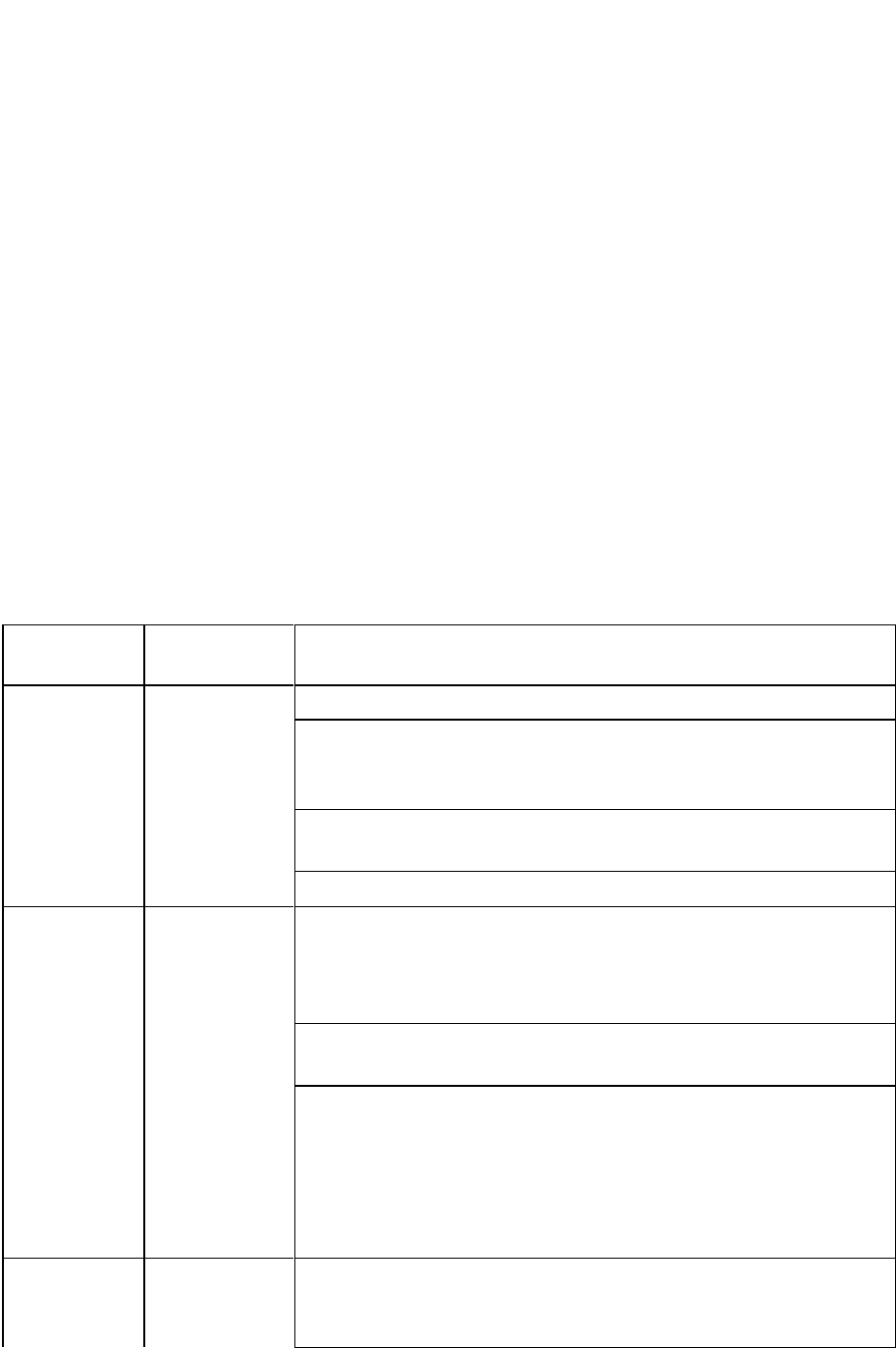

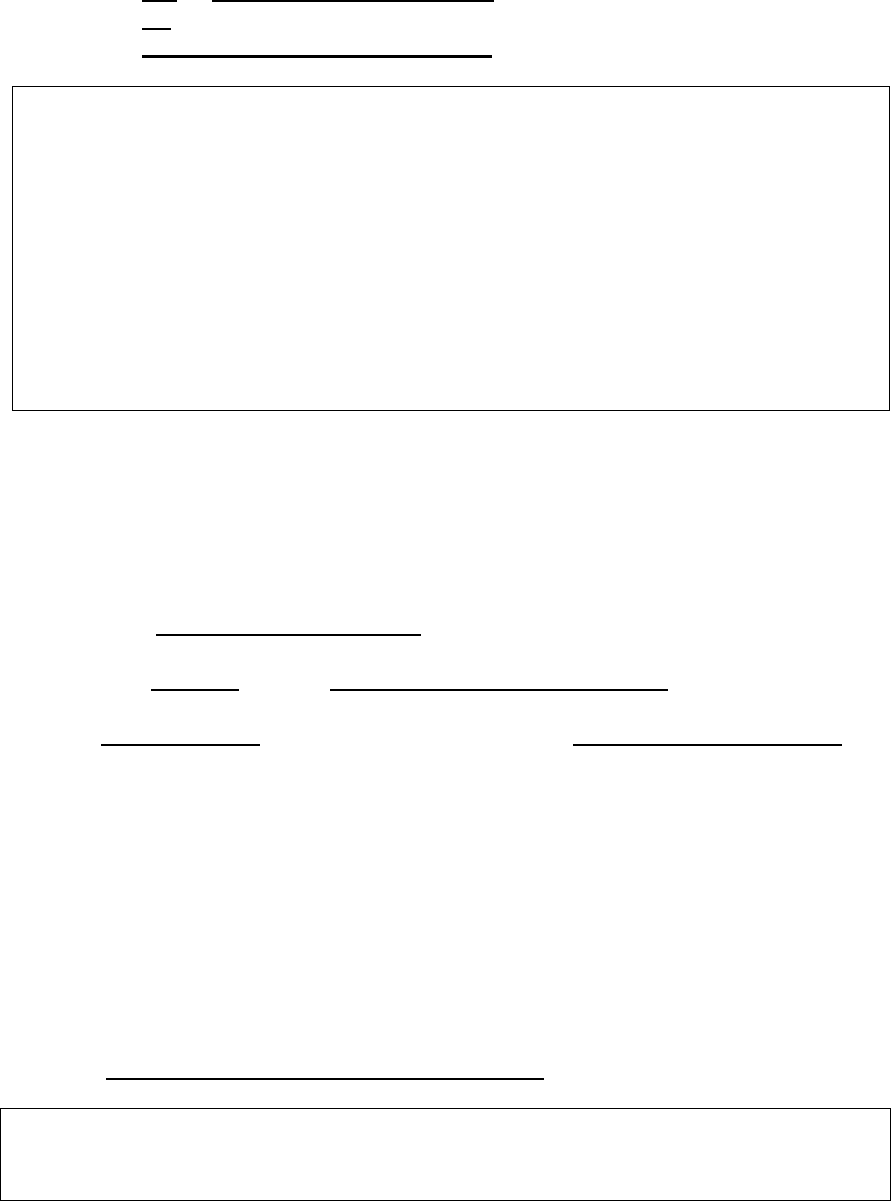

Figure 1.1: Anatomy of the Domain Name System (DNS)

Source: ICANN, “New Generic Top-Level Domains: New gTLD Basics; New Internet Extensions

4

1

The Global Domain Name Market (2018), Global Industry Analyst, Inc.

https://www.strategyr.com/MarketResearch/market-report-infographic-domain-names-forecasts-global-

industry-analysts-inc.asp

2

In fact, every computer on the internet network has a unique IP address

3

ASCII is abbreviated from American Standard Code for Information Interchange, is a character encoding

standard for electronic communication

4

New gTLD basics, New Internet Extensions, ICANN, https://archive.icann.org/en/topics/new-gtlds/basics-

new-extensions-21jul11-en.pdf

2

The Domain Name System (DNS) follows a treelike hierarchy, where each top-level domain

(TLD) includes many second-level domains; each second-level domain can include third-

level domains, and so on and so forth. These various elements within a domain name are

called labels; they are organized into different levels segmented by a dot (“.”). For instance,

in google.com, “.com” is the top-level domain name (TLD) and “Google” is the second level

domain name. The top-level domain such as ".com," is fairly generic. Although it is the

controlling address feature, it does not help to distinguish a site from others. A second-level

domain (SLD) is the portion of a Uniform Resource Locator (URL) that identifies the specific

and unique administrative owner associated with an Internet Protocol address (IP address)

5

.

For example, in a domain name like "google.com," the word "google," as the second-level

domain, is where domain holders put the brand name, project name, organization name or

other familiar identifier for users.In addition, there are country code top level domain

(ccTLD) that are used or reserved for a country, sovereign state, or dependent territory

identified with a country code.There are also common second-level domains, there is also a

country code second-level domain (ccSLDs). For instance, ac.uk - academic represents

tertiary education and research establishments and learned societies in United Kingdom.

A third-level domain is the next highest level following the second-level domain in domain

name hierarchy. It is the segment that is found directly to the left of the second-level domain.

The third-level domain is often called a "subdomain", and includes a third domain section to

the URL. In large organizations, every department or division may include a unique third-

level domain that can act as a simple, yet effective, way of identifying that particular

department. Various third-level domain names are used to balance the load on sites with

heavy traffic. For example, in www.mydomain.com, "www" is the third-level domain. The

usage of third-level domain names adds clarity to domain names, which makes them more

intuitive.

TLDs are further classified as country-code top-level domains (ccTLDs) and generic top-

level domains (gTLDs). Box 1.1 provides a comprehensive understanding of the DNS

typology.

5

Intermedia , https://kb.intermedia.net/Article/1215

3

Box 1.1: Understanding the Top-Level Domains (TLDs) Typology

General Top level domain name (GTLDs): A gTLD (generic top-level domain

name) is an internet domain name extension or root zone with three or more

characters. The stability and reliabilityof the namespace of all domains under gTLDs is

overseen by the non-profit organization, Internet Council for Assigned Names &

Numbers (ICANN). gTLDs are associated with some domain class, such as .com

(commercial), .net (originally intended for Internet service providers, but now used for

many purposes), .org (for non-profit organizations, industry groups, and others), .gov

(U.S. government agencies), .mil (for the military), .edu (for educational institutions);

and .int (for international treaties or databases and not much used). For example, in the

domain name, www.ibm.com, .com is the chosen gTLD. Some of the the original

gTLDs such as .com, .org or .net are now called legacy TLDs These can be

segregated in to two categories namely:

Sponsored: According to ICANN a sponsored TLD is a specialized TLD that has a

sponsor representing the narrower community that is most affected by the TLD. For

instance, .asia, .aero, .cat, .edu, .coop, .int, .gov,.jobs etc. that are mostly industry

specific and sponsored by organization and institutions.

Unsponsored: An unsponsored TLD operates under policies established by the global

Internet community directly through the ICANN process. .biz, .name, .pro which can

be used for specified purpose and are restricted to specific type of registrants. For

instance, .biz can only be used for business purposes.

Country code Top-Level Domain: It represents domain of a particular country or

territory (e.g., .in, .eu, .de, .mx, and .jp). The management of these TLDs are delegated

to designated individual country managers, whose country or territory is assigned a

unique two-letter code from the International Standards Organization’s; the managers

operate the ccTLDs according to local policies that are adapted to best meet the

economic, cultural, linguistic, and legal circumstances of the country or territory

involved. The ISO country codes are internationally recognized codes that designate every

country and most of the dependent areas a two-letter combination or a three-letter

combination; it is like an acronym, that stands for a country or a state.

International domain names (IDNs): IDN that contains at least one label that is

displayed in software applications, in whole or in part, in a language-specific script

or alphabet, such as Arabic, Chinese, or the Latin alphabet-based characters

with diacritics or ligatures, such as French. These writing systems are encoded by

computers in multi-byte Unicode. Examples of IDNs are. இந்யா, .संगठन, etc.

IDNs were introduced in 2003.

4

The past few years have witnessed a steep rise in demand for domain names. Since late 2013,

several hundred new TLDs were added by Internet Corporation for Assigned Names &

Numbers (ICANN), a non-profit organization responsible for coordination of the global

Internet system.

6

As per nTLD stats

7

, there are 1,187 new gTLDs across the globe. In

addition, the release of international domain names (IDNs) that feature non-Latin alphabets

have also enhanced the available domain name count. The increase in regional content,

access to smartphones and Internet hotspots led to increase in overall domain name

registrations

8

.

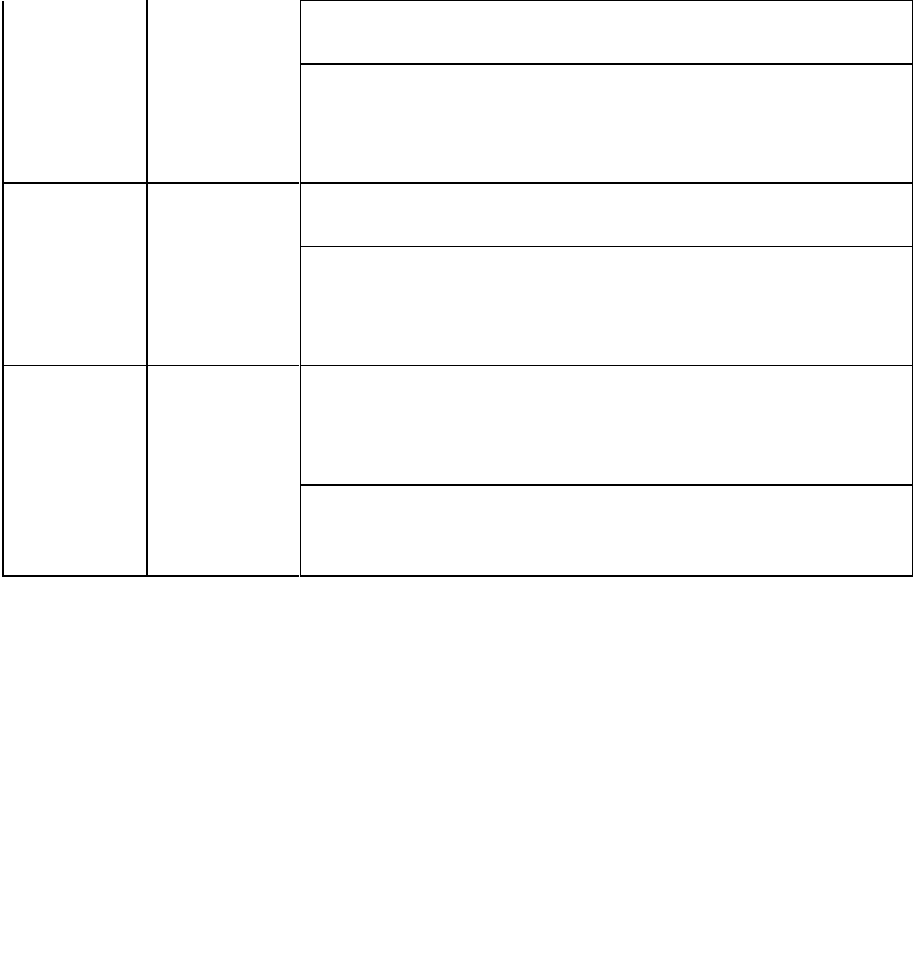

1.1 Industry Value Chain

The value chain helps explain the different layers within the industry and the relationship

between stakeholders. ICANN in 2013 represented the value chain, as depicted in Figure 1.2

below

Figure 1.2: Value chain of the domain name industry

Source: ICANN

ICANN manages coordination of technical aspects within the DNS. It also formulates rules

and procedures that are essential to the preservation of a reliable global address book of

domain names. The Internet Assigned Numbers Authority (IANA), responsible for the

operational aspects. It is responsible for Internet protocol (IP) and coordinates global IP

addressing, symbols, numbering, media-type and DNS root zone management. Based at the

University of Southern California (USC), IANA manages a centralized IP database and uses

global DNS oversight to assign unique IP addresses to private or public organization.The

6

Winterfeldt . B & Moltrup . D (2015). “Brand Protection on the Internet: Domain Names, Social Media,

and Beyond”, International Trademark Association http://www.inta.org/trademarkadministration/

Documents/BrandProtectionontheInternetWinterfeldt-Final.pdf

7

https://ntldstats.com/tld

8

The Global Domain Name Market (2018), Global Industry Analyst, Inc.

https://www.strategyr.com/MarketResearch/market-report-infographic-domain-names-forecasts-global-

industry-analysts-inc.asp

5

other major stakeholders include registry operators that are responsible for management,

operation and administration of TLDs

9

. Most of the entities in this layer do not directly sell

domain names to end consumers. They sell domain names through a network of distributors

(or registrars). Some examples of ccTLD registries include the National Internet Exchange of

India (NIXI)

10

providing “.in”, DENIC (Germany)

11

providing “.de”, Association Française

Pour Le Mommage Internet En Cooperation (AFNIC)

12

- incumbent manager of “.fr”

(France). VeriSign

13

is a gTLDregistry providing “.com” and “.net”.

Registrars form the distribution layer of the value chain. For selling gTLDs and ccTLDs,

registrars have to be accredited by ICANN and ccTLD registries, respectively. Registrars

have to fulfil working capital requirements provided by ICANN to become eligible for selling

and registering domain names. Globally, there are approximately 2000

14

registrars. Some of

the big players in the market include GoDaddy, Tucows, Name Cheap etc

15

. Resellers, are

part of the distribution layer, belong in the resale market. They buy domains with the purpose

of reselling them to consumers. Registrars use the reseller network to increase their sales by

offering them sale commissions. The expanding network of registries, registrars and resellers

has led to an explosive growth of the industry with the global count of domain name

registrations across all TLDs having reached 408.5 million in May 2020

16

. The new gTLD

(new gTLD) and country-code TLD (ccTLD) registrations were totaled at 62 million and

149.6 million, respectively

17

. In growth terms, global domain name registrations have

increased at an annual rate of 3.9% in 2019

18

. The following sections examine the evolution

of the global domain name market, with a special focus on India.

1.2 Evolution of domain name market

The Internet has drastically transformed from the time it was established in 1969. The

Advanced Research Projects Agency Network (ARPANET)

19

connected research centers

across the United States to share information. By the end of 1969, four host computers

20

were

added to the original ARPANET. The Network Control Protocol (NCP) was implemented in

1971-72

21

. Towards the end of the 1980s, a total of 320 computers were connected to the

9

https://www.iana.org/about

10

https://nixi.in/

11

https://www.denic.de/en/

12

https://www.afnic.fr/en/

13

https://www.verisign.com/en_IN/

14

ICANN.org; https://www.icann.org/news/multimedia/185

15

DomainState.com https://www.domainstate.com/registrar-stats.html

16

Domain Name Stats https://domainnamestat.com/statistics/overview. Numbers are as of May 26

th

, 2020.

17

Ibid. Numbers are as of May 13

th

, 2020.

18

The VeriSign Domain Name Industry Brief Q4, 2019 ; https://www.verisign.com/en_IN/domain-

names/dnib/index.xhtml?section=executive-summary

19

americasbesthistory.com ; https://americasbesthistory.com/abhtimeline1969m.html

20

Host computer is the main or controlling computer connected to other computer or terminals to which it

provides data or computing services via a network.

21

Satorras. R & , Vespignani .A (2004), “Evolution and Structure of the Internet: A Statistical Physics

Approach, ”http://fizweb.elte.hu/download/Fizikus-MSc/Infokommunikacios-halozatok-modelljei/Evo-and-

Struct-of-Internet.pdf

6

network.The growth was rapid. By 1981, the number of hosts increased to 213, with a new

host added every twenty days

22

. On January 1, 1983, NCP on the ARPANET was replaced by

the more flexible and powerful family of transmission control protocol/ internet

protocols(TCP/IP). This marked the beginning of the modern Internet.

While this development was promising, it lacked scalability. With more computers accessing

ARPANET, the challenge to remember multiple numerical IP addresses

23

began to rise. To

address this problem, hosts

24

were now assigned names along with IP addresses. Originally, a

limited number of hosts meant it was feasible to maintain a single table of all the hosts and

their associated names and IP addresses. To migrate to a larger number of independently

managed networks (e.g., LANs) meant that having a single table of hosts was no longer

feasible. This led to the inventionof the Domain Name System (DNS), developed by Paul

Mockapetris of the Information Sciences Institute of the University of Southern California in

1983.Prior to the launch of the DNS every computer retrieved a file named “HOSTS.TXT”

that mapped a domain name to a numerical IP address. Figure 1.3 provides a brief history of

the global domain name system.

The Domain Name System is essentially referred to as a mnemonic device that translates the

numerical addresses used by computers into words and phrases that are capable of being

easily remembered by users. It also translates names, such as www.cisco.com, into IP

addresses, such as 192.168.40.0 (or the more extended IPv6 addresses), so that computers can

communicate with each other. Symbolics Inc., a computer manufacturer in Massachusetts,

registered the domain name Symbolics.com, making it the first appropriately registered

“.com” domain in the world on March 15, 1985

25

.

Until 1993, domain names were registered free of cost. Network Solutions was first granted

the right to charge for domain name registrations at $100 for two years of registration.

Network Solutions Inc. (NSI) operated the registries for three top-level domains (TLDs) -

.com, .net, and .org. In addition to its function of a domain name registry, it was also the sole

registrar for these domains.

26

In 1993, the Department of Commerce, under President Clinton,

issued a proposal for privatizing the Domain Name System (DNS), which was then controlled

by the U.S. government. The document — known as the "Green Paper" — was created with

the goal to both increase competition in the market and to encourage international

participation. Public criticism of the proposal of privatization led to the creation of the "White

Paper.” Later in 1998, the business of domain providers (Registry) and domain sellers

22

A Timeline of the Internet and E-Retailing: Milestones of Influence and Concurrent Events, Kelly School of

Business . Available at https://kelley.iu.edu/CERR/timeline/print/page14868.html

23

IP address is a unique string of numbers separated by full stops that identifies each computer using the

Internet Protocol to communicate over a network.

24

In computer networking, a host (is a label that is assigned to a device connected to a computer network and

that is used to identify the device in various forms of electronic communication, such as the World Wide

Web.

25

A Brief History of the Domain Name. https://mashable.com/2014/03/10/domain-names-history/

26

ICANN Wiki. https://icannwiki.org/Network_Solutions

7

(Registrars) were separated with amendments

27

in cooperative agreements between the United

States’ Department of Commerce (DoC) and Network Solutions, Inc. ("NSI"). Amendment

13

28

set a registry fee of $9 per domain name per year, payable as $18 for new registrations.

In November of 1998, the DoC identified ICANN, a newly-formed, private, non-profit

corporation as the entity that would oversee competition under the shared registry system

(SRS)

29

. A program for registrar accreditation for TLDs such as .com, .net, and .org was

implemented in March, 1999. The domain name registrationsincreased significantly during

the dotcom boom in the late 1990s as several companies, including startups, established their

presence on the Internet.

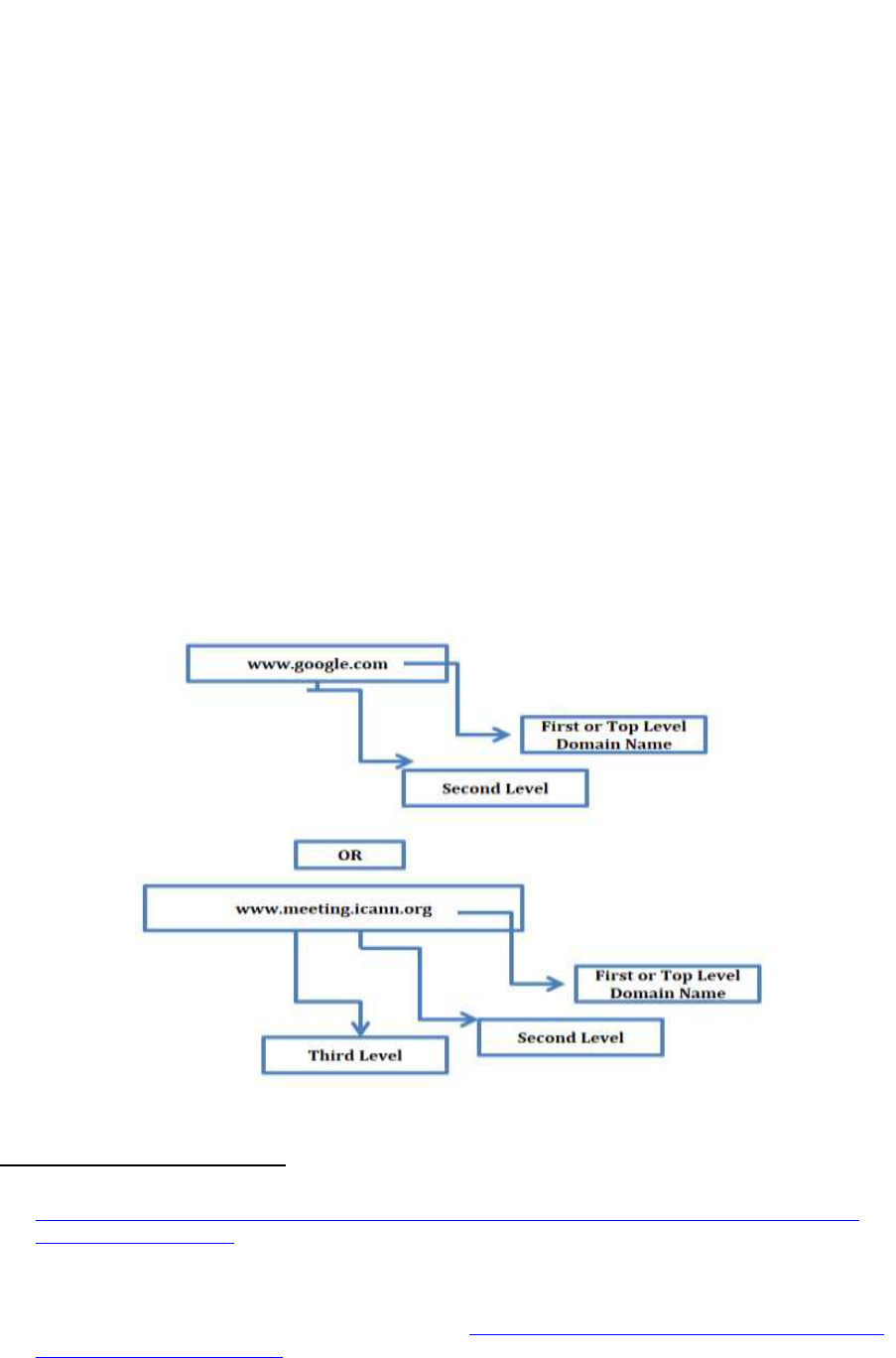

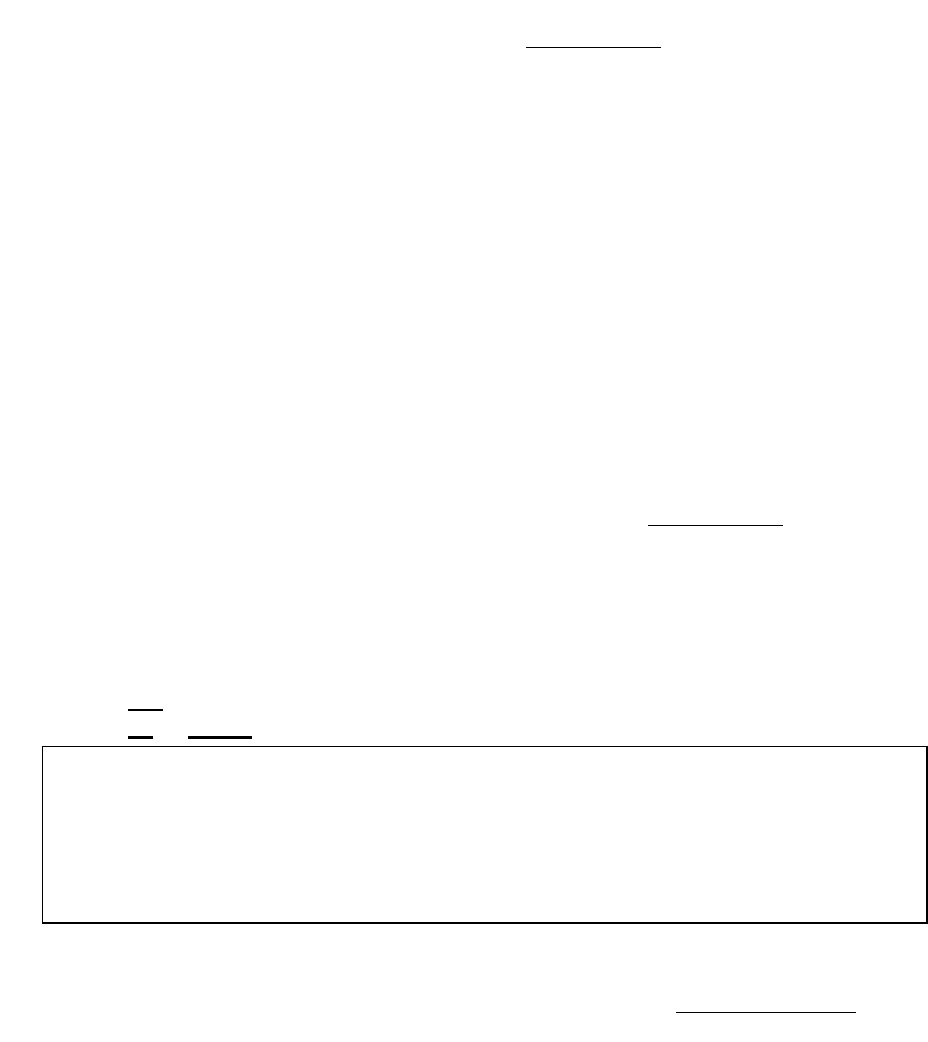

Figure 1.3: Evolution and History of Domain Name System

27

The Amendment 11 required the establishment of a Shared Registration System in which an unlimited

number of registrars would compete for domain name registration business utilizing one shared registry (for

which NSI would continue to act as registry administrator).

https://www.ntia.doc.gov/legacy/ntiahome/domainname/proposals/DOCNSI100698.htm

28

Registrar License and Agreement. https://www.ntia.doc.gov/files/ntia/publications/amendment13.pdf

29

ICANN.org https://www.icann.org/resources/pages/history-2012-02-25-en

8

VeriSign

(1995)

.com, .net

152 billion

transactions

daily

Growth of Registries

Growth of registrars

Source: Compiled by Author

New gTLDs were subsequently introduced. In November 2000, seven new gTLDs were

introduced out of which four (.biz, .info, .name, and .pro) were unsponsored and three (.aero,

.coop, and .museum) were sponsored

30

. In 2003, ICANN initiated a process that resulted in

the introduction of another six TLDs (.asia, .cat, .jobs, .mobi, .tel and .travel) that were all

sponsored

31

.By 2005, the Domain Name System (DNS) served a global Internet, larger and

more diverse, in users and in uses, than the relatively small homogeneous network for which

it was first deployed in the early 1980s.

The Internet evolved into a new phase, with social media platforms such as Facebook,

YouTube and WhatsApp entering the market between 2004 and 2009. The thriving app

economy and online businesses further accelerated the demand for domain names. As a

result, the DNS capacity was rapidly falling short of demand. The three-character .com

domains were already used up by 1997. In December 2013, WhoAPI, a domain data analysis

startup, revealed, that every possible combination of four-letter .com domain names had been

registered. From AAAA.com to ZZZZ.com, all 456,976 combinations were already

exhausted.

32

In October 2013 the new generic top-level domain (new gTLD) programwas

introduced

33

. Today we have over a thousand TLDs, including gTLDs and new gTLDs,

giving consumers and businesses the opportunity to register domains under the likes

of .science, .guru, .xyz, .expert, .ninja, .pizza, .wine, and many more

34

.The country-code top-

level domains (ccTLDs) and internationalized domain names (IDNs) are also gaining

30

An unsponsored TLD operates under policies established by the global Internet community directly through

the ICANN process, while a sponsored TLD is a specialized TLD that has a sponsor representing the

narrower community that is most affected by the TLD. The sponsor thus carries out delegated policy-

formulation responsibilities over many matters concerning the TLD.

31

https://archive.icann.org/en/tlds/

32

A Brief History of the Domain Name. https://mashable.com/2014/03/10/domain-names-history/

33

New Generic Top Level Domains https://newgtlds.icann.org/en/about/program

34

Each applicant was required to pay a $185,000 evaluation fee, which was intended to recover the costs

involved in running the New gTLD Program.

Neustar

(1996)

Connected to

over 250

registrars

globally

Afilias

(2000)

DNS for

over 25

TLDs

PIR

(2002)

Offers

over 3000

domain

extensions

Nixi

(2005)

2 million

.IN

registered

since

2005.

DotAsia

(2008) 37,000

applications

received, over

95% success

rate, 0 record

of disputes

New TLDs

(2013)

Net4India (1985)

500,000 direct

customers over

100,000 websites

hosted

GoDaddy (1997)

17 million

customers

Name Cheap (2000)

Manages 10 million

domain names

Hover (2008)

Information

missing here.

Big Rock (2010)

Enabled over 6

million websites

9

significance. This has expanded business opportunities for both registrars and registries

across the globe.

The rest of the paper is organized as follows. Section 2 discusses the global trends in the

domain name industry. Section 3 focuses on the domain name market in India. Section 4

analyses competition in India’s domain name market using Porter’s Five Forces Framework.

Section 5 concludes.

2. Global Trends in the Domain Name Industry

With the Internet and its several applications gaining preeminence in our daily lives, thepast

decade has witnessed an explosive growth in the number of businesses and individuals

desirous of owning a personal webspace. Thousands of startups are incorporated every year; a

large proportion of them sport an online presence. Nearly two-thirds of small businesses rely

on websites to connect with customers. At the beginning of 2018, nearly two-thirds (64%) of

small businesses have a website

35

. The data by Eurostat showed that the percentage of

enterprise owning a website varies from 94 % in Denmark to 47% in Romania (See figure 2.1

below) in European countries

Figure 2.1: Cross country comparison (percentage of enterprises owning a website)

(2018)

Source: Eurostat

36

In India, domain names are still an underpenetrated market. Only about 30% small and

medium enterprises (SME) in India are online

37

. There is, however, growing consciousness

among businesses about the benefits of going digital. Not just India, developing countries in

general, are hubs for Internet services of the future. With developed country markets rapidly

35

Visual Object Survey. https://c212.net/c/link/?t=0&l=en&o=2388863-

1&h=1953702719&u=https%3A%2F%2Fvisualobjects.com%2Fweb-design%2Ftop-web-designers%2Fsmall-business-

websites-2019&a=Visual+Objects

36

Eurostat; http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=isoc_ciweb&lang=en

37

Ming. C (2017). Google wants to get more Indian businesses online,

CNBChttps://www.cnbc.com/2017/01/09/google-wants-to-get-more-indian-businesses-online.html

0

20

40

60

80

100

Belgium

Bulgaria

Czechia

Denmark

Germany

Estonia

Ireland

Greece

Spain

France

Croatia

Italy

Cyprus

Latvia

Lithuania

Luxembourg

Hungary

Malta

Netherlands

Austria

Poland

Portugal

Romania

Slovenia

Slovakia

Sweden

United Kingdom

Norway

Serbia

Turkey

Bosnia and…

Percentage of Enter[prise

Owning a Website

10

saturating, the domain name players are turning their attention towards relatively

underpenetrated markets in developing countries.

As the global Internet ecosystem evolved, there was an observable growth in the number of

internet users and domain name counts. The rise is almost simultaneous as one drives the

growth of the other. Figure 2.2 captures the growth patterns in Internet users and domain

registrations across the globe since 2001

38

.

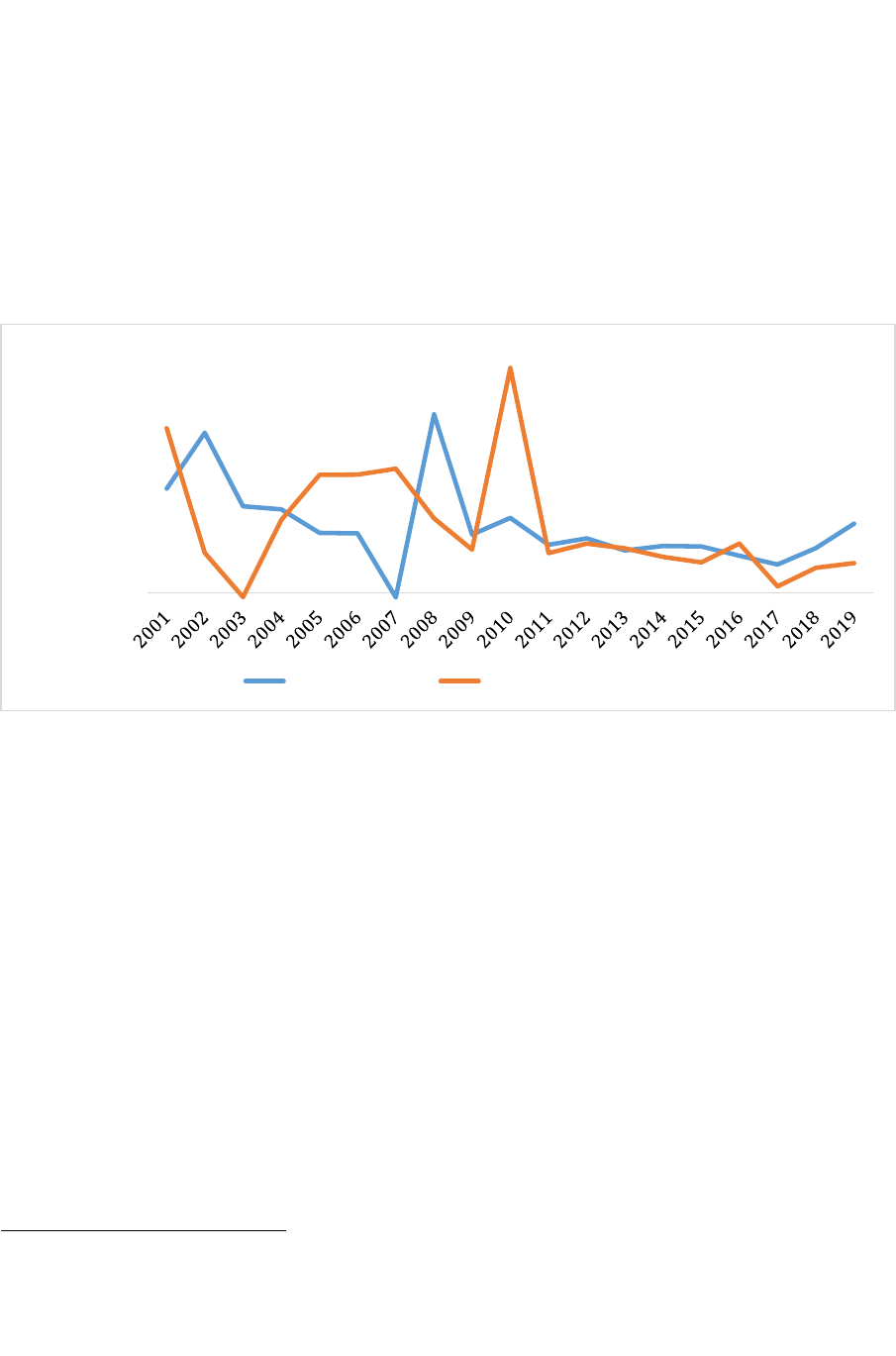

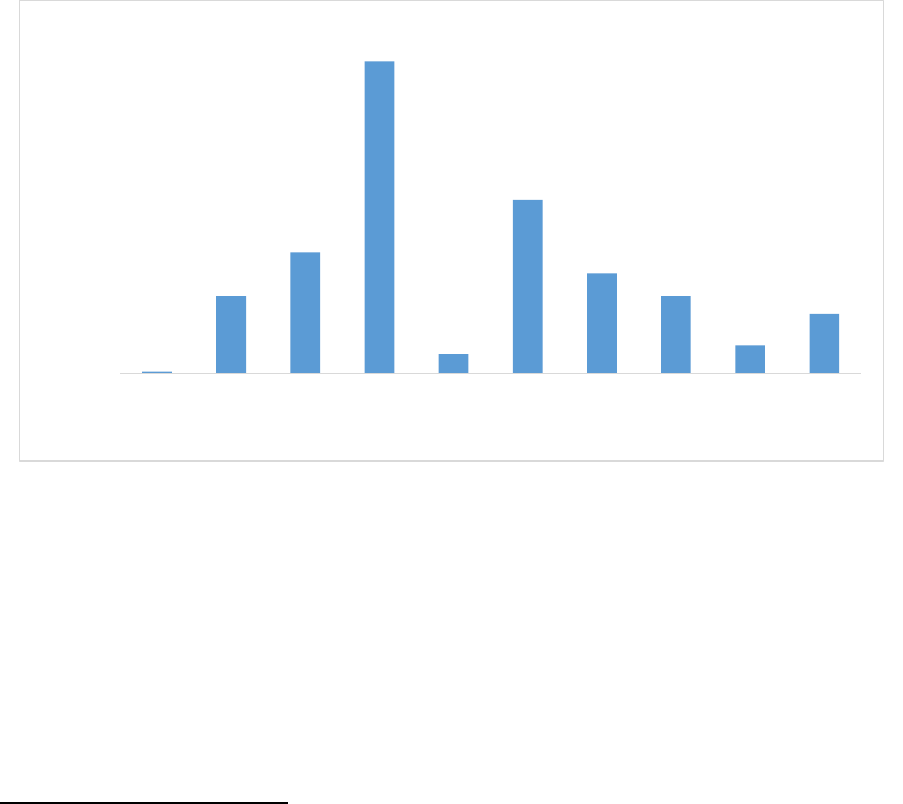

Figure 2.2: Growth in internet users and domain name count across the globe

(in percentage)

Source: Verisign DNIBs, Zooknic, Internet World Stats, Statista

As per the domain name stats, domain name counts were recorded to be 408.5 million across

all top-level domains (TLDs) in May 2020. ccTLDs accounted for 37 % of the total

registrations (149.6 million). Figure 2.3 below provides the regional distribution of domain

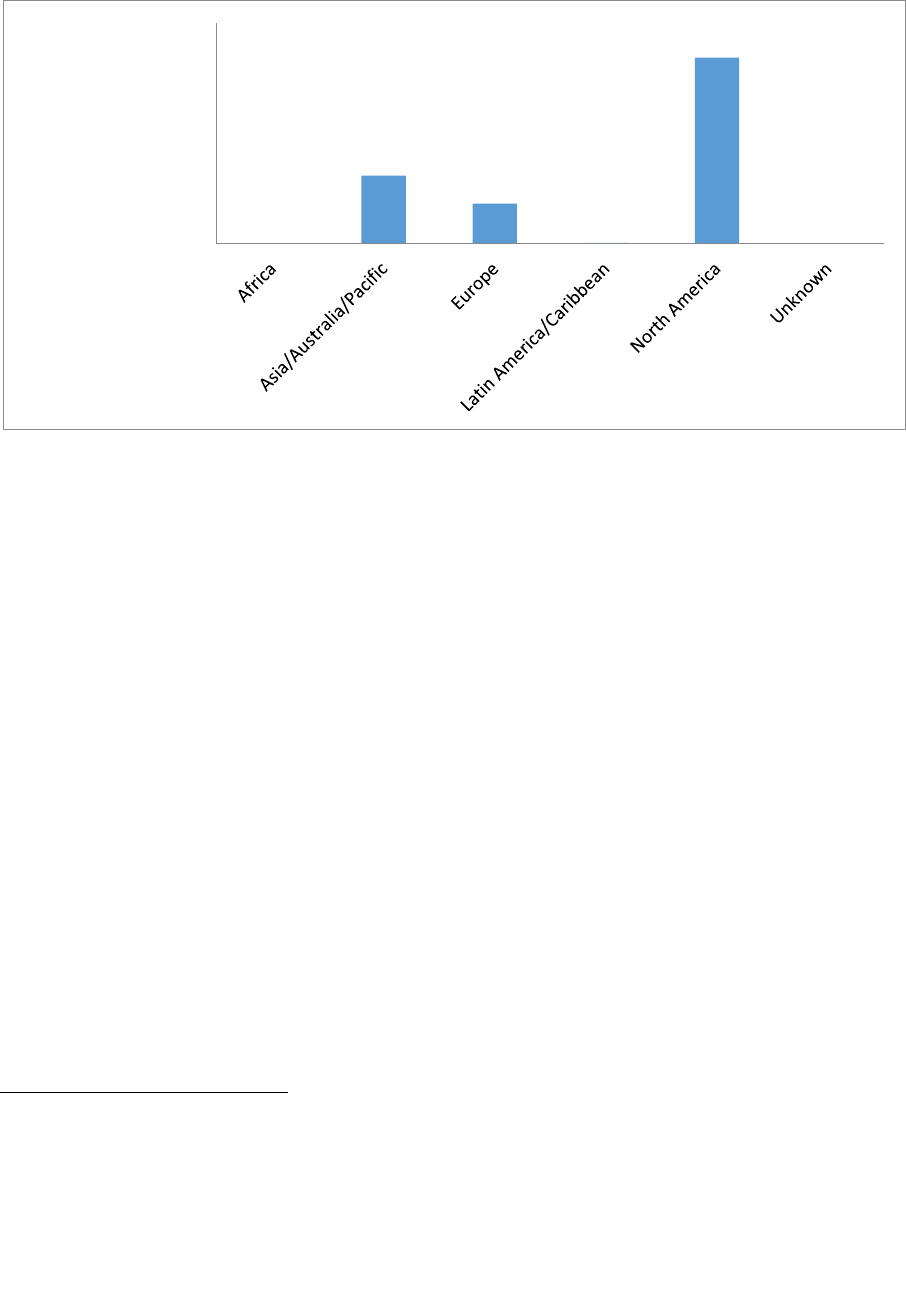

counts. As of December 2019, North America leads the pack with 134 million gTLDs,

followed by Asia, Australia and the Pacific with 49 million and Europe with 28 million.

Appendix 1 provides the details of this calculation and the composite list of gTLDs across

each region.

38

It is to be noted that not all the registrations are the new. There are renewals. When the domain names are

registered, they are registered for certain number of years. In order to continue using the domain names

beyond its expiry date, one needs to renew them. Therefore, the number of domain name registrations

presented in figure 2.2 provides a composite mix of both renewals and the new domains registered by the

registrants.

-10

0

10

20

30

40

50

Growth in internet users and

domain name count across the

globe

Internet Users Domain Name Count

11

Figure 2.3: Domain Count (gTLDs) per Region as of December 2019

39

Source: ICANN Contractual Compliance Performance Report

2.1 Top Level Domains (TLD)

Top Level domains (TLDs) comprise country code top-level domains (ccTLDs) such as .uk

(United Kingdom), .in (India) and .ca (Canada) and generic top level domains (gTLDs) such

as .com, .org, .gov. and .net. While anybody can register general domains such as .net, .org or

.com; .sponsored domains such as .mil (United States Department of Defense and its

subsidiary or affiliated organizations) and .gov (restricted use by government entities in the

United States) are available only for certain types of institutions. As of May, .com, .net, .org,

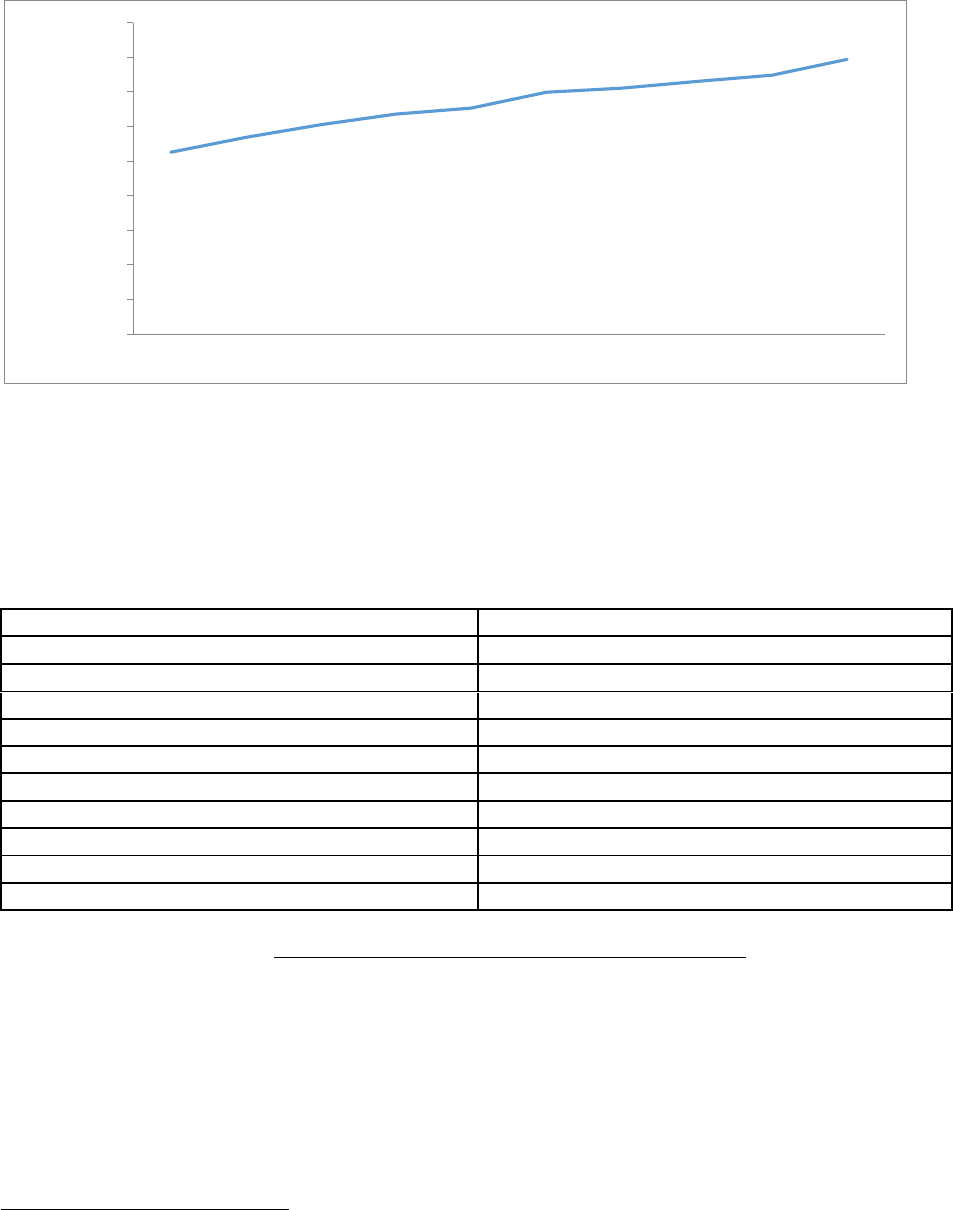

.edu, .gov, .int .mil, and .arpa are the top preferred domains by registrants. Amongst gTLDs,

.com and .net continue to be market leaders. They have a combined total of approximately

183.9 million registrations

40

as of May 2020. . Figure 2.4 provides the combined number of

registrations under.com and .net over time.

39

Unknown in the graph means: Domain name counts are not always identifiable with respect to region.

Some TLDs have restrictions, such as document verification and reactive occasional checks. According to

ICANN rules, when buying a domain, a registrant necessarily agrees to enter an obligation to provide and

maintain their current address. However, as per registrants’ experiences, in reality, these checks are not

always made. There is a risk of not providing a factual address in the event of a dispute, or if a competitor

files a complaint. However, most domain holders reportedly do not face this issue.

40

The domain name base is the active zone plus the number of domain names that are registered but not

configured for use in the respective Top-Level Domain zone file plus the number of domain names that are

in a client or server hold status.

69079

49361310

28875721

660485

134818150

75867

0

20000000

40000000

60000000

80000000

100000000

120000000

140000000

160000000

Domain Name count (gTLDs) per region

as of December 2019

12

Figure 2.4: Combined registrations on .com and .net (in millions)

Source: VeriSign 2010-2019 briefs up untilQ4 2019.

The count for ccTLD registrations was approximately 149.4 million. Table 2.1 provides the

share of top 10 ccTLD registrations as on May 2020.

Table 2.1: Top 10 ccTLDs Registrations as on May 2020

ccTLDs Domain names

ccTLDs registrations (% share)

.tk (Tokelau)

12.86%

.cn (China)

12.50%

.de (Germany)

8.96%

.uk (United Kingdom)

7.20%

.ru (Russian Federation)

5.09%

.ga (Gabon)

2.87%

.fr (France)

2.78%

.cf ( Central African Republic)

2.73%

.nl (Netherlands)

2.56%

.eu (European Union)

2.51%

Source: Domain Name Stats https://domainnamestat.com/statistics/tldtype/country

For new gTLDs, recorded registrations were 62 million as on May 2020

41

, accounting for

approximately 15% of the total TLDs

42

. The popular new gTLDs as stated by domain name

stats are .info

43

.top, .xyz, .icu and .loan. However data provided by nTLD showcases the top

five popular domains to be .icu, .top, .xyz, .site and .online

41

https://ntldstats.com/tld

42

The new gTLD registration recorded on nTld stats were 34, 889,359.

43

While .info is categorized as new gTLD in Domain Name Stats. new gTLD stat doesn’t categorise it as a

new gTLD.

0

20

40

60

80

100

120

140

160

180

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Combined registrations on .com

and .net (in millions)

13

The success of. top is often attributed to its positioning as an easily recognizable name,

making it the natural choice for a businesses' online presence. “.xyz” is positioned as a

domain that cuts across the three generations and brings a perception of finality. In addition,

to market positioning and building brand appeal, new gTLDs build popularity by giving

discounts and promotional offers that attract first time registrants. Figure 2.5a and 2.5b

provides the share of new gTLDs as of August 2019. The top three registrars selling new

gTLDs are Alibaba Cloud Computing Ltd, Namecheap Inc and GoDaddy.com.Their share in

the market for new gTLDs is13.73%, 11.61% and 10.03 %,respectively.

Figure 2.5a: New gTLDs: percentage share as on May 2020

Source: Domain name stats. https://domainnamestat.com/statistics/tldtype/new (Data is compiled on

May 26

th

)

Figure 2.5b: New gTLDs: percentage share as on May 2020

Source: nTLD Stats. https://ntldstats.com/ ( Data is compiled on May 26

th

)

11.94%

11.30%

7.05%

6.92%

5.71%

4.60%

3.66%

3.53%

3.07%

2.62%

39.58%

.info .top .xyz .icu .loan .biz .club .site .online .wang Others

18.80%

10.50%

9%

5.90%

4.50%

4%

3.90%

3%

2.10%

2%

35.30%

.icu .top .xyz .site .online .vip .wang .club .shop .live others

14

There seems no doubt that businesses and institutions find clear impact on brand building and

marketing with registered websites. The returns on their investment from registering a

domain and designing a website are also impacted by the choice of TLD. A domain registered

on (.org) for instance represents an important organization ;(.co) represents a forward-

thinking startup, etc

44

. TLD helps business or purpose categorization, even before users visit

the website. Domain names help organisations create and promote a company’s identity on

the Internet. The popularity of a TLD depends on the perception that it is able to create

among users and the way it is positioned in the market. It is also largely driven by

promotional offers that registries provide to popularize their domain.

Growth of domain names in mature markets such as the US are beginning to plateau as the

market has reached high levels of penetration and several businesses are already online.

However, there is a potential for growth in the global domain name market from the Asia

Pacific region including India. The launch of International Domain Names (IDNs) that

feature non-Latin alphabets are particularly important to this region given the extensive use

of non-Latin scripts such as Chinese, Devnagari, Cyrillic, etc. that enables users to

communicate in their own language. The growth and potential of the Indian domain name

market is discussed in Section 3.

3. Domain Name Market in India

On the back of a vibrant Internet ecosystem in India, thrives a rapidly growing domain name

market. Domain name registrations counts in India recorded a total of 5 million in May

2020

45

. In the absence of a centralised system for data collection, statistics on the domain

name market are available from multiple sources, often different from each other.

Registrations in India, however, account for only 1.24 percent of the global market.

46

. The

popularity of “.com” is also observable in India. As a legacy TLD it commands almost 51%

of the domain name market in India. Stakeholder discussions revealed that .com and .in are

the first and second most preferred domain names respectively in India as was also concluded

from the survey results analysed in section 4.The top 3 TLDs in India include .com, .in and

.org with their respective share being 50.68%, 31.14% and 4.41% respectively. The other

preferred TLDs include .net, .xyz, .online etc. The market share and rankings of TLDs change

over time, even though the top choices have always remained .com and .in. The primary

reason for this order of preference to change among the lower ranked TLDs is promotional

offers and discounts offered by registries and registrars. Appendix 2 provides the complete

list of TLDs share in India.

44

Miler. D (2017). What are the five most common domain extensions and which one should I use?

https://www.godaddy.com/garage/what-are-the-five-most-common-domain-extensions-and-which-one-

should-i-use/

45

Domain Name Stats https://domainnamestat.com/statistics/country/IN

46

Domain Name Stats; https://domainnamestat.com/statistics/registrar/others

15

Figure 3.1: Percentage share of Top 10 TLDs in India as on May 2020

Source: Domain Name Stats; https://domainnamestat.com/statistics/registrar/others

The top three new gTLDs are .xyz and .online and .ooo. Provided by Infibeam, the

“.ooo” new gTLD is positioned for entities entering or expanding an e-commerce business or

multichannel operators that sell products both online and offline. The success of “.ooo” can

be attributed to the marketing strategies adopted by Infibeam. A “. ooo” domain registered

today can be renewed at an annual charge of Rs 1699 for the next ten years. With every new

registration, registrants are given over $100 worth free add-on services including email

account, DNS management and access to the bulk tools that make registrations, transfers and

renewals easy.

47

On the other hand, “.xyz” is a new generation of domain names which is

short and easy to remember and recognizable

48

. “.xyz” is a bold, fresh choice for users who

crave creativity and versatility in a domain name. Table 3.2 provides the market share of the

top 10 new gTLDs in India.

Table 3.2a: new gTLDs registartions in India percentage share

new gTLD

% Share

.xyz

22.43%

.online

19.01%

.tech

6.99%

.club

5.16%

.site

5.03%

.live

3.98%

.store

2.87%

.website

2.52%

.space

2.50%

.world

1.96%

Others

27.60%

Source: nTld Stats. https://ntldstats.com/country/IN

47

https://medium.com/@dottripleo/desired-website-domain-name-free-ooo-the-power-domain-bc32f878d07c

48

https://www.name.com/domains/xyz

50.68%

31.14%

4.41%

2.72%

1.29%

1.21%

1.18%

1.14%

0.72% 0.62% 4.89%

.com .in .org .net .xyz .online .co .info .ooo .club Others

16

Despite the growth in domain name registrations, India is still far behind several countries in

overall domain penetration ratio. Defined as the number of domains per 1000 Internet users,

the domain penetration ratio in India is 1.12%, compared to China which sits at 3.3% and the

US at 38%. Moreover, domain registrations are concentrated

49

in a few states. Maharashtra,

Delhi/ NCR, Tamil Nadu and Karnataka account for 50% of the total registrations; states

where Internet usage, online businesses and startups are thriving. Moreover, there are

relatively fewer registrants who actively use their domain names when compared to

developed and other developing countries. A report by dataprovider.com analysed 260

million domain registrations and found that only 1 million (57.9%) of those had

developed

50

websites. Of these 57.1% were used by businesses and 39.8 % as personal

websites. Of the developed websites, about 2.1% websites are used by e-commerce platforms

and 1% for blogging

51

. Interestingly, a significant proportion of registered domains continue

to remain undeveloped (in this sample 42.1%). This reflects the lack of meaningful utilization

of domain names by registrants in India. Table 3.3 below provides a summary of domain

names registered by different registrars and the proportion of those on which websites are

available and of those with developed websites that host meaningful content. For instance, of

the 556,496 domains registered by Publidomainregistry.com(PDR), 82% have a website but

only 66% have developed their websites

52

. The proportion of developed websites is the

lowest for Net4India.

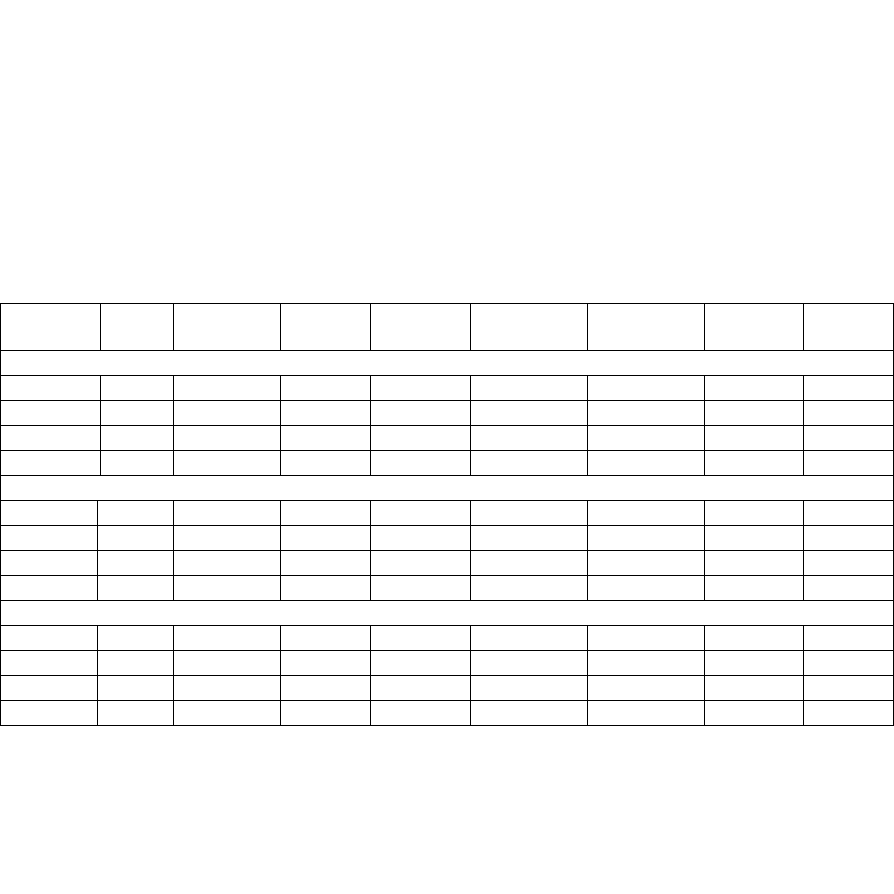

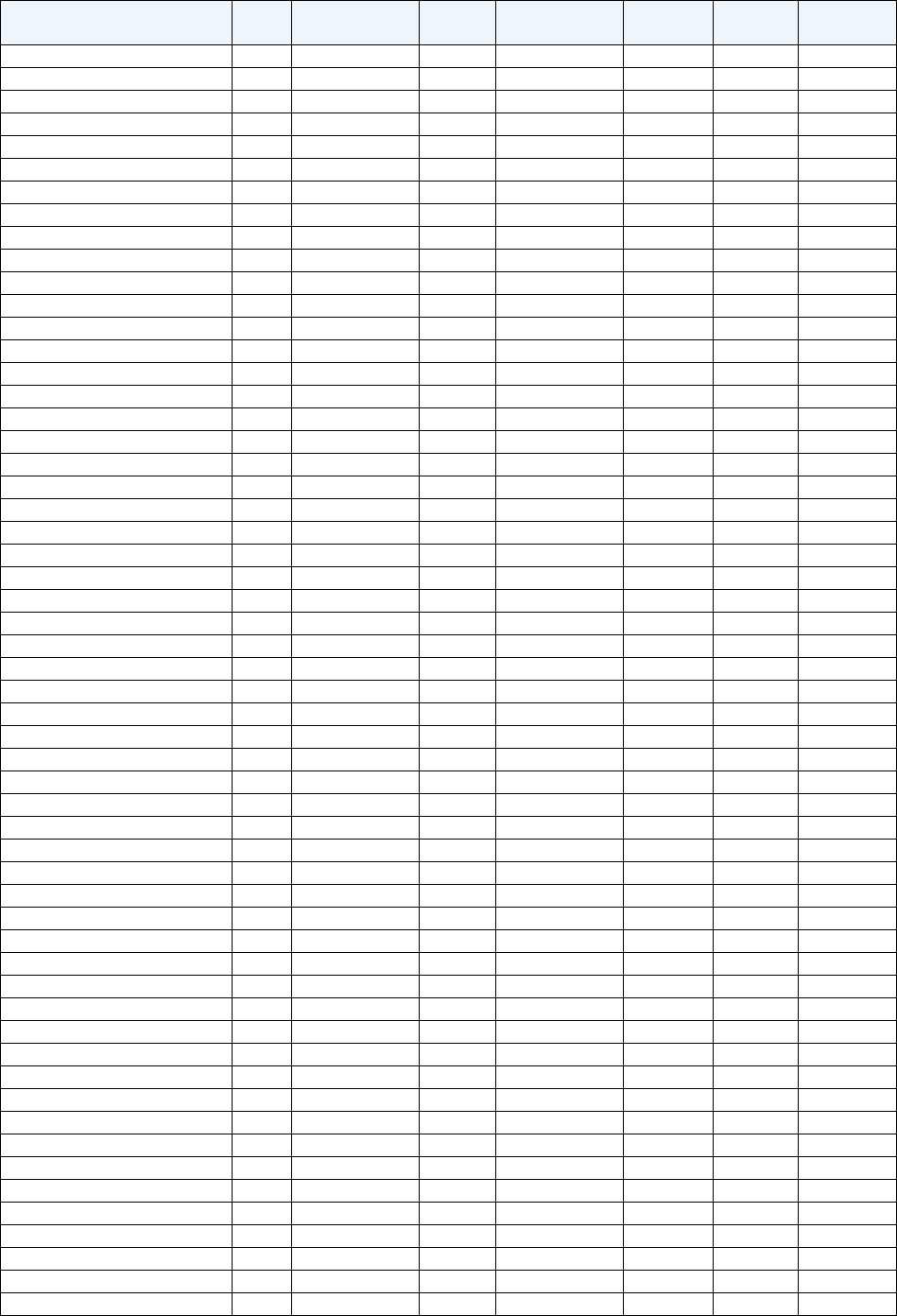

Table 3.3: Registrar-wise Percentage of Domains with (Developed) Websites

Registrars

Domains

Available

Developed

(PDR)

556,496

454,411(82%)

29,471(66%)

Godaddy.com, IIC

526,572

409,131(78%)

240,648(59%)

Bigrock solutions Ltd

207,540

175,765(85%)

92,232 (52%)

Endurance domains technology

201,703

162,002 (80%)

97,838 (60%)

Net4India limited

103,172

85,591(83%)

40, 263(47%)

Net4India

58,545

47, 193 (81%)

16,479(35%)

Tucows.inc

47,599

31,580 (66%)

25,087(79%)

Network Solutions, IIc

43,914

35,649(81%)

18,743 (53%)

Enom, inc.

41,788

27,408 (66%)

17,557 (64%)

Crazy domains fz-IIc

35,477

27,820(78%)

16,375 (59%)

Name.com, inc.

33,243

15,381 (46%)

10,742 (70%)

Go daddy, IIc

32,723

26,715 (82%)

6,215 (23%)

Wild West domains, IIc

21,643

15,874 (73%)

11,628 (73%)

Dynadot IIc

16,372

7,482 (46%)

2,832(38%)

NIXI holding account

16,135

11,974( 74%)

2,086 (17%)

Source: dataprovider.com

49

India Domain Name Report 2018; Zinnov https://zinnov.com/india-domain-name-report-2018/

50

A developed website is a website which contains real, manual created content. Developed websites are

good for renewals.

51

India Domain Name Report 2018; Zinnov https://zinnov.com/india-domain-name-report-2018/

52

dataprovider.com

17

However, improved network availability and access to smartphones has changed the nature of

digital consumption in the country. India presents a huge opportunity for the domain name

market as online businesses trickle down to Tier 2 and Tier 3 cities. Some of these trends are

discussed in the section below.

3.1 Future growth drivers of the Domain Name Industry in India

3.1.1 Smartphone adoption, high internet penetration and growth in data

consumption provide foundation for growth

The digital ecosystem in India has transformed dramatically with a steep rise in Internet

subscription and data use. The disruptive entry of Reliance Jio in September 2016, brought

down data prices fromRs from Rs. 180 per GB in September 2016 to Rs. 6.98 per GB

in 2019.

53

.The total number of Internet subscribers increased to 687 million in the quarter

ending September 2020

54

. The latest data from Cisco’s VNI index indicates that the total

number of Internet users in India is likely to reach 907 million by 2023

55

. The pace of

progress indicates that 2023 could see 2.1 billion networked devices and 6.5 Exabyte’s of

data used per month in India

56

. Much of this growth will be fueled by massive consumer

adoption of smartphones, Internet of Things (IoT) and use of machine-to-machine (M2M)

connections. Internet in India is expected to deliver US$ 250 billion by 2020, contributing up

to 7.5 percent to GDP

57

. The smartphone industry in India is a growing market with around

39 percent of mobile phone users expected to own a smartphone by 2019. As per e-marketer

forecasts the number of smartphone users in India is expected to grow by close to 16% this

year—the highest growth rate for any country in the world

58

. The spiraling sales of

smartphones coupled with an increase in Internet penetration will drive the use of mobile-

value added services (M-VAS) such as browsing, gaming, social networking, online

shopping, location-based services, etc. The overall growth of the Internet ecosystem will be a

positive driver for the domain name industry in India. The expected growth in available

digital infrastructure and its use is captured in Table 3.4 below.

53

TRAI performance Indicator Report

54

Ibid.

55

CISCO’s Virtual Networking Index. Available at

https://www.cisco.com/c/dam/m/en_us/solutions/executive-perspectives/vni-forecast-

highlights/total/pdf/India_Internet_Users.pdf

56

Ibid.

57

BCG-TiE Report, 2017; https://media-publications.bcg.com/BCG-TiE-Digital-Volcano-Apr2017.pdf

58

eMarketerhttps://www.emarketer.com/chart/218240/smartphone-users-penetration-india-2017-2022-

millions-change-of-population

18

Table 3.4: India’s Digital Economy

2016

2022

CAGR

(2016-2022)

Percentage of individuals from the total population using social

media applications on a monthly basis

12.7

26.2

12.90%

Percentage of individuals from the total population using a

smartphone on a monthly basis

19

31.3

8.70%

Percentage of individuals from the total population using the

internet on a monthly basis

22.3

36.2

8.40%

Average internet connection speed in Kbits/s

3,168

4,995

7.90%

Number of fixed broadband subscriptions per 100 inhabitants

1.3

1.3

0.20%

Source: Compiled from Statista, based on IMF, World Bank, UN and Eurostat

3.1.2 Growing online commerce

Proliferation of the Internet has also supported growth of e-commerce in India. According to

IBEF, the e-commerce market in India is expected to touch US$ 150 billion by 2022.

According to Forrester’s Online Retail Market HI 2017 report, online retail sales in India are

likely to reach $64 billion by 2021 at a compounded annual growth rate of 31.2%. While,

40% of FMCG purchases in India are likely to be online by 2020.

59

Technology giants are

rapidly expanding their footprint in India through online advertising. The Indian unit of

Google is said to have crossed the billion-dollar sales milestone in 2017.

60

In fiscal 2017,

Facebook also posted a 93% increase in its India turnover. E-commerce companies

61

are one

of the major drivers of domain names in India. These forecasts suggest that increased focus

on online commerce will drive the growth of the domain name industry in years to come.

3.1.3 Growing small and medium business (SMBs)

Small and Medium Businesses (SMBs), in particular startups are a fast-growing segment in

the digital economy. New businesses adaptto the digital model because it minimizes the cost

of startup infrastructure. India is now home to ten unicorns,

62

and studies indicate that the

rapidly growing startup ecosystem could produce at least 50 more in the future

63

. The digital

unicorns include Flipkart, Snapdeal, Hike, Ola, Shopclues, Paytm and Zomato. According to

a NASSCOM report, more than 1,200 startups came up in 2018, including eight

59

Shah. G (2018), “Rise in digital economy creating FMCG 2.0”;

https://retail.economictimes.indiatimes.com/re-tales/rise-in-digital-economy-creating-fmcg-2-0/3012

60

Malviya.S & Anand .S (2017); Google India hits Rs 7,208.9 crore sales

mark https://economictimes.indiatimes.com/tech/internet/google-india-hits-rs-7208-9-crore-sales-

mark/articleshow/61695169.cms

61

Tofler (2018). Facebook India Online Services Financials For FY Ending 2017.

https://www.tofler.in/blog/uncategorized/facebook-india-online-services-financials-for-fy-ending-2017/

62

Unicorns are start-ups valued at over $1 billion

63

Karnik. M & Madhura. B (2017), “How many Indian unicorns are actually going to make money?”, Quartz

India, https://qz.com/950672/after-mu-sigma-and-inmobi-how-many-indian-unicorns-are-actually-going-to-

make-money/

19

unicorns,thereby increasing the total number of startups to 7,200 s.

64

The report also states

that the tech–influenced SMBs would increase from 55% in 2017 to 90% in 2020. India is

witnessing a rapid rise in the B2B tech startup landscape, focused on verticals like healthtech

and fintech. These will be the potential users and drivers of the domain name industry in

India.

3.1.4 Government Initiatives

The flagship “Digital India” programme seeks to hasten the adoption of digital services that

will in turndrive growth of the domain name industry in India. Connecting rural areas with

high-speed Internet networks and improving digital literacy are other steadfast aims of this

national program. In the last couple of years, a concentrated effort towards inclusive growth

in electronic provision of services, through initiatives like the JanDhan, Aadhaar and Mobile

(JAM) trinity has produced discernable impact. Payments facilitating programs such as UPI

and BHIM have also made significant progress. Currently, India has approximately 1.5

million kilometers of laid Optical Fiber Cable (OFC) and over 170,000 operational common

service centers to enhance the internet usage

65

. Increased government focus through the

Startup India program and other facilitating regulations will also drive growth of the domain

name industry in India.

3.1.5 Favourable demographics and a burgeoning middle class

A young middle class is among the first adopters of the Internet in any country. A population

dominated by such demographics is likely to see quick Internet adoption. According to

National Council of Applied Economic Research (NCAER), India's middle-class population

is anticipated to grow from 267 million in 2016 to 547 million individuals in 2025-26. Also,

India is likely to have the world’s largest workforce by 2027, with a billion people aged

between 15 and 6. This emerging cohort of young trainable individuals with buying power is

much more likely to embrace the digital world compared to the previous generation. There is

evidence of young workers preferring to use digital media versus traditional options

66

.

Businesses with an online presence are thus the future. With more individuals and businesses

engaging in the digital ecosystem, the domain name industry is also going to flourish.

The following chapter provides insights from the enterprise and individual survey conducted

in the Indian market to derive an understanding of the consumer’s preferences of the domain

name and services that are being offered by registrars in India. For the purpose of this study

we have focused on the registrar and registrant market. The dynamism between the registries

and registrars are not explored.

64

NASSCOM : https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/startups-in-india-see-108-

growth-in-funding-in-2018-nasscom/articleshow/66365422.cms?from=mdr

65

Digital India Unlocking the Trillion Dollar Opportunity November 2016.

https://www2.deloitte.com/content/dam/Deloitte/in/Documents/technology-media-telecommunications/in-

tmt-digital-india-unlock-opportunity-noexp.pdf

66

The Deloitte Global Millennial Survey 2019, Optimism, trust reach troubling low levels.

https://www2.deloitte.com/global/en/pages/about-deloitte/articles/millennialsurvey.html#info

20

4. Insights from the Enterprise Survey on the domain name industry in India

Split into an enterprise edition and an individual edition, this survey covered both categories

of registrants to build an exhaustive understanding of the consumer layer of the domain name

value chain. This survey elicited notable trends in usage patterns, industry priorities, and

market perceptions, and also delved into currently underutilised, yet high potential, categories

such as Internationalised Domain Names (IDNs). Preferences for traditional gTLDs are also

gauged vis-à-vis ccTLDs. Valuable policy insights can be gleaned through this survey’s wide

range of questions, which we have incorporated into our policy recommendations.

4.1 Enterprise survey

4.1.1 Sample description

In the enterprise edition of the domain name market survey, the sample of 204 enterprises

consisted of largely private sector firms. At an average age of around 16.1 years, this

constituted a relatively young sample of firms with only a very few outliers. In terms of

revenue, 120 of the 204 enterprises (58.9% of the overall sample) fit the Government of

India’s revised 2018 definition of a micro enterprise (those with revenues of up to INR 5

crore). Of these, 30 have revenues of less than INR 1 crore, while 90 have revenues between

INR 1 crore and INR 5 crore. 49 firms can be classified as small enterprises (24% of the

sample), while 26 are medium enterprises (12.75% of the sample). Overall, this means that

95.6% of our sample consists of micro, small and medium enterprises (MSMEs), which is not

surprising given that there are approximately 63.4 million MSME units across India (CII

2019)

67

. They contribute around 6.11% of India’s manufacturing GDP, and 24.63% of the

GDP from service activities, as well as 33.4% of the country’s manufacturing output

68

.

67

CII (2019). Micro, Medium & Small Scale

Industry.https://www.cii.in/Sectors.aspx?enc=prvePUj2bdMtgTmvPwvisYH+5EnGjyGXO9hLECvTuNuX

K6QP3tp4gPGuPr/xpT2f

68

Ibid

21

Figure 4.1a: Enterprises in the sample by revenue

Figure 4.1b: Enterprises in the sample by revenue

Moreover, it is crucial to focus on MSMEs in the context of understanding the challenges and

opportunities of India’s domain name industry. This is because most large enterprises with

revenues of over INR 250 crore (4.41% of our sample) are far more likely to have a

substantial focus on registering a domain name and having a viable online presence. The

incentives and capacity for registering domain names, as well as the wherewithal to make an

informed business decision to optimise marketability and relevance through appropriate

TLDs, is significantly lesser for MSMEs vis-à-vis large enterprises. The next phase of growth

in domain name registrations, as well as in opting for new gTLDs and ccTLDs, lies in the

MSME sector. Furthermore, given the nature of the client base of Indian MSMEs, as well as

the fact that around 20% of them are based in rural areas (CII 2019), IDNs possess enormous

potential given that local languages are spoken and understood more than English in non-

16%

48%

14%

13%

9%

Less than 10 10 to 50 50 to 100 100 to 500 More than 150

15%

44%

24%

13%

4%

Less than INR 1 crore INR 1-5 crore INR 5-75 crore

INR 75-250 crore More than INR 250 crore

22

urban areas. Figures 4.1 A and B juxtapose the revenue-wise breakdown of our sample vis-à-

vis the size of its employee base.

Therefore, given the degree of MSME presence in our sample, it is not altogether surprising

that there is an almost one-to-one correlation between the revenues of the enterprises and the

size of their workforces. This is illustrated in Figures 4.1 a and b. The sectoral distribution of

the enterprises in the sample is depicted in Figure 4.2. IT and IT enabled services such as

business process outsourcing (BPO) command the pole position at around 30% of our

sample, followed by manufacturing, electronics and engineering, which forms 22% of the

sample. Other services include consulting that formed around 20% of our sample. Beyond

these three buckets the other sectors included travel, transportation and hospitality (8%);

banking, financial services and insurance, retail, consumer packaged goods and distribution at

6% share each; and life sciences and healthcare at 4%. Communications, media and

publishing accounted for 3% of the sample; and energy, resources and utilities were at 1%.

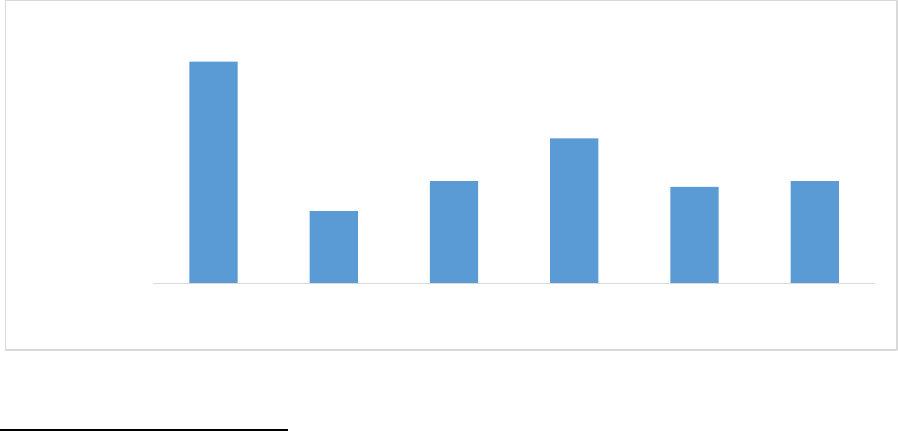

Figure 4.3: Enterprises’ reasons for using a domain name

Among those in the sample who used their domain name for redirecting, 59 redirect to a

social media platform page such as Facebook, Instagram, or Twitter, while 43 redirect to a

marketplace or directory listing like Indiamart, OLX, or Amazon. Meanwhile, 39.2% of the

sample had registered more than one domain name, while 59.3% did not

69

. Data on the year

of domain name purchase, and the year of purchase of the domain name of primary usage

utilised (in the event of multiple domain name purchases) were analysed. On the basis of this,

it was found that on an average, the firms purchased their domain name 10.7 years ago (in

approximately 2008-09).

69

The remaining 1.5% did not respond to this question

Website

13%

Email

0%

Website & Email

55%

Redirecting

1%

Redirecting &

Website/Email

31%

Website Email Website & Email Redirecting Redirecting & Website/Email

23

Figure 4.4 represents the frequency of particular TLDs) registered by the enterprises in the

sample. The undisputed leader of the pack is .com with 154 respondents having registered the

most popular gTLD globally. This was followed by.in, with 67 respondents having registered

the .in ccTLD(less than half the number of .com registrations). Of the 154 enterprises who

registered a .com TLD, 31 registered a .in TLD as well. .in does not appear to be adequately

popular among firms vis-à-vis .com. These were followed by .info at 16 registrations, .org at

15, .net at 11, .biz at 2, and others at 1, while .asia and .mobi were not registered by any of

the firms.These results run against enterprise preferences, which tilt heavily towards .in

(explained further below).

Respondents were asked to state their preference of a .in TLD over other TLDs. 64.2% stated

that they did prefer .in over others, while only 19.1% answered negatively and 15.7% might

consider buying “.in” domain. This is indeed encouraging for the .in ccTLD, since it

highlights that enterprises are desirous of a .in TLD, however, for certain reasons the uptake

does not behove such a high degree of preference. The most popular reason for preferring the

.in TLD was found to be that it reflected that the activity or business location is in India (123

respondents), followed by the familiarity of .in among people and its easy recognisability