G B O I

T O I M

DISCLAIMER

This Guide Book has been compiled/summarised from information available in ofcial documents/

circulars/websites of the Govt. of India, RBI and other reliable sources. Every possible care has been

taken to provide current and authentic information. This Guide Book for Overseas Indians is intended

to serve as a guide to them and does not purport to be a legal document. In case of any variation be-

tween what has been stated in this Guide Book and the relevant Act, Rules, Regulations, Policy State-

ments etc., the latter shall prevail.

Price: 500.00 (INR)

Overseas Indian Facilitation Centre

The Indian Diaspora is the largest in the world to day after China and has roots in every country

in the globe. The Diaspora contribution to their state of origin has been made in various ways,

through remittances, foreign direct investment (FDI), transfer of knowledge and entrepreneurial

networks.

In order to expand the entrepreneurial ties and engage them as partners in India’s progress, an

Overseas Indian Facilitation Centre, a not for prot public private initiative of Ministry of Overseas

Indian Affairs (MOIA) and Confederation of Indian Industry (CII), was launched on 28th May

2007.

With a strong intention to facilitate and bridge the gap between the Overseas Indians and India,

OIFC has a mandate to cover broad areas: investment facilitation, knowledge networking and

ensuring business-to-business partnerships in focus sectors like real estate, wealth management,

taxation, legal, healthcare, education and infrastructure.

The key objectives of OIFC are:

• Promote overseas Indian investment into India and facilitate business partnership by giving

authentic & real time information

• Establish and maintain a Diaspora Knowledge Network by creating a database of Overseas

Indians

• Function as a clearing house for all investment related information

• Assist States to project and promote investment opportunities to overseas Indians in key

focus sectors.

In line with the above objectives, OIFC provides the following services:

• To appraise the Indian Diaspora with the up-to-date investment opportunities existing in

India provide hand-holding services via its knowledge partners

• To provide customized services in the form of nding sector and state specic investment

projects, preparing feasibility reports and organizing and assisting in overseas road shows to

attract FDI

• To assist in effective business-to-business partnerships

• To maintain a strong Diaspora Knowledge Network

• To provide consular services in the long run

CONTENTS

PART - I : TAXATION

1. Residential Status for Tax Purposes 9

2. Special Provisions Relating to Certain Income of NRIs 18

3. Tax Exemptions from Income Tax, Wealth Tax and Gift Tax 20

4. Presumptive Tax Provisions 23

5. Tax Incentives for Industries 25

6. Authority for Advance Rulings 27

7. Transfer Pricing 31

8. Double Tax Avoidance Agreements 38

PART-II : OTHER IMPORTANT MATTERS & OVERSEAS INDIANS

9. Overseas Citizenship of India (OCI) 41

10. PIO Card 53

11. Foreign Contribution Regulation Act, 1976 56

12. Special Economic Zones 70

13. List of Important Websites 75

14. Contact Details 77

PART - I

TAXATION

9

RESIDENTIAL STATUS FOR

TAX PURPOSES

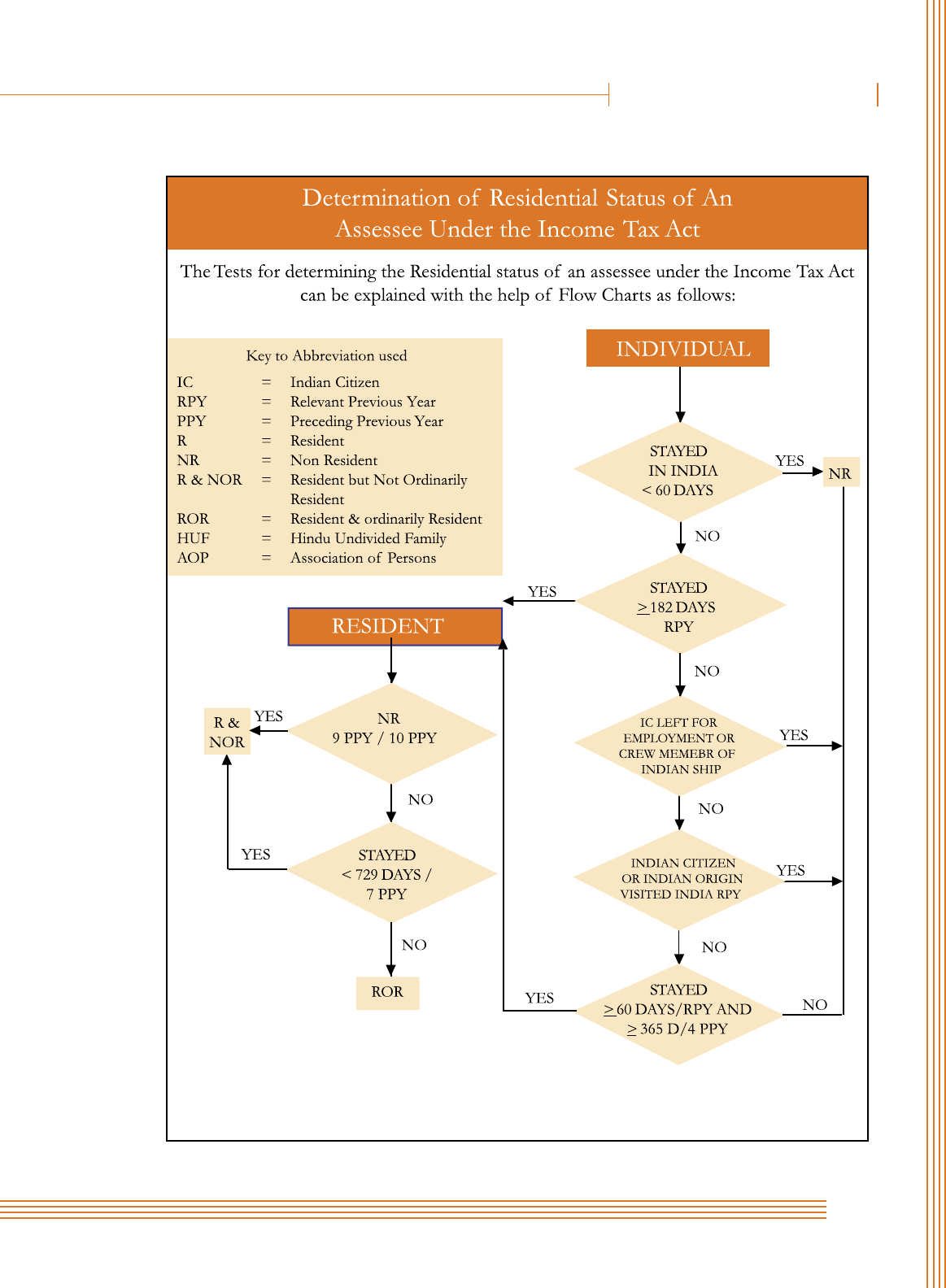

In India, as in many other countries, the charge

of income tax and the scope of taxable income

varies with the factor of residence. There

are two categories of taxable entities viz. (1)

residents and (2) non-residents. Residents are

further classied into two sub-categories (i)

resident and ordinarily resident and (ii) resident

but not ordinarily resident. The law prescribes

two alternative technical tests of residence for

individual taxpayers. Each of the two tests

relate to the physical presence of the taxpayer

in India in the course of the “previous year”

which would be the twelve months from April

1 to March 31.

A person is said to be “resident” in India in any

previous year if he

(a) is in India in that year for an aggregate

period of 182 days or more; or

(b) having within the four years preceding

that year been in India for a period of

365 days or more, is in India in that year

for an aggregate period of 60 days or

more.

The above provisions are applicable to all

individuals irrespective of their nationality.

However, as a special concession for Indian

citizens and foreign citizens of Indian origin,

the period of 60 days referred to in Clause

(b) above, will be extended to 182 days in

two cases: (i) where an Indian citizen

leaves India in any year for employment

outside India; and (ii) where an Indian

citizen or a foreign citizen of Indian

origin (NRI), who is outside India,

comes on a visit to India.

In the above context, an individual visiting India

several times during the relevant “previous

year” should note that judicial authorities in

India have held that both the days of entry and

exit are counted while calculating the number

of days stay in India, irrespective of however

short the time spent in India on those two days

may be.

A “non-resident” is merely dened as a person

who is not a “resident” i.e. one who does not

satisfy either of the two prescribed tests of

residence.

An individual, who is dened as Resident in a

given nancial year is said to be “not ordinarily

resident” in any previous year if he has been a

non-resident in India 9 out of the 10 preceding

previous years or he has during the 7 preceding

previous years been in India for a period of, or

periods amounting in all to, 729 days or less.

Till 31st March 2003, “not ordinarily resident”

was dened as a person who has not been resident

in India in 9 out of 10 preceding previous years

or he has not during the 7 preceding previous

years been in India for a period of, or periods

amounting in all to, 730 days or more.

Section 6 of the Income-tax Act, 1961, prescribes

the tests for determining the residential status

of a person. Section 6, as amended, reads as

follows:

For the purposes of this Act,

(1) An individual is said to be resident in

India in any previous year, if he-

1

G B O I T O I M

10

a) is in India in that year for a period

or periods amounting in all to one

hundred and eighty-two days or

more; or

b) [* * *]

c) having within the four years

preceding that year been in India

for a period or periods amounting

in all to three hundred and sixty ve

days or more, is in India for a period

or periods amounting in all to sixty

days or more in that year.

Explanation.- In the case of an individual,

(a) being a citizen of India, who leaves

India in any previous year [as a

member of the crew of an Indian

ship as dened in clause (18) of

section 3 of the Merchant Shipping

Act, 1958 (44 of 1958), or] for the

purpose of employment outside

India, the provisions of sub-clause

(c) shall apply in relation to that

year as if for the words “sixty days”,

occurring therein, the words “one

hundred and eighty-two days” had

been substituted

(b) being a citizen of India, or a person

of Indian origin within the meaning

of Explanation to clause (e) of

section 115C, who, being outside

India, comes on a visit to India in

any previous year, the provisions of

sub-clause

(c) shall apply in relation to that year

as if for the words “sixty days”,

occurring therein, the words “one

hundred and eighty-two days” had

been substituted.

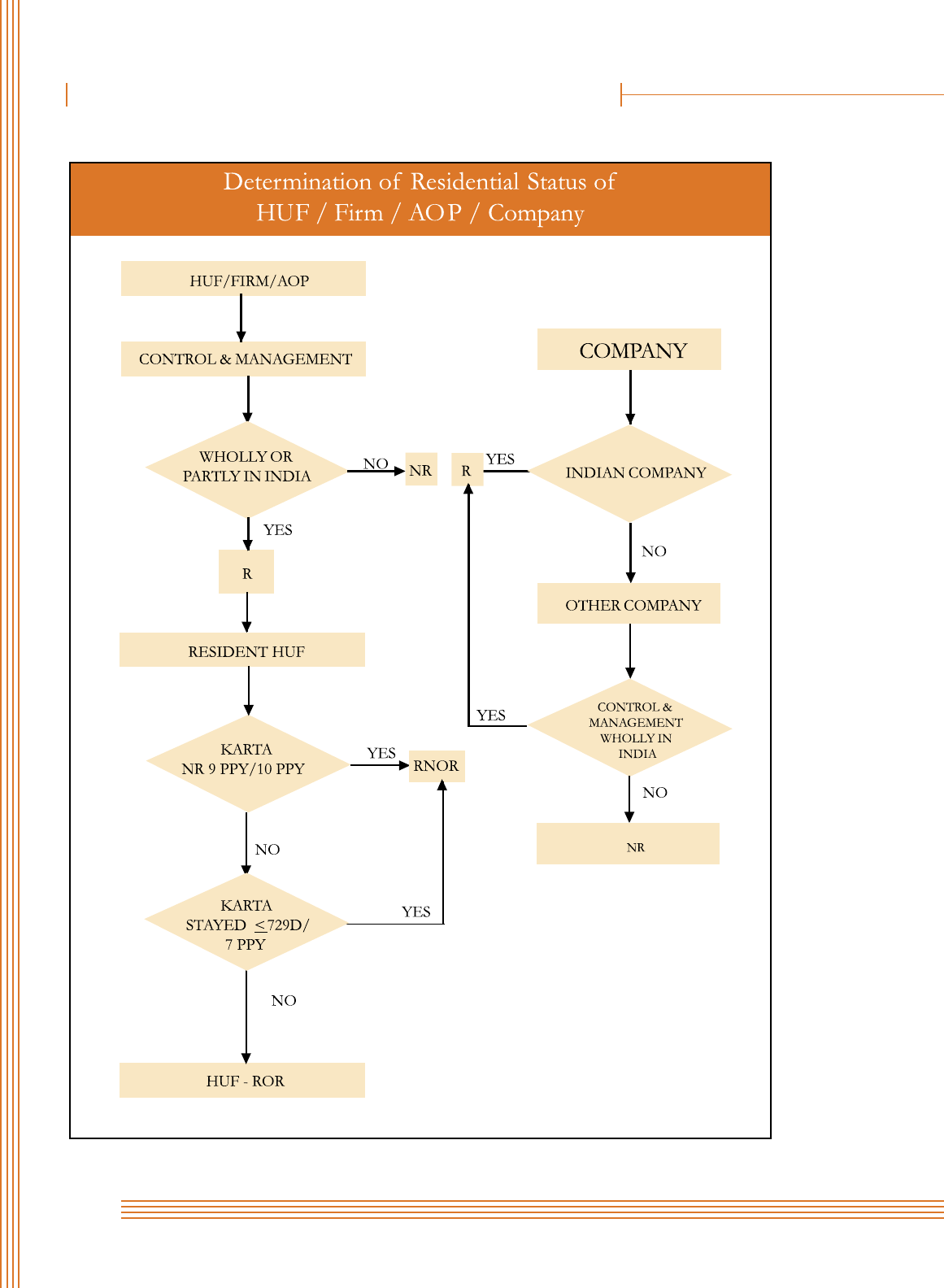

(2) A Hindu undivided family, rm or

other association of persons is said to

be resident in India in any previous year

in every case except where during that

year the control and management of its

affairs is situated wholly outside India.

(3) A company is said to be resident in India

in any previous year, if

(a) it is an Indian company; or

(b) during that year, the control and

management of its affairs is situated

wholly in India.

(4) Every other person is said to be resident

in India in any previous year in every

case, except where during that year the

control and management of his affairs

is situated wholly outside India.

(5) If a person is resident in India in a

previous year relevant to an assessment

year in respect of any source of income,

he shall be deemed to be resident in

India in the previous year relevant to the

assessment year in respect of each of

his other sources of income.

(6) A person is said to be “not ordinarily

resident” in India in any previous year if

such person is

(a) an individual who has not been a

non-resident in India in nine out

of the ten previous years preceding

that year, or has not during the

seven previous years preceding that

year been in India for a period of,

or periods amounting in all to, seven

hundred and twenty-nine days or

less; or

(b) a Hindu undivided family whose

11

R S T P R S T P

G B O I T O I M

12

13

R S T P

manager has not been non-resident

in India in nine out of the ten

previous years preceding that year,

or has not during the seven previous

years preceding that year been in

India for a period of, or periods

amounting in all to, seven hundred

and twenty-nine days or less.

An analysis of the above provisions would

indicate that -

1. To become a non-resident for

income- tax purposes, an Indian citizen

leaving India for the rst time to take up

employment abroad should be out of

the country latest by 28th September

and should not return to India before

1st April of the next year. However, in

case of a person leaving India for taking

up a business or profession, the criteria

of 60 days will apply, as dened earlier.

2. An NRI individual, whose total stay

in India in 4 preceding years exceeds

364 days, will not lose his non-resident

status in the following year(s) if his total

stay in India in that year (from April 1 to

March 31) does not exceed-

(a) 181 days, if he is on a “visit” to

India; or

(b) 59 days, if he comes to India on

“transfer of residence”.

3. An NRI who has returned to India for

settlement, whose total stay in India for

4 preceding years does not exceed 364

days will not lose his non-resident status

in the following year(s) if his total stay

in India in such year(s) (from April 1 to

March 31) does not exceed 181 days.

4. A new-comer to India would be treated

as “not ordinarily resident” for the rst

two years of his stay in India or if treated

as Non Resident in the year of arrival

then for the second and third year of

his stay in India. An individual (whether

Indian or foreign citizen) who has left

India and remains non-resident for at

least nine years preceding his return to

India or whose stay in 7 years preceding

the year of return has not exceeded 729

days would, upon his return, be treated

as “non-resident” or “not ordinarily

resident” depending upon the number

of days stay in India in the year of

return. The status of “not ordinarily

resident” will remain effective for 2

years including or following the year of

return as the case may be.

Important Points to be Borne in Mind

while Determining the Residential

Status of an Individual

(a) Residential status is always determined

for the Previous Year because the

assessee has to determine the total

income of the Previous Year only. In

other words, as the tax is on the income

of a particular Previous Year, the enquiry

and determination of the residence

qualication must conne to the facts

obtaining in that Previous Year.

(b) If a person is resident in India in a

Previous Year in respect of any source

of income, he shall be deemed to be

resident in India in the Previous Year

relevant to the Assessment Year in

respect of each of his other sources of

Income. [Section 6(5)]

(c) Relevant Previous Year means, the

Previous Year for which residential

status is to be determined

(d) It is not necessary that the stay should

be for a continuous period.

(e) It is not necessary that the stay should

R S T P

G B O I T O I M

14

be at one place in India.

(f) Both the day of entry and the day of

departure should be treated as the day

of stay in India [Petition No.7 of 1995

225 ITR 462 (AAR)]

(g) Presence in territorial waters in India

would also be regarded as stay in India.

(h) A person is said to be of Indian Origin

if he or either of his parents or any of

his grand parents was born in undivided

India [Section 115C]

(i) Ofcial tours abroad in connection

with employment in India shall not be

regarded as employment outside India.

(j) A person may be resident of more than

one country for any Previous Year.

(k) Citizenship of a country and residential

status of that country are two separate

concepts. A person may be an Indian

national/Citizen but may not be a

resident in India and vice versa.

Points to be Considered by NRIs

• Previous Year is period of 12 months

from 1st April to 31st March. Number

of days stay in India is to be counted

during this period.

• Both the Day of Arrival into India and

the Day of Departure from India are

counted as the days of stay in India (i.e.

2 days stay in India).

• Dates stamped on Passport are normally

considered as proof of dates of

departure from and arrival in India.

• It is advisable to keep several

photocopies of the relevant passport

pages for present and future use.

• Ensure that date stamped on the

passport is legible.

• Keep track of no. of days in India

from year to year and check the same

before making the next trip to India.

It is advisable to maintain a chart for

the number of days stay in the current

and in the preceding seven (7) previous

years.

• In the 1st year of leaving India for

employment outside India, ensure

that you leave before 29th September.

Otherwise total income of the nancial

year (including the foreign income) will

be taxable in India if it exceeds the basic

exemption limit.

• During the last year of stay abroad, on

transfer of residence to India, ensure

to come back on or after Feb 1st (or

Feb 2nd in case of a leap year). Since

arrival before this date will result in stay

in India exceeding 59 days. However, a

person whose stay in India in preceding

four (4) previous years does not exceed

365 days, he may return after September

30th of the relevant year without loss of

non-resident status.

Implications of Residential Status for

NRIs/PIOs

The complexities of determining the residential

status for individual NRI/PIO under various

statutes and regulations will be obvious from the

provisions outlined above and in this context it

would be important to note the following:

1 The concepts and rules for determining

the residential status income-tax laws

and FEMA are quite different and it

would be possible to be a resident under

one law and non-resident under the

other.

2 For exemption of income tax in respect

of NRE and FCNR deposits investor

should be non-resident under FEMA.

3 The special tax rate concessions on

income and long-term capital gains on

specied assets, purchased in convertible

15

R S T P

foreign exchange are available to non-

residents under the Income-tax Act.

CHARGEABLE INCOME

Section 5 of the Income-tax Act lays down the

scope of total income of any previous year of

any person. The Section reads as follows:

(1) Subject to the provisions of this Act,

the total income of any previous year of

a person who is a resident includes all

income from whatever source derived

which-

(a) is received or is deemed to be

received in India in such year by or

on behalf of such person ;or

(b) accrues or arises or is deemed to

accrue or arise to him in India during

such year; or

(c) accrues or arises to him outside India

during such year:

Provided that, in the case of a person

not ordinarily resident in India

within the meaning of sub-section

(6) of Section 6, the income which

accrues or arises to him outside India

shall not be so included unless it is

derived from a business controlled

in or a profession set up in India.

(2) Subject to the provisions of this Act,

the total income of any previous year of

a person who is a non-resident includes

all income from whatever source derived

which

(a) is received or is deemed to be

received in India in such year by or

on behalf of such person; or

(b) accrues or arises or is deemed to

accrue or arise to him in India during

such year.

Explanation I.-Income accruing or arising

outside India shall not be deemed to be received

in India within the meaning of this section by

reason only of the fact that it is taken into

account in a balance sheet prepared in India.

Explanation 2.-For the removal of doubts, it

is hereby declared that income which has been

included in the total income of a person on the

basis that it has accrued or arisen or is deemed

to have accrued or arisen to him shall not again

be so included on the basis that it is received or

deemed to be received by him in India.”

Thus, it is clear from the above that the incidence

of tax depends upon a person’s Residential

Status and also upon the place and time of

accrual and receipt of income.

As stated earlier, the charge of income tax varies

with the factor of residence in the previous year

and the general position with regard to the three

categories of taxpayers can be summarised as

follows:

1. Taxpayers in all categories are chargeable

on income, from whatever source

derived, which is received or is deemed

to be received in India by or on behalf

of them or which accrues or arises or

is deemed to accrue or arise to them

in India other than income specied as

exempt income.

R S T P

G B O I T O I M

16

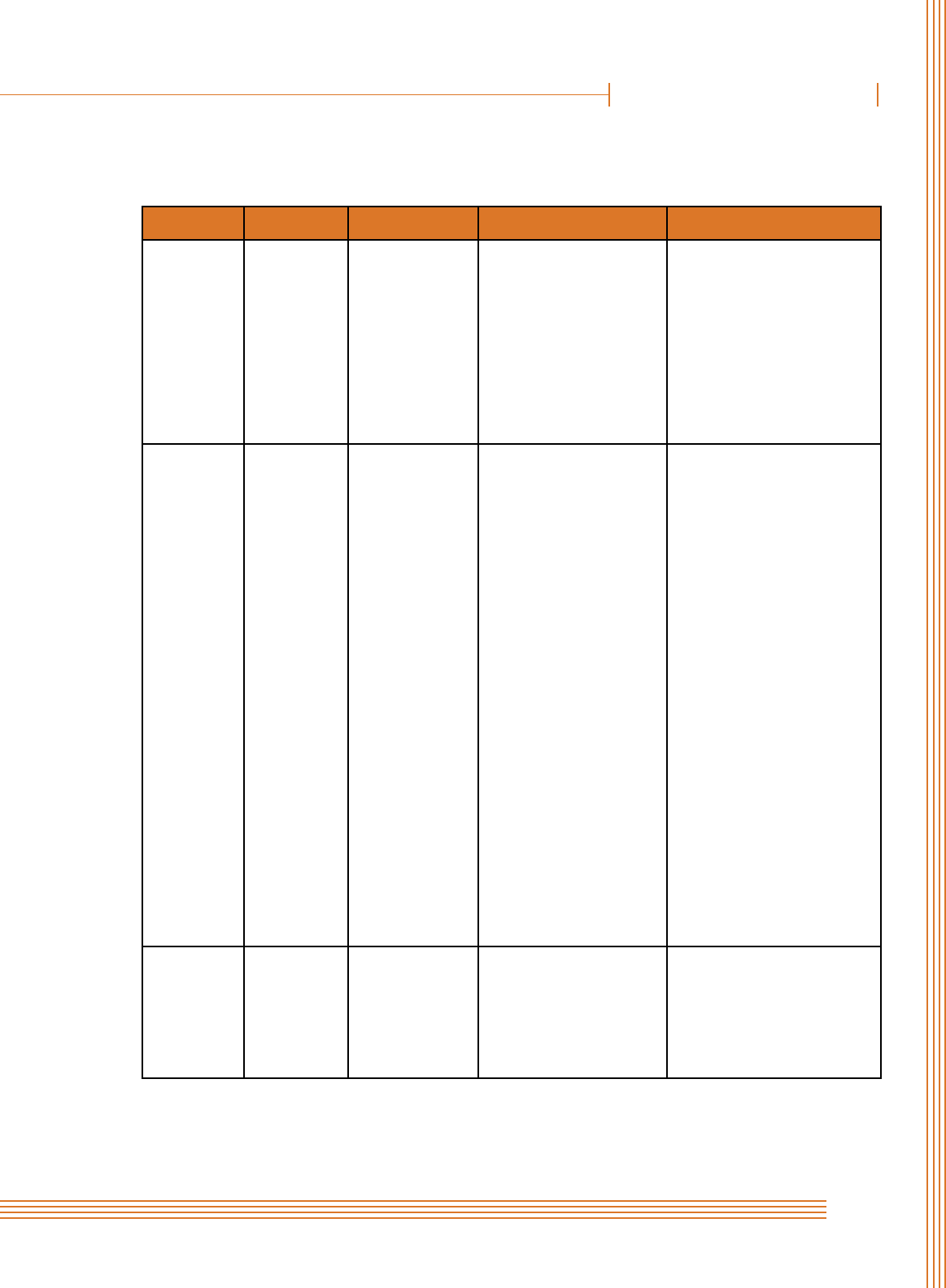

Sources of Income R & OR R & NOR NR

Indian Income

Income received or deemed to

be received in India during the

current nancial year.

Taxable in India Taxable in India Taxable in India

Income accruing or arising or

deemed to accrue or arise in

India during the current

nancial year.

Taxable in India Taxable in India

Taxable in India

Income accruing or arising or

deemed to accrue or arise out-

side India, but rst receipt

is in India during the current

nancial year

Taxable in India Taxable in India

Taxable in India

Foreign Income

Income accruing or arising

or deemed to accrue or arise

outside India and recieved

outside India, during the current

nancial year.

Taxable in India Taxable in India

Not Taxable in

India

Income accruing or arising or

outside India from a Business/

profession controlled in/from

India during the current

nancial year.

Taxable in India Taxable in India

Not Taxable in

India

Income accruing or arising out-

side India from any source

other than Business Profession

controlled from India

Taxable in India Taxable in India

Not Taxable in

India.

In the above context, it may be noted

that the ‘receipt’ of income refers to the

rst occasion when the recipient gets the

money under his own control and it is

the rst receipt that determines the year

and place of receipt for the purposes

of taxation. If the income is already

received outside India, no tax liability

will arise when the whole or any part of

such income is remitted to India.

In tabular form, the above may be stated as under:

2. A “resident and ordinarily resident” pays

tax in India on his entire world income,

wherever accrued or received.

3. A “non-resident” pays tax only on his

taxable Indian income and his foreign

income (earned and received outside

India) is totally exempt from Indian

taxes.

4. A “not ordinarily resident” pays tax

on taxable Indian income and on

17

R S T P

foreign income derived from a business

controlled in or a profession set up in

India

5. An individual upon acquiring the status

of “not ordinarily resident” would not

pay tax, for a period of two years, on the

interest on :

a) the continued Foreign Currency

Non-Resident (FCNR) account;

(b) the Resident Foreign Currency

(RFC) account; and

(c) on income earned from foreign

sources unless such income is

directly received in India or is earned

from a business controlled in or a

profession set up in India.

R S T P

18

SPECIAL PROVISIONS RELATING TO

CERTAIN INCOME OF NRIs

Some of the special tax concessions for NRIs/

PIO investing in India were introduced in the

Finance Act, 1983, which became effective on

June 1, 1983. The tax provisions were further

liberalised by subsequent Finance Acts and

other amending laws.

Special Concessions

Investment income from ‘foreign exchange

assets’ comprising shares and debenture of

and deposits with Indian companies and

central government securities, subscribed to

or purchased in convertible foreign exchange,

is charged to income tax at a at rate of 20%.

No deductions are, however, allowed and tax is

levied on gross income. The basic exemption,

below which income is not taxed in India, is also

not allowed.

Under these special concessions a reduced rate

of 10% is applied to the long-term capital gains

on transfer of any foreign exchange asset held

by the NRI/PIO. In order to qualify for long-

term capital gains, the minimum holding period

for shares held in a company or any other

security listed in a recognised Stock Exchange

in India or units of Unit Trust of India or of

a specied Mutual Fund is 12 months and for

other assets it is 36 months. Long-term capital

gains on foreign exchange assets are, however,

exempted from tax if the net proceeds realized

on transfer are re-invested, within six months of

such transfer, in any specied securities and the

new assets are retained for at least three years.

The Finance Act, 2003 has withdrawn the

taxing provision in respect of dividend received

by the shareholders on shares held in Indian

companies. Accordingly, dividend received by

the shareholders of Indian companies will be

exempt from tax. The income received from

units of Unit Trust of India and of specied

mutual funds will also be exempt.

Finance Act 2004 has:

(a) granted tax exemption as regards long

term capital gains arising from transfer

of equity shares in a company and/

or units of equity oriented schemes

of Mutual Funds, which are subject to

securities transaction tax; and

(b) xed at 10% the tax on short-term

capital gains arising from such shares

and/or units.

The tax concessions in respect of investment

income (and not long term capital gain) will

continue to apply even after the NRI/PIO

returns to India but such exemption would be

available only in respect of foreign exchange

assets other than shares in Indian companies

and the exemption will continue until such time

as the assets are transferred or converted into

money. However, as dividend is exempt income

from 1st April 2003, exclusion of shares from

said provision is redundant.

In the circumstances where the income of NRI/

PIO from such foreign exchange assets is below

the taxable limit or the average level of tax is

below 20%, he may elect not to be governed by

the special tax concessions referred to above. He

would then have to furnish a Return of Income

in the normal course together with a declaration

of such election and he would be entitled to

claim a refund of the whole or a part of the tax

2

S P R C I NRIs

19

deducted at source, as may be appropriate.

As mentioned above, short-term capital gains

arising from transfer of equity shares and/or

units of equity-oriented schemes of Mutual

Funds, which are subject to securities transaction

tax, are taxed at 10%. Other Short-term capital

gain is taxable at normal slab rates as applicable

to residents, and the return of income has to be

led by the NRI/ PIO making such gain.

Capital gain from transfer of shares or debentures

of Indian companies will be computed by

converting the cost of acquisition, expenses

incurred in connection with such transfer

and the sale price of the capital asset into the

same foreign currency as was initially used in

the purchase of these assets and the capital

gain so computed in such foreign currency

will be reconverted into Indian currency. This

computation effectively gives the NRI/PIO

the benet of claiming exchange loss, if any,

on all capital gains arising from sale of shares

or debentures of Indian companies, whether

these are long term or short term. It may be

noted that the aforesaid benet is available only

if the investment is made from convertible

foreign exchange. In respect of investment

made from funds other than convertible foreign

exchange, and if the asset is a long-term capital

asset benet of indexation can be availed.

However, indexation is not available in respect

of debentures.

20

TAX EXEMPTIONS FROM INCOME TAX,

WEALTH TAX AND GIFT TAX

Tax exemptions from income tax

Income from the following investments made by

NRIs/PIO out of convertible foreign exchange

is totally exempt from tax.

(a) Deposits in under mentioned bank

accounts :

(i) Non Resident External Rupee

Account (NRE)

(ii) Foreign Currency Non-resident

Account (FCNR)

(b) Units of Unit Trust of India and

specied mutual funds, other specic

securities, bonds and savings certicates

(subject to conditions and prescribed

limits under the Income-tax laws and

regulations).

(c) Dividend declared by Indian company.

(d) Long term capital gains arising from

transfer of equity shares in a company

and/or equity oriented schemes of

Mutual Funds, which are subject to

securities transaction tax.

It should be noted that the tax exemptions

relating to NRE bank deposits will cease

immediately upon the NRI/PIO becoming a

resident in India whereas the interest on FCNR

bank deposits will continue to be tax free as long

as the NRI maintains the status of Resident

but Not Ordinarily Resident or until maturity,

whichever is earlier.

Tax exemptions from wealth tax

Where an NRI/PIO returns to India for

permanent residence, moneys and the value of

assets brought by him into India and the value

of assets acquired by him out of such moneys

within one year immediately preceding the date

of his return and at any time thereafter are

totally exempt from Wealth-tax for a period of

seven years after return to India.

The above exemption may not have much

relevance now since the Finance Act 1992 has

considerably reduced the scope of Wealth-tax.

With effect from 1st April, 1993, Wealth-tax

is being levied only on non-productive assets

like urban land, buildings (except one house

property), jewellery, bullion and vehicles, cash

over Rs.50,000- etc. The current rate of Wealth-

tax is 1 % on the aggregate market value of

chargeable assets as on 31st March every year in

excess of Rs.1.5 million.

However, it may be noted that NRIs are also

liable to pay wealth tax if the market value of

taxable assets as on 31st March exceeds Rs.l.5

million.

Tax exemptions from gift tax

Gift Tax Act, 1958 has been repealed with effect

from 1st October, 1998 and as such, Gift Tax is

not chargeable on any gifts made on or after

that date.

With regard to gifts of foreign exchange or

specied assets made by NRIs to their relatives

in India, it should be noted that

1 Gifts made by an NRI/PIO to his or her

spouse, minor children or son’s wife will

involve clubbing of income and wealth

in the hands of the donor-NRI/ PIO.

2 In the case of gifts to minor children the

clubbing of income, as above, will cease

upon such children attaining the age of

3

21

18 years.

3. The clubbing provisions will apply,

in case of gift to spouse or son’s wife

in India, only to the’ rst-stage of

income from the original gift. Second-

stage income arising from investment

of the income from the original gift is

not clubbed and this will constitute the

separate wealth/income of the donee

spouse.

Generally, the income of minor children, from

any source (including income from gifts from

parents) is clubbed with the income of the parent

whose total chargeable income is greater.

Other matters to be noted regarding gifts are

1 All gifts received by residents from

NRIs/PIO may be subject to the tax

authorities requiring the recipient to

provide evidence as regards the identity

and nancial capacity of the donor and

genuineness of the gift.

2 Under the Foreign Exchange

Management Act, 1999 no approval

from Reserve Bank of India (RBI) is

necessary for the resident donee to

hold gifted immovable property outside

India provided the said property is

gifted by a person resident outside

India. General permission, subject to

certain conditions, is granted by RBI

for the resident donees to hold foreign

moveable properties such as shares and

securities gifted by NRI/PIO donors.

3 The Income Tax Act has provided that

any sum of money exceeding Rs.50,000

received without consideration (i.e., gift)

by an individual or Hindu undivided

Family from any person on or after

1st April, 2006 the whole of such sum

will be chargeable to income-tax in the

assessment of recipient (i.e., donee)

under that head “Income from other

sources” for and from assessment year

2007-08 and onwards. Any sum of

money exceeding Rs. 25,000 received

without consideration (i.e. gift) by an

individual or Hindu undivided family

from any person on or after September

1, 2004 but before April 1, 2006, the

whole of sum will be chargeable to

income tax.

However, the above provisions will not apply to

any sum of money /gift received:

(a) from any relative; or

(b) on the occasion of the marriage of the

individual; or

(c) under a will or by way of inheritance;

or

(d) in contemplation of death of the payer;

or

(e) from a local authority; or

(f) from any fund, foundation, university,

other educational institution, hospital,

medical institution, any trust or

institution referred to in section 10

(23C); or

(g) from a charitable institute registered

under section 12AA.

The term “relative” is dened as:

(1) spouse of the individual;

(2) brother or sister of the individual;

(3) brother or sister of the spouse of the

individual;

(4) brother or sister of either of the parents

of the individual;

(5) any lineal ascendant or descendant of

the individual;

(6) any lineal ascendant or descendant of

the spouse of the individual; and

(7) spouse of the person referred to in (2)

to (6).

T E F I T, W T G T

G B O I T O I M

22

Scope of Receipts

l As per plain reading of the provision,

any receipt without consideration, save

exclusions, whether capital or otherwise,

may be considered as income. l

l Similar receipts by any person (such as, a

partnership rm, a company, and AOP

etc.), other than an individual or a Hindu

undivided Family, would not constitute

income in its hands.

l The provision would apply to an

individual irrespective of his residential

status. Accordingly, any receipt in India

by a non-resident of the nature discussed

above would be considered as income in

his hands.

l Gifts on occasion other than marriage,

for example, birthday, marriage

anniversary and other social occasions,

religious ceremonies etc., would be

taxable as income. Gifts received on

the occasion of the marriage of the

individual, irrespective of any limit,

(but within reasonable limits) would not

constitute income.

l The receipts should be in the form of

money. Accordingly, any gift in kind

would not be taxable.

l The receipts must be without

consideration, implying in the nature of

gift.

23

PRESUMPTIVE TAX PROVISIONS

Certain provisions have been incorporated in

the Income-tax Act whereby the total income

of certain non-resident assessee is computed on

the basis of certain percentage of their gross

total receipts. This estimated income approach

is expected to reduce areas of uncertainty and

resultant tax litigation. However, a non-resident

assessee has the option to maintain books of

account and get his books of account audited

u/s 44AB (“Tax Audit”) and offer lower prots

and gains for taxation in India than the prots

and gains estimated under Sections 44BB and

44BBB on presumptive basis.

Special provisions applicable to non-residents

for computing their income under the head

“Business Income”

Shipping Business (Sections 44B & 172)

Section 44B contains special provisions for

computing prots and gains of shipping

business of a non-resident assessee. In the case

of non-residents, such prots and gains will be

taken at an amount equal to 7.5% (seven and a

half per cent) of the amount paid or payable

to the non-resident or to any other person

on his behalf on account of the carriage of

passengers, livestock, mail or goods shipped at

any Indian port as also of the amount received

or deemed to be received in India on account

of the carriage of passengers, livestock, mail or

goods shipped at any port outside India.

Section 172, which is a complete code in itself,

contains provisions for taxation of occasional

shipping business of non-residents in respect

of prots made by them from carriage of

passengers, livestock, mail or goods shipped at

a port in India.

Business of Providing Services and

Facilities in Connection with Exploration

etc. of Mineral Oils (Section 44BB)

Section 44BB contains special provisions for

computation of taxable income of a non-

resident assessee engaged in the business of

providing services or facilities in connection

with, or supplying plant and machinery on

hire, used or to be used, in the prospecting for,

or extraction or production of, mineral oils.

It provides that 10% of the amount paid or

payable to, or the amount received or receivable

by, the assessee for provision of such services

or facilities or supply of plant and machinery

shall be deemed to be the taxable income of

such non-resident assessee.

Business of Operation of Aircraft

(Section 44BBA)

Section 44BBA contains special provisions for

computing prots and gains of the business

of operation of aircraft of non-residents. It

provides for determination of the income of

non-resident taxpayers on presumptive basis

at a at rate of 5% of the amount received or

receivable for carriage of persons, livestock,

mail or goods from any place in India or the

amount received or deemed to be received

within India on account of such carriage from

any place outside India.

Prots and Gains of Foreign Companies

Engaged in the Business of Civil

Construction or Erection of Plant and

Machinery or Testing or Commissioning

thereof, in Connection with certain

Turnkey Power Projects (Section

44BBB)

Section 44BBB provides that, notwithstanding

anything to the contrary contained in Sections

4

G B O I T O I M

24

28 to 44AA of the Income-tax Act, the income

of foreign companies who are engaged in the

business of civil construction or erection or

testing or commissioning of plant or machinery

in connection with a turnkey power project shall

be deemed at 10 per cent of the amount paid or

payable to such assessee or to any person on

his behalf, whether in or out of India. For this

purpose, the turnkey power project should be

approved by the Central Government. It has

also been claried that erection of plant or

machinery or testing or commissioning thereof

will include lying of transmission lines and

systems.

Taxation of Non-Resident’s Royalty

Income or Fees for Technical Services

(Section 44DA)

Royalties and fees for Technical Services

received from the Government or an Indian

concern by a Non-Resident or a foreign

company in pursuance of an agreement entered

into after 31-3-2003 shall be computed under

the head “Business Income” in accordance

with the provisions of the Income Tax Act i.e.

after allowing deduction for various permissible

expenses and allowances.

Section 44DA does not Permit Deduction

of following Expenses

(i) expenditure which is not wholly and

exclusively incurred for the business of

such permanent establishment or xed

place of profession in India, and

(ii) amounts reimbursed by permanent

establishment to its head ofce or to

any of its other ofces (Other than,

reimbursement of actual expenses).

Restriction on Deduction of Head Ofce

Expenses (Section 44C)

Section 44C is intended to be made applicable

only in the cases of those non-residents who

carry on business in India through their

branches.

The deduction in respect of head ofce expenses

will be limited to:

a) An amount equal to 5 per cent of the

“adjusted total income” for the relevant

year: or

b) The actual amount of head ofce

expenditure attributable to the business

in India, whichever is least.

25

TAX INCENTIVES FOR INDUSTRIES

Tax holidays in the form of deductions are

available for private sectors and incentives to

industries located in special area/regions are

listed below:

Infrastructure Sectors (Section 80-IA)

Deduction of 100% of the prots from business

for a period of 10 years for:

(a) Development or operation and

maintenance of ports, airports, roads,

highways, bridges, rail systems, inland

water ways, inland port or navigational

channel in sea, water supply projects,

water treatment systems, irrigation

projects, sanitation and sewage projects,

and solid waste management systems.

(b) Generation and distribution of power

that commence before March 31, 2010

(c) Laying and operating a cross country

natural gas distribution network.

Mineral Oil (Section 80-IB)

Deduction of 100% of prots from the

Business of Rening Mineral Oil for a period

of 10 Years for:

a. Undertaking wholly owned by a public

sector Company or any other company

in which Public Sector Company hold

Forty Nine Percent of voting rights.

b. Undertaking starts Rening on or before

March 31, 2012.

Hospital (Section 80-IB)

Deduction of 100% of prots from business

of operating and maintaining Hospital for a

period of 5 years for:

a. Hospital is constructed and has started

or starts functioning at any time during

April 1, 2008 & March 31, 2013.

b. Hospital has at least one hundred beds

for patients.

c. Hospital is located anywhere in India

other than excluded area.

Hotels and Convention Centre in NCR

(Sec 80-ID)

Deduction of 100% of the prots from business

of hotels and convention centres for a period

of 5 years for

a. Hotel and Convention Centre located

in National Capital Territory of

Delhi and the districts of Faridabad,

Gurgaon, Gautam Budh Nagar and

Ghaziabad.

Hotel is constructed and has started or

starts functioning at any time during

April 1, 2007 and March 31, 2010.

Likewise, the Convention Centre is

constructed at any time during April

1, 2007 and March 31, 2010.

b. Hotel located in the specied district

having a World Heritage site. Hotel is

constructed and has started or starts

functioning at any time during April 1,

2008 and March 31, 2013.

Undertakings in North Eastern States

(Sec 80-IE)

Deduction of 100% of the prots from business

for a period of 10 years for:

a. Manufacture or production of goods or

undertakes substantial expansion during

April 1, 2007 and March 31, 2017.

Providing eligible services during April

1, 2007 and March 31, 2017.

b. Deduction is not available in respect of

manufacture or production of tobacco,

pan masala, plastic carry bag of less

than 20 microns or goods produced by

petroleum and gas reneries.

5

G B O I T O I M

26

c. Eligible services are hotel (2 star or above),

nursing home(25 beds or more), old age

homes, vocational training institutes for

hotel management, catering and food

crafts, entrepreneurship development,

nursing and paramedical, civil aviation

related training, fashion designing and

industrial training, IT related training

centres, IT hardware manufacture units

and bio-technology.

d. The aforesaid activity takes place in any

North-Eastern States(i.e., Arunachal

Pradesh, Assam, Manipur, Meghalaya,

Mizoram, Nagaland, Sikkim and

Tripura).

Tax Exemptions

Following tax exemptions are available in

different sectors:

Deduction of 100% of the Prot from

Business of

(a) Development or operation and

maintenance of ports, airports, roads,

highways, bridges etc. (Sec 80-IA).

(b) Generation, distribution and

transmission of power (Sec 80-IA).

(c) Development, operation and

maintenance of an Industrial Park or

SEZ (Sec 80-IAB).

(d) By undertakings set up in certain

notied areas or in certain thrust sector

industries in the North Eastern states

and Sikkim (Sec 80-IC).

(e) By undertakings set up in certain

notied areas or in certain thrust sector

industries in Uttaranchal and Himachal

Pradesh (Sec 80-IC).

(f) Derived from export of articles or

software by undertakings in FTZ,

EHTP/STP (Sec 10A).

(g) Derived from export of articles or

software by undertakings in SEZ

(Sec 10AA).

(h) Derived from export of articles or

software by 100% EOU (Sec 10B).

(i) An offshore banking unit situated in

SEZ from business activities with units

located in the SEZ (Sec 80LA).

(j) Derived by undertakings engaged in

Business of operating and maintaining

Hospital located anywhere in India

other than excluded area. (Sec 80-IB)

(k) Derived by an undertaking engaged in

the integrated business of handling,

storage and transportation of food

grains (Sec 80-IB).

(l) Derived by an undertaking engaged in

the commercial production or rening

of mineral oil (Sec 80-IB).

(m) Derived by an undertaking from export

of wood based handicraft (Sec 10BA).

27

AUTHORITY FOR ADVANCE RULINGS

Introduction

The scheme of advance rulings was introduced

by the Finance Act, 1993, Chapter XIX-B of

the Income-tax Act, which deals with advance

rulings, came into force with effect from 1-6-

1993. Under the scheme, the power of giving

advance rulings has been entrusted to an

independent adjudicatory body. Accordingly,

a high level body headed by a retired judge of

the Supreme Court has been set up. This is

empowered to issue rulings, which are binding

both on the Income-tax Department and the

applicant. The procedure prescribed is simple,

inexpensive, expeditious and authoritative.

Advance Ruling, means written opinion

or authoritative decision by an Authority

empowered to render it with regard to the tax

consequences of a transaction or proposed

transaction or an assessment in regard thereto.

It has been dened in section 245N(a) of the

Income-tax Act, 1961 as amended from time

to time. Under section 245N, a ruling can be

obtained by an applicant (who may be either a

non-resident or a resident having a transaction

with a non-resident) in respect of any question

of law or fact in relation to the tax liability of

the non-resident arising out of a transaction

undertaken or proposed to be undertaken.

Salient features:

a. Available only for Income-tax:—

The procedure of advance ruling is

available only under the Income-tax

Act, 1961.

b. Must relate to a transaction entered into

or proposed to be entered into by the

applicant: -

The advance ruling is to be given on questions

specied in relation to such a transaction by the

applicant.

c. Questions on which ruling can be

sought:—

i. Even though the word used in the

denition is the word “question”,

it is clear that the non-resident can

raise more than one question in one

application. This has been made

amply clear by Column No. 8 of the

form of application for obtaining an

advance ruling (Form No. 34C)

ii. Though the word “question” is

unqualied, it is only proper to read

it as a reference to questions of law

or fact, pertaining to the income tax

liability of the non-resident qua the

transaction undertaken or proposed

to be undertaken.

iii. The question may be on points of law

as well as on fact; therefore, mixed

questions of law and fact can also

be included in the application. The

questions should be so drafted that

each question is capable of a brief

answer. This may need breaking-up

of complex question into two or

more simple questions.

iv. The questions should arise out of

the statement of facts given with the

application. No ruling will be given

on a purely hypothetical question.

No question not specied in the

application can be urged. Normally

a question is not allowed to be

amended but in deserving cases the

Authority may allow amendment of

one or more questions.

6

G B O I T O I M

28

v. Subject to the limitations to be

presently referred to, the question

may relate to any aspect of the

non-resident’s liability including

international aspects and aspects

governed by double tax agreements.

The questions may even cover

aspects of allied laws that may have

a bearing on tax liability such as the

law of contracts, the law of trusts

and the like, but the question must

have a direct bearing, on and nexus

with the interpretation of the Indian

Income-tax Act.

d. Time limit for ruling:

The Authority shall pronounce it advance

ruling within 6 months of receipt of the

application.

e. Binding nature of advance ruling:

The effect of the ruling is stated to be

limited to the parties appear before the

authority and the transaction in relation

to which the ruling was given. This is

because the ruling was rendered on a set

of facts before the Authority and can

not be of general application.

Question precluded: Under section 245R,

certain restrictions have been imposed on the

admissibility of an application, if the question

concerned is pending before other authorities.

According to it, the authority shall not allow

an application where the question raised by the

non-resident applicant (or a resident applicant

having transaction with a non-resident) is already

pending before any income-tax authority or

appellate Tribunal or any court of law. Further,

the authority shall not allow the application

where the question raised in it:—

i. involves determination of fair market

value of any property; or

ii. it relates to a transaction or issue which

is designed prima facie for the avoidance

of income-tax.

The Authority and Its Powers

The authority is constituted by the Central

Government and is known as “Authority for

Advance Ruling” (AAR) [Section 245-O (1)].

AAR consist of three member, viz :

l Chairman (who is a retired judge of the

Supreme Court)

l An IRS ofcer (who is qualied to be a

member of CBDT); and

l An ILS ofcer (who is qualied to be an

additional secretary to the Government

of India) [Section 245-O(2)]

The AAR enjoys all powers of a Civil Court

under the code of Civil Procedure, 1908, as are

referred to in Section 131 of the Income Tax

Act, 1961 [Section 245U(1)]

The AAR also enjoys the status of a Civil Court

for the purpose of section 195 of the Code of

Criminal Procedure, 1973. [Section 245U(2)].

Every proceedings before the AAR is deemed

to be a judicial proceedings within the meaning

of Sections 193 & 228 and for the purpose of

Section 196 of the Indian Penal Code,1860.

Meaning of “Advance Ruling”

The term “Advance ruling” is dened in Section

245N(a) of the Act. Following are the main

features of the denition:

l Advance ruling means the determination

of a question specied in the application

by the applicant;

l Such question may be a question of

law or a question of fact. Such question

must be in relation to a transaction and

cannot be a hypothetical or academic

question;

29

l The transaction may be the one which

is already undertaken or the one which

is proposed to be undertaken by the

applicant;

l The determination of such question on

such a transaction is to be done by the

AAR.

This term also indicates the determination or

decision in respect of an issue pending before:

(i) An Income-tax Authority; or

(ii) The Appellate Tribunal.

Such determination could be determination on

a question of law or on a question of fact.

Who can Apply

An application for advance ruling can be made

by a NON-RESIDENT as also by a resident

in respect of a transaction with a non-resident.

Besides, a resident falling within a notied class

or category may also make an application. The

class or category so notied by the Government

till date are:

l Public Sector Company; and

l A resident seeking advance ruling in

relation to the tax liability of a non-

resident arising out of a transaction with

a non-resident.

In case of resident applicants, no Income-

tax Authority or the Appellate Tribunal shall

proceed to decide any issue in respect of which

an application has been made.

Procedure for Making an Application

The application has to be made in following

forms:

l By Non-Residents : Form 34C

l By resident in relation to transaction

with Non-Residents : Form 34D

l By residents notied by the

Government : Form 34E

l Application must be made in

quadruplicate.

l It should be presented by the applicant in

person or by an authorized representative

or may be sent by post;

l The AAR, at present, holds its sittings at

its headquarters at Delhi.

l The application must be accompanied

by draft of Rs. 2500 drawn in favor of

“Authority of Advance Ruling” payable

at New Delhi.

l The secretary may send the application

back to the applicant if it is defective in

any manner for removing the defect.

The application must be signed as per the

provisions of Rule 44E (2) of the Income Tax

Rule, 1962.

Enclosures to the Application

l A statement listing question(s) in relation

to the transaction on which the advance

ruling is required. This is optional. The

question(s) may be stated in the

application form itself. If, however,

space provided is insufcient, separate

enclosure may be used for this purpose.

It may be noted that the question(s) raised

in the application should be exhaustively

drafted covering all aspects of the issue

involved and all alternative claims that

the applicant may wish to make without

prejudice to each other. This is because

if at a later stage the applicant desires

to raise any additional question which is

not set-forth in the application, he may

have to obtain permission of the AAR.

Granting of such permission is at the

discretion of the AAR.

A A R

G B O I T O I M

30

l A statement of relevant facts having a

bearing on the question(s) on which the

advance ruling is required.

l A statement containing the applicant’s

interpretation of law or facts, as the

case may be, in respect of the

question(s) on which the advance

ruling is required.

l Where the application is signed by an

authorized representative, the power of

attorney authorizing him to sign.

l Where the application is signed by an

authorized representative, an afdavit

setting out the unavoidable reasons

which entitles him to sign.

l Separate enclosures may be used where

the space provided for any of the items

in the relevant forms is insufcient.

l In the covering letter, the applicant may

make a request for being heard before

pronouncing the ruling.

Procedure After Making of the

Appliation

l On receipt of the application, the

AAR will forward a copy to the

Commissioner.

l Commissioner may be called upon to

furnish the relevant records.

l AAR shall examine the application and

such records.

l After examination, an order shall be

passed u/s 245R(2) to either allow or

reject the application

l A copy of order u/s 245R(2) is sent to

the applicant and to the commissioner.

l If the application is allowed vide order

u/s 245R(2), the AAR shall :

(i) Examine such further material

as may be placed before it by the

applicant;

(ii) Examine such further material as

may be obtained by the Authority

suo moto; and

(iii) Pronounce its advance ruling on the

question specied in the application

within six months of the receipt of

the application either with or without

giving the assessee a hearing.

31

TRANSFER PRICING

Meaning

Commercial transactions between the different

parts of the multinational groups may not

be subject to the same market forces shaping

relations between the two independent rms.

One party transfers to another goods or services,

for a price. That price is known as transfer

price. This may be arbitrary and dictated, with

no relation to cost and added value, diverge

from the market forces. Transfer price is, thus,

a price which represents the value of goods; or

services between independently operating units

of an organisation. But, the expression transfer

pricing generally refers to prices of transactions

between associated enterprises which may take

place under conditions differing from those

taking place between independent enterprises.

It refers to the value attached to transfers of

goods, services and technology between related

entities. It also refers to the value attached to

transfers between unrelated parties which are

controlled by a common entity.

Suppose a company A purchases goods for 100

rupees and sales it to its associated company B

in another country for 200 rupees, who in turn

sells in the open market for 400 rupees. Had A

sold it direct, it would have made a prot of 300

rupees. But by routing it through B, it restricted

it to 100 rupees, permitting B to appropriate

the balance. The transaction between A and B

is arranged and not governed by market forces.

The prot of 200 rupees is, thereby, shifted to

the country of B. The goods are transferred

on a price (transfer price) which is arbitrary or

dictated (200 hundred rupees), but not on the

market price (400 rupees).

Thus, the effect of transfer pricing is that the

parent company or a specic subsidiary tends to

produce insufcient taxable income or excessive

loss on a transaction. For instance, prots

accruing to the parent can be increased by

setting high transfer prices siphon prots from

subsidiaries domiciled in high tax countries,

and low transfer prices to move prots to

subsidiaries located in low tax jurisdiction. As

an example of this, a group which manufacture

products in a high tax countries may decide

to sell them at a low prot to its afliate sales

company based in a tax heaven country. That

company would in turn sell the product at an

arm’s length price and the resulting (inated)

prot would be subject to little or no tax in that

country. The result is revenue loss and also a

drain on foreign exchange reserves.

Transfer pricing – Arm’s length price

92F(ii) Arms length price means a price which is

applied or proposed to be applied in a transaction

between persons other than associated

enterprises, in uncontrolled conditions;

Enterprise

92F(iii) enterprises means a person (including a

permanent establishment of such person) who

is, or has been, or is proposed to be, engaged in

any activity, relating to the production storage,

supply, distribution, acquisition or control

of articles or goods, or know-how, patents,

copyright, trademarks, licences, franchises or any

other business or commercial rights of similar

nature, or any data, documentation, drawing or

specication relating to any patent, invention,

model, design, secret formula or process, of

which the other enterprise is the owner or

in respect of which the other enterprise has

exclusive rights, or the provision of service

of any kind, [or in carrying out any work in

pursuance of a contract,] or in Investment, or

7

G B O I T O I M

32

providing loan or in the business of acquiring,

holding, underwriting or dealing with shares,

debentures or other securities of any other body

corporate, whether such activity or business is

carried on, directly or through one or more of

its units or divisions or subsidiaries, or whether

such unit or division or subsidiary is located at

the same place where the enterprise is located

or at a different place or places;

Permanent establishment

92F [(iiia) permanent establishment, referred to

in clause (iii), includes a xed place of business

through which the business of the enterprise is

wholly or partly carried on;

Transaction

92F (v) transaction includes an arrangement,

understanding or action in concert,

(a) whether or not such arrangement,

understanding or action is formal or in

writing; or

(b) Whether or not such arrangement,

understanding or action is intended to

be enforceable by legal proceeding.

Computation of arms length price.

92C. (1) The arms length price in relation to an

international transaction shall be determined by

any of the following methods, being the most

appropriate method, having regard to the nature

of transaction or class of transaction or class of

associated persons or functions performed by

such persons or such other relevant factors as

the Board may prescribe, namely :

(a) comparable uncontrolled price method;

(b) resale price method;

(c) cost plus method;

(d) prot split method;

(e) transactional net margin method;

(f) such other method as may be prescribed

by the Board.

(2) The most appropriate method referred

to in sub-section (1) shall be applied, for

determination of arms length price, in

the manner as may be prescribed :

Provided that where more than one price is

determined by the most appropriate method,

the arms length price shall be taken to be the

arithmetical mean of such prices, or, at the

option of the assessee, a price which may vary

from the arithmetical mean by an amount not

exceeding ve per cent of such arithmetical

mean.

(3) Where during the course of any

proceeding for the assessment of

income, the Assessing Ofcer is, on

the basis of material or information

or document in his possession, of the

opinion that

(a) the price charged or paid in an

international transaction has not

been determined in accordance with

sub-sections (1) and (2); or

(b) any information and document

relating to an international

transaction have not been kept

and maintained by the assessee in

accordance with the provisions

contained in sub-section (1) of

section 92D and the rules made in

this behalf; or

(c) the information or data used in

computation of the arms length

price is not reliable or correct; or

(d) the assessee has failed to furnish,

within the specied time, any

information or document which

he was required to furnish by a

notice issued under sub-section

(3) of section 92D. the Assessing

Ofcer may proceed to determine

the arms length price in relation to

33

T P

the said international transaction in

accordance with sub-sections (1) and

(2), on the basis of such material or

information or document available

with him:

Provided that an opportunity shall be given by

the Assessing Ofcer by serving a notice calling

upon the assessee to show cause, on a date and

time to be specied in the notice, why the arms

length price should not be so determined on the

basis of material or information or document in

the possession of the Assessing Ofcer.

(4) Where an arm’s length price is

determined by the Assessing Ofcer

under sub-section (3), the Assessing

Ofcer may compute the total income

of the assessee having regard to the

arms length price so determined :

Provided that no deduction under section 10A

[or section 10AA] or section 10B or under

Chapter VI-A shall be allowed in respect of the

amount of income by which the total income

of the assessee is enhanced after computation

of income under this sub-section :

Provided further that where the total income of

an associated enterprise is computed under this

sub-section on determination of the arms length

price paid to another associated enterprise from

which tax has been deducted [or was deductible]

under the provisions of Chapter XVIIB, the

income of the other associated enterprise

shall not be recomputed by reason of such

determination of arms length price in the case

of the rst mentioned enterprise.

Meaning of international transaction.

92B. (1) For the purposes of this

section and sections 92, 92C, 92D and

92E, international transaction means

a transaction between two or more

associated enterprises, either or both of

whom are non-residents, in the nature

of purchase, sale or lease of tangible

or intangible property, or provision

of services, or lending or borrowing

money, or any other transaction having

a bearing on the prots, income,

losses or assets of such enterprises,

and shall include a mutual agreement

or arrangement between two or more

associated enterprises for the allocation

or apportionment of, or any contribution

to, any cost or expense incurred or to be

incurred in connection with a benet,

service or facility provided or to be

provided to any one or more of such

enterprises.

(2) A transaction entered into by an

enterprise with a person other than

an associated enterprise shall, for the

purposes of sub-section (1), be deemed

to be a transaction entered into between

two associated enterprises, if there exists

a prior agreement in relation to the

relevant transaction between such other

person and the associated enterprise, or

the terms of the relevant transaction

are determined in substance between

such other person and the associated

enterprise.

Meaning of associated enterprise.

92A. (1) For the purposes of this section

and sections 92, 92B, 92C, 92D, 92E and

92F, associated enterprise, in relation to

another enterprise, means an enterprise

(a) which participates, directly or indirectly,

or through one or more intermediaries,

in the management or control or capital

of the other enterprise; or

(b) in respect of which one or more persons

G B O I T O I M

34

who participate, directly or indirectly, or

through one or more intermediaries, in

its management or control or capital,

are the same persons who participate,

directly or indirectly, or through one or

more intermediaries, in the management

or control or capital of the other

enterprise.

(2) For the purposes of sub-section (1),

two enterprises shall be deemed to be

associated enterprises if, at any time

during the previous year,

(a) one enterprise holds, directly or

indirectly, shares carrying not less

than twenty-six per cent of the

voting power in the other enterprise;

or

(b) any person or enterprise holds,

directly or indirectly, shares carrying

not less than twenty-six per cent of

the voting power in each of such

enterprises; or

(c) a loan advanced by one enterprise to

the other enterprise constitutes not

less than fty-one per cent of the

book value of the total assets of the

other enterprise; or

(d) one enterprise guarantees not

less than ten per cent of the total

borrowings of the other enterprise;

or

(e) more than half of the board

of directors or members of the

governing board, or one or more

executive directors or executive

members of the governing board of

one enterprise, are appointed by the

other enterprise; or

(f) more than half of the directors or

members of the governing board,

or one or more of the executive

directors or members of the

governing board, of each of the

two enterprises are appointed by the

same person or persons; or

(g) the manufacture or processing

of goods or articles or business

carried out by one enterprise is

wholly dependent on the use of

know-how, patents, copyrights,

trade-marks, licences, franchises or

any other business or commercial

rights of similar nature, or any

data, documentation, drawing or

specication relating to any patent,

invention, model, design, secret

formula or process, of which the

other enterprise is the owner or in

respect of which the other enterprise

has exclusive rights; or

(h) ninety per cent or more of the raw

materials and consumables required

for the manufacture or processing of

goods or articles carried out by one

enterprise, are supplied by the other

enterprise, or by persons specied by

the other enterprise, and the prices

and other conditions relating to the

supply are inuenced by such other

enterprise; or

(i) the goods or articles manufactured or

processed by one enterprise, are sold

to the other enterprise or to persons

specied by the other enterprise,

and the prices and other conditions

relating thereto are inuenced by

such other enterprise; or

(j) where one enterprise is controlled

by an individual, the other enterprise

is also controlled by such individual

or his relative or jointly by such

individual and relative of such

individual; or

(k) where one enterprise is controlled by

35

a Hindu undivided family, the other

enterprise is controlled by a member

of such Hindu undivided family or

by a relative of a member of such

Hindu undivided family or jointly by

such member and his relative; or

(l) where one enterprise is a rm,

association of persons or body of

individuals, the other enterprise

holds not less than ten per cent

interest in such rm, association of

persons or body of individuals; or

(m) there exists between the two

enterprises, any relationship

of mutual interest, as may be

prescribed.

Reference to Transfer Pricing Ofcer.

92CA. (1) Where any person, being the

assessee, has entered into an international

transaction in any previous year, and the

Assessing Ofcer considers it necessary

or expedient so to do, he may, with the

previous approval of the Commissioner,

refer the computation of the arms length

price in relation to the said international

transaction under section 92C to the

Transfer Pricing Ofcer.

(2) Where a reference is made under sub-

section (1), the Transfer Pricing Ofcer

shall serve a notice on the assessee

requiring him to produce or cause to

be produced on a date to be specied

therein, any evidence on which the

assessee may rely in support of the

computation made by him of the

arms length price in relation to the

international transaction referred to in

sub-section (1).

(3) On the date specied in the notice under

sub-section (2), or as soon thereafter as

may be, after hearing such evidence as

the assessee may produce, including any

information or documents referred to

in sub-section (3) of section 92D and

after considering such evidence as the

Transfer Pricing Ofcer may require on

any specied points and after taking into

account all relevant materials which he

has gathered, the Transfer Pricing Ofcer

shall, by order in writing, determine

the arms length price in relation to the

international transaction in accordance

with sub-section (3) of section 92C and

send a copy of his order to the Assessing

Ofcer and to the assessee.

(3A) Where a reference was made under sub-

section (1) before the 1st day of June,

2007 but the order under sub-section

(3) has not been made by the Transfer

Pricing Ofcer before the said date, or a

reference under sub-section (1) is made

on or after the 1st day of June, 2007, an

order under sub-section (3) may be made

at any time before sixty days prior to the

date on which the period of limitation

referred to in section 153, or as the case

may be, in section 153B for making the

order of assessment or reassessment or

recomputation or fresh assessment, as

the case may be, expires.

(4) On receipt of the order under sub-

section (3), the Assessing Ofcer shall

proceed to compute the total income

of the assessee under sub-section (4)

of section 92C in conformity with the

arms length price as so determined by

the Transfer Pricing Ofcer.

(5) With a view to rectifying any mistake

apparent from the record, the Transfer

Pricing Ofcer may amend any order

passed by him under sub-section (3),

and the provisions of section 154 shall,

so far as may be, apply accordingly.

(6) Where any amendment is made by the

Transfer Pricing Ofcer under sub-

T P

G B O I T O I M

36

section (5), he shall send a copy of his

order to the Assessing Ofcer who shall

thereafter proceed to amend the order

of assessment in conformity with such

order of the Transfer Pricing Ofcer.

(7) The Transfer Pricing Ofcer may, for the

purposes of determining the arms length

price under this section, exercise all or

any of the powers specied in clauses (a)

to (d) of sub-section (1) of section 131

or sub-section (6) of section 133.

Explanation.For the purposes of this section,

Transfer Pricing Ofcer means a Joint

Commissioner or Deputy Commissioner or

Assistant Commissioner authorised by the

Board85 to perform all or any of the functions

of an Assessing Ofcer specied in sections

92C and 92D in respect of any person or class

of persons.

Maintenance and keeping of information

and document by persons entering into an

international transaction.

92D. (1) Every person who has entered

into an international transaction shall

keep and maintain such information and

document in respect thereof, as may be

prescribed

(2) Without prejudice to the provisions

contained in sub-section (1), the Board

may prescribe the period for which the

information and document shall be kept

and maintained under that sub-section.

(3) The Assessing Ofcer or the

Commissioner (Appeals) may, in the

course of any proceeding under this Act,

require any person who has entered into

an international transaction to furnish

any information or document in respect

thereof, as may be prescribed under

sub-section (1), within a period of thirty

days from the date of receipt of a notice

issued in this regard :

Provided that the Assessing Ofcer or the

Commissioner (Appeals) may, on an application

made by such person, extend the period of

thirty days by a further period not exceeding

thirty days.

Report from an accountant to be furnished by

persons entering into international transaction.

92E. Every person who has entered

into an international transaction during

a previous year shall obtain a report

from an accountant and furnish such

report on or before the specied date

in the prescribed form duly signed and

veried in the prescribed manner by

such accountant and setting forth such

particulars as may be prescribed